The minutes from the March Fed meeting were released yesterday, laying out a plan for reducing the Fed's balance sheet.

Translation: there will be less liquidity in the economy (tighter money).

Let's take a look at how we got here.

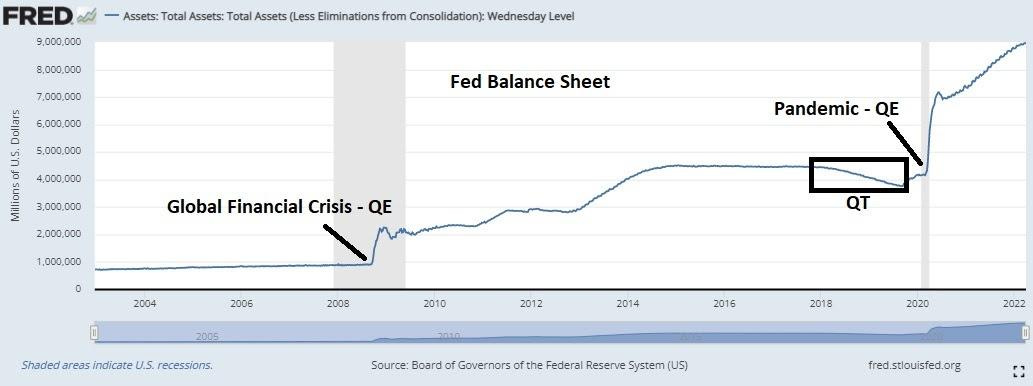

You can see above, the global financial crisis response included three iterations of QE, and resulted in the Fed adding $3.5 trillion in assets to the balance sheet - they were left with an economy that could barely muster 2% economic growth.

Still, they tried to normalise rates and shrink the balance sheet (i.e. quantitative tightening or "QT"). From 2017 to 2019, they allowed about $800 billion of assets to mature. You can see that framed in the box in the chart above.

By the end of 2019, the Fed was forced to restart QE. Why? Because the overnight lending market did this ...

Here's how the Fed explained what happened (my emphasis)...

"Strains in money market in September occurred against a backdrop of a declining level of reserves, due to the Fed's balance sheet normalisation and heavy issuance of Treasury securities."

So, the Fed was forced to rescue the overnight lending market (between the biggest banks in the country) because of an unforeseen consequence of balance sheet normalisation.

With this in mind, the minutes yesterday spelled out a plan to start allowing about 1% of the Fed's balance sheet to start "rolling off" (maturing, which equates to reducing the size of the balance sheet). But they will gradually get to that size over a few months, "over a period of three months or modestly longer."

That statement is telling. Many are expecting some aggressive quantitative tightening. But the Fed, surely, has very clear memories of the 2019 shakeup.

It's important to understand that reversing the Fed balance sheet is an experiment, with outcomes unknown.