Last week maintained a familiar theme.

US stock indices broke to new highs despite the spread of the Delta variant and US Covid cases breaking back above 100k a day. This was due to continued economic improvement reflected by Friday's NFP and despite a number of central banks moving closer to a tighter monetary policy during the week.

The RBA could hardly be called hawkish but it did send a message by resisting calls to make a U-turn on last month’s taper as long-running lockdowns take a toll on the economy. The BoE also made small steps towards tightening while significant pressure in the NZ labour market could mean the RBNZ raise rates as early as this month (just one month after completely stopping QE).

Strong employment data in the US was the big news on the week Friday’s big news and triggered a surge in the USD and US yields as the Fed moves closer to announcing Taper (September) probably for the start of 2022.

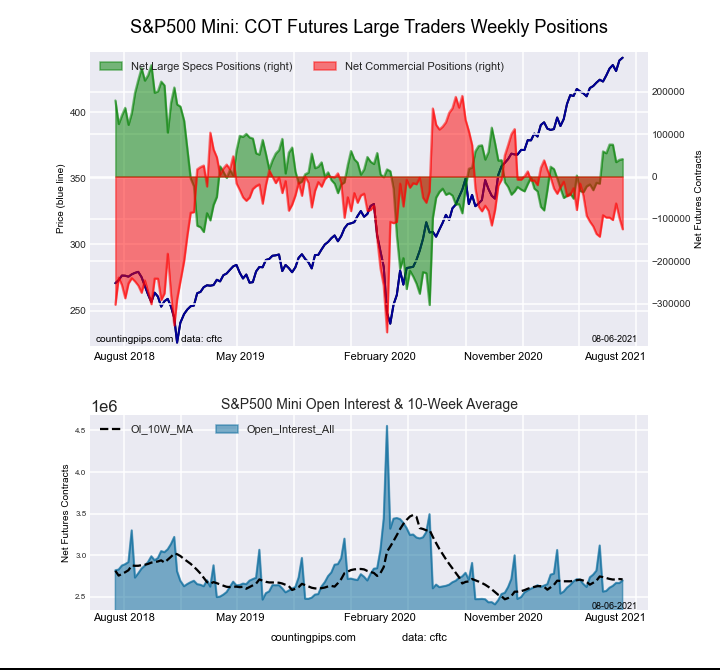

It is curious that indices are making new highs while sentiment is not as bullish as people think due to this persistent fear of monetary tightening. So although the break to new highs in US indices again this week has duly shifted sentiment more bullish, or rather less bearish, this doesn’t mean the market is extremely long.