Expectations Reset

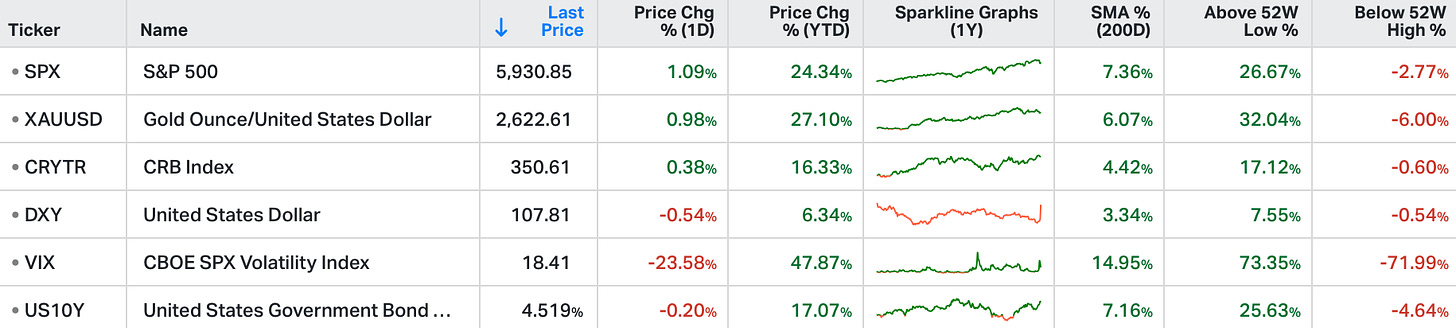

US stocks bounced back on the last triple witching day of the year, with the S&P 500 up 1%, the Nasdaq rising 0.8% while the Dow gained 497 points.

The rally followed cooler-than-expected inflation data, with November’s PCE index showing a 2.4% year-over-year increase, slightly below expectations.

Sentiment was also weighed down by the threat of a government shutdown and global market pressure from tariff threats.

The healthcare sector took the spotlight after Novo Nordisk’s new obesity drug missed targets in its test, driving the pharmaceutical giant’s ADRs to plunge 17.7%.

In turn, equities for competitor Eli Lilly gained 1.4%.

The Federal Reserve lowered the Fed Funds rate by 0.25% this last week as expected. Less expectedly, they reduced their outlook for rate cuts in 2025 from 100-basis points to 50-basis points. The 10-year treasury interest rate jumped from 4.38% pre Fed announcement to 4.55%+. Higher rates for longer exacerbated valuation concerns, and the major US market stock indexes declined by roughly 2-4% on Wednesday afternoon.

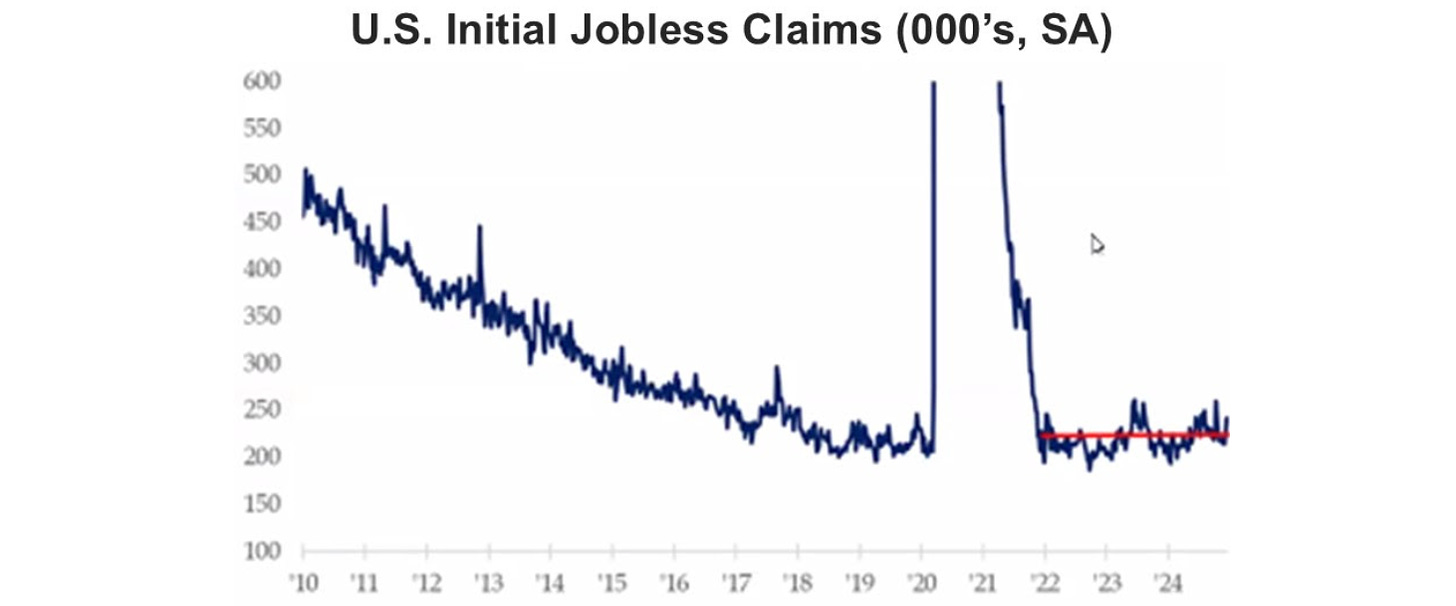

Fundamentally, the Federal Reserve is projecting fewer rate cuts in 2025 because of better-than-expected strength in the economy (and inflation not falling as fast as expected). The third estimate for Q3 GDP growth was revised to 3.1% from 2.8%. Initial jobless claims reported for last week decreased by 22,000. A strong economy and job market should outweigh negatives associated with the possibility of one-half of a percent fewer Fed Fund rate cuts next year.

Recently, a family member sent me a book titled “Die with Zero: Getting All You Can from Your Money and Your Life.” The author argues for spending your money on "experiences,” whereby at death your balance sheet is at zero. He argues experience in life is a richer wealth than financial asset wealth.

It looks like everyone is reading this book. Total retail sales increased 0.7% month-over-month in November (consensus 0.5%) following an upwardly revised 0.5% (from 0.4%) in October. Bank of America CEO Brian Moynihan last week: "Consumers are spending money at about a 4% growth rate over last year. The period around Thanksgiving, Black Friday, Cyber Monday was up 10-ish percent, which is strong...consumers are in pretty good shape."

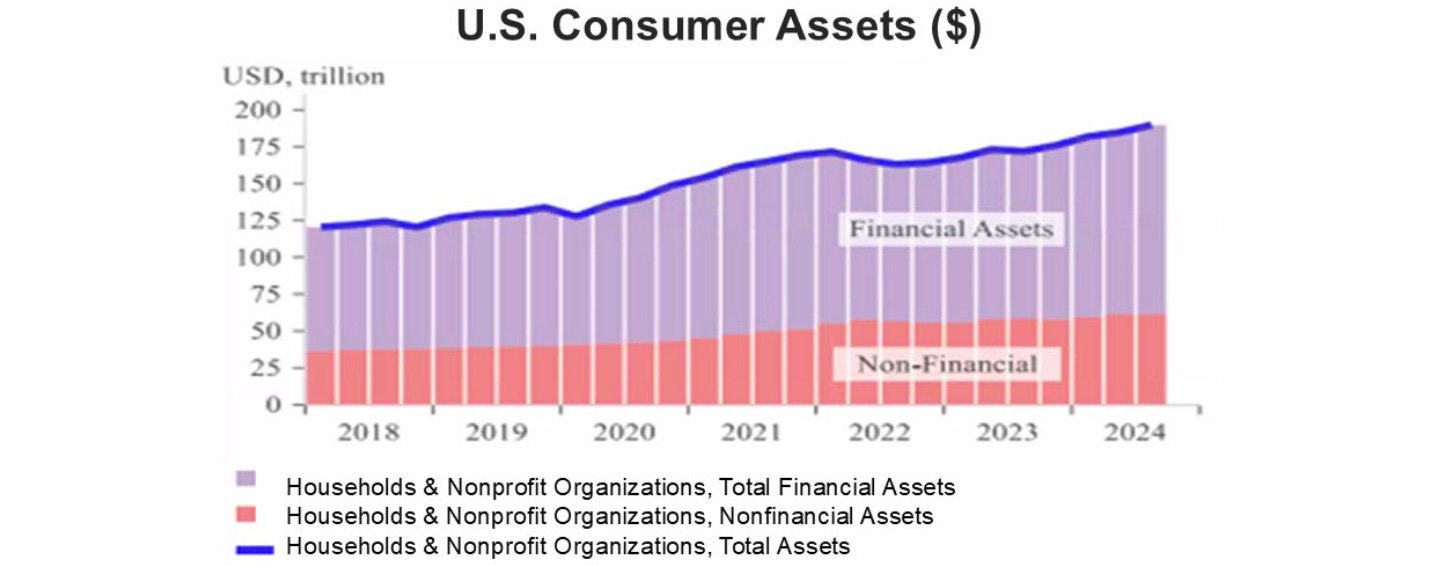

A reason to be optimistic about further stock market appreciation in 2025 is the financial health of the consumer and their propensity to spend. Household net worth is at an all-time high.

The job market is near full-employment and initial jobless claims are flatlining at a low level. Being relatively better off and having confidence in your employment prospects fuels consumption.

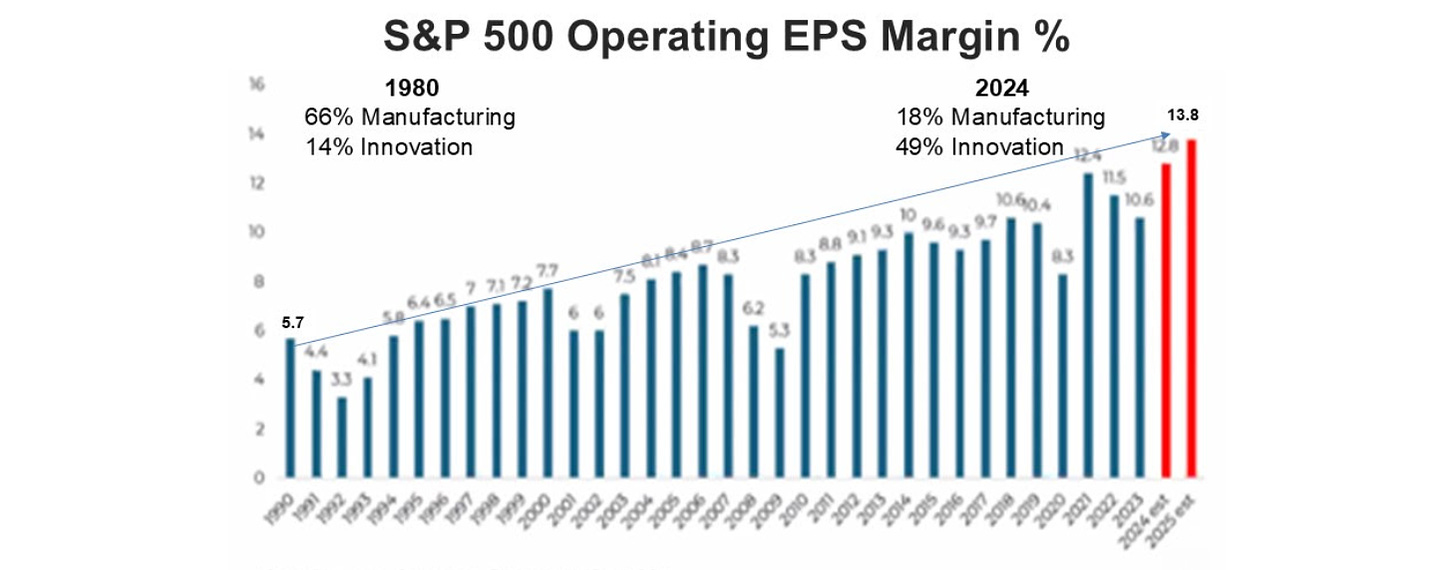

The combination of strong end-market demand (consumption) with rising operating margins in the S&P 500 creates a potential for earnings upside.

For the past 32 months, the month-over-month change in the Leading Economic Index (LEI) has been negative with the exception of last February and, just announced, November 2024. With the 10-year treasury yield above the two-year yield, the yield curve has a positive slope. The yield curve and LEI have historically been good predictors of recession. For now, they indicate recession risk is reduced.

From January 2021 to October 2021, the S&P 500 declined by about 25% and the NASDAQ lost roughly 36% of its value. These losses meet the definition of a bear market. We are now two years into the new bull market. Historically, once a bull market reaches age 2, it tends to have upward momentum for several more years.