Earlier this month, the Fed laid out a timeline and plan for ending emergency level monetary policies - we got some insight into the conversations they had to arrive at that plan.

The broad takeaway from the minutes of the Fed's meeting: a Fed that sounds compelled to move even faster than they publicly telegraphed.

That means an end to asset purchases, maybe sooner than June of next year. And a rate liftoff, also maybe sooner than June of next year (maybe as early as March). With that, not surprisingly, there are some Fed members out doing some media interviews in recent days, to start setting expectations for a more aggressive timeline to rate hikes.

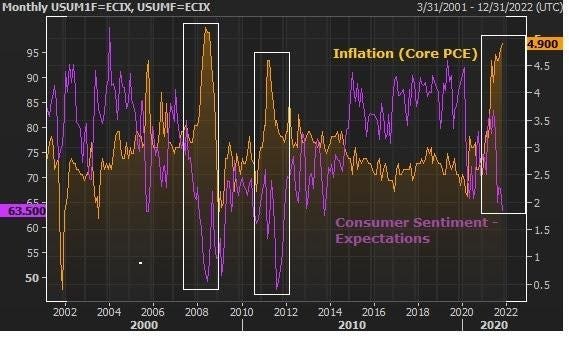

A more aggressive path to a tightening cycle: Is this good or bad for markets and the economy? Consider this chart...

As you can see in the chart above, despite what the Fed and politicians would like us to believe about inflation (i.e. "transitory"), consumers have their own views - and those views tend to be led by the reality of prices that are impacting their daily lives. Prices up, Sentiment down - ultimately consumer sentiment dictates consumer behavior.

The Fed clearly knows they are dangerously close to the point of losing control of consumer behavior. So, a faster path to normalising rates (and stabilising prices and sentiment) should be good for market and economic stability.

Happy Thanksgiving to you and your family!