The sweeping tariffs announced by the US administration on April 2nd have sent shockwaves through global markets and exposed deep contradictions in the strategy underpinning them. While billed as a corrective to US trade imbalances and a lever for industrial revival, the policy has triggered immediate financial aftershocks—equity sell-offs, capital outflows from emerging markets, rising volatility, and a collapse in sentiment. All that said, the global economy received a brief reprieve on April 9th, as President Trump announced a 90-day pause on his sweeping “reciprocal” tariffs.

US-China Trade Tariffs

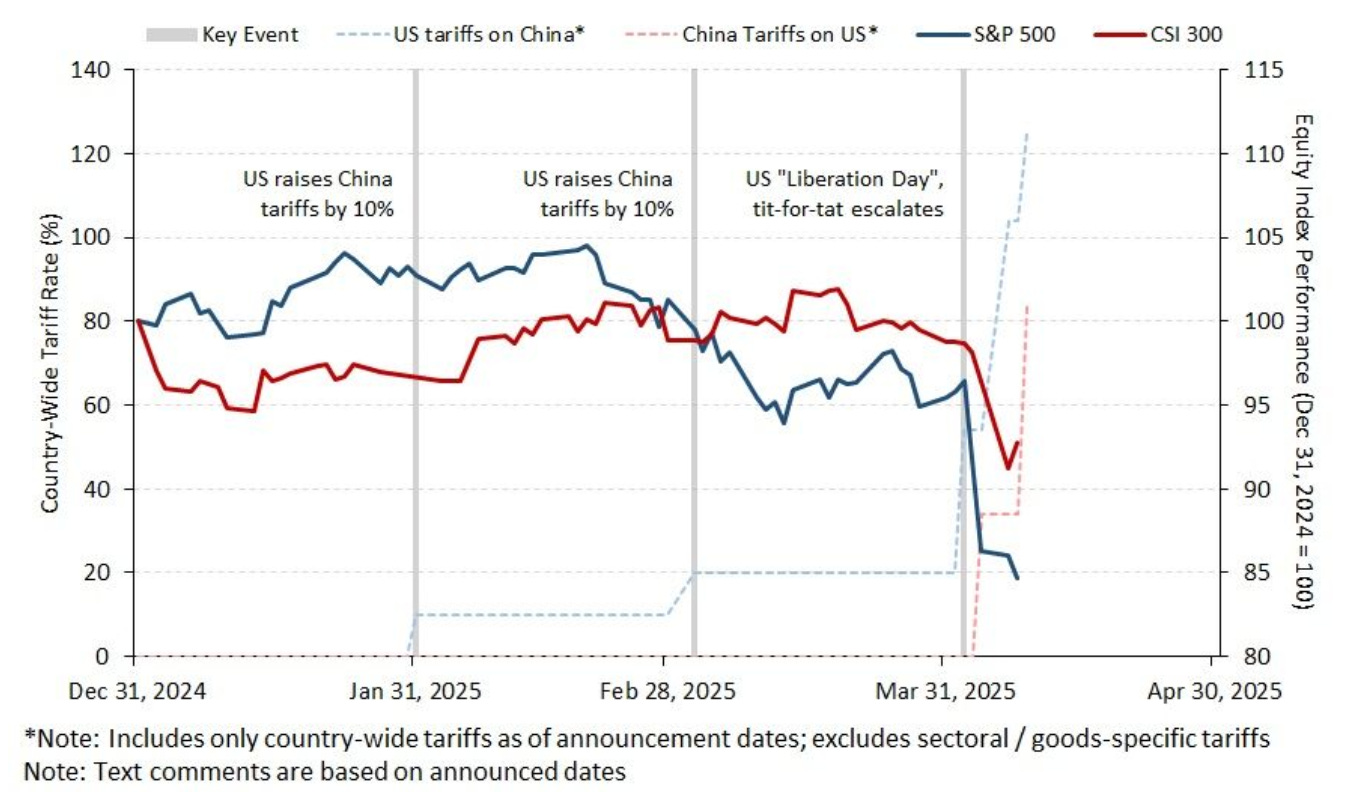

The global trade landscape remains highly volatile, underscored by a dramatic shift in US policy just days after President Trump unveiled his sweeping “reciprocal” tariffs on April 2. He has since announced a 90-day pause, opting to maintain a 10% tariff rate in the interim—excluding measures directed at China. In response to Beijing’s firm retaliation against the initial 34% US tariff, Washington has sharply escalated its stance.

What followed was a rapid tit-for-tat exchange, with the US now threatening tariffs of up to 125% on Chinese imports—an aggressive jump from the 20% rate seen in March. China, for its part, has imposed its own broad set of tariffs on US goods, currently standing at a still-significant 84%.

US investment in intangibles

This next chart highlights a crucial structural shift in the US economy: the dominance of intangible investment. Since 1995, fixed investment in intellectual property products—such as software, R&D, and other intangible assets—has grown nearly sevenfold, far outpacing investment in physical equipment and structures. This divergence underscores the increasingly "weightless" nature of the American economy, where value is generated less by traditional manufacturing and more by innovation, code, design, and proprietary knowledge.

Against this backdrop, the reintroduction of broad-based US tariffs on goods appears misaligned with the realities of domestic economic strength. Tariffs target the flow of physical goods, but they do little to influence or protect the intangible drivers of US competitiveness. As such, they may serve more as a political gesture than an effective economic strategy—raising costs without meaningfully reshaping the foundations of American productivity or global influence.

US trade deficits and relative demand patterns

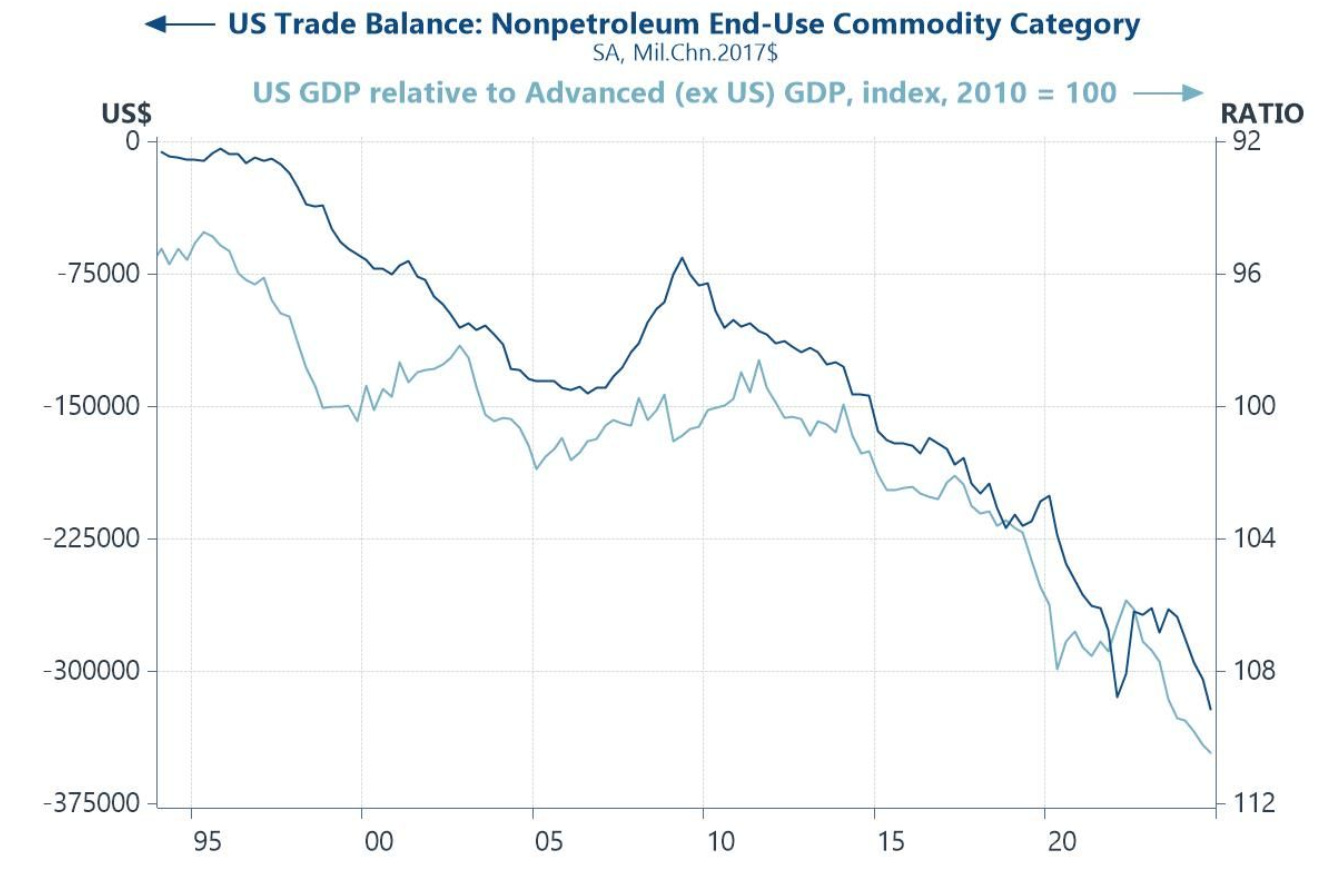

The chart below illustrates the widening gap between the US non-oil trade deficit and the relative strength of the US economy compared to other advanced economies. Even as US GDP growth has consistently outpaced that of its advanced peers since 2010 (as shown by the light blue line and measured on the inverted right axis), the real non-oil US trade deficit has widened. This divergence highlights a key structural reality: when the US economy grows faster than others, it naturally imports more goods.

Imposing tariffs in this context could therefore do little to reverse the trade imbalance, because it does not address the core driver: strong US domestic demand relative to global supply. Instead, tariffs may simply raise prices for consumers and disrupt supply chains, without materially improving the trade balance. In a world where growth differentials shape trade flows, protectionist tools like tariffs are more symbolic than effective.

US high-tech trade versus its capacity to produce

This next chart underscores another critical structural limitation in the US economy: its capacity to produce advanced technology products. Over the past two decades, the US trade balance in this sector has steadily deteriorated. Simultaneously, capacity utilisation in high-tech industries has remained high. In this context, tariffs on imported technology goods are unlikely to achieve their intended aim of reviving US manufacturing competitiveness.

With so little spare capacity in place, the US might not be in a position to ramp up production fast enough to substitute for the goods it imports. Instead, tariffs risk raising input costs for downstream industries, increasing prices for consumers, and worsening supply chain bottlenecks—without meaningfully reducing the trade deficit or restoring lost industrial strength.

Uncertainty and financial markets

This chart captures the dramatic spike in economic policy uncertainty and market volatility following the US administration’s announcement of sweeping new tariffs on April 2nd. Both the News-Based Economic Policy Uncertainty Index and the CBOE Volatility Index (VIX) have surged to their highest levels since the early stages of the COVID-19 crisis, underscoring the disruptive nature of the administration’s policy shift.

Although the 90-day pause on “reciprocal” tariffs announced on April 9th has provided a brief reprieve, markets continue to struggle to price the wide range of potential outcomes—ranging from retaliatory trade measures and global supply chain disruption to knock-on effects on inflation, corporate earnings, and monetary policy.

The surge in uncertainty reflects not only the scale of the proposed tariffs but also a deeper strategic shift away from cooperative economic engagement, raising fears of a more fragmented and volatile global trade environment.

The global economic cycle

This chart reveals a striking divergence in global business sentiment before and after the U.S. administration’s tariff announcement on April 2nd. The Global Composite PMI—which reflects economic activity across manufacturing and services—remained relatively stable in March, just prior to the announcement. However, the Sentix expectations index, which captures forward-looking sentiment and was conducted after the tariff shock, has plunged sharply. This suggests that global business and investor confidence deteriorated significantly in early April, with survey respondents anticipating a marked slowdown in activity.

The scale of the Sentix decline implies that the April PMI reading is likely to fall below the 50 threshold, signalling a contraction in global economic activity. This disconnect underscores the disruptive impact of the new US tariff regime, which has rapidly altered expectations for trade, investment, and global demand, and before the hard data have had a chance to reflect the fallout.