We had another day with a lot of green on the screens: stocks, commodities...everything UP.

On Tuesday we looked at a few index charts...

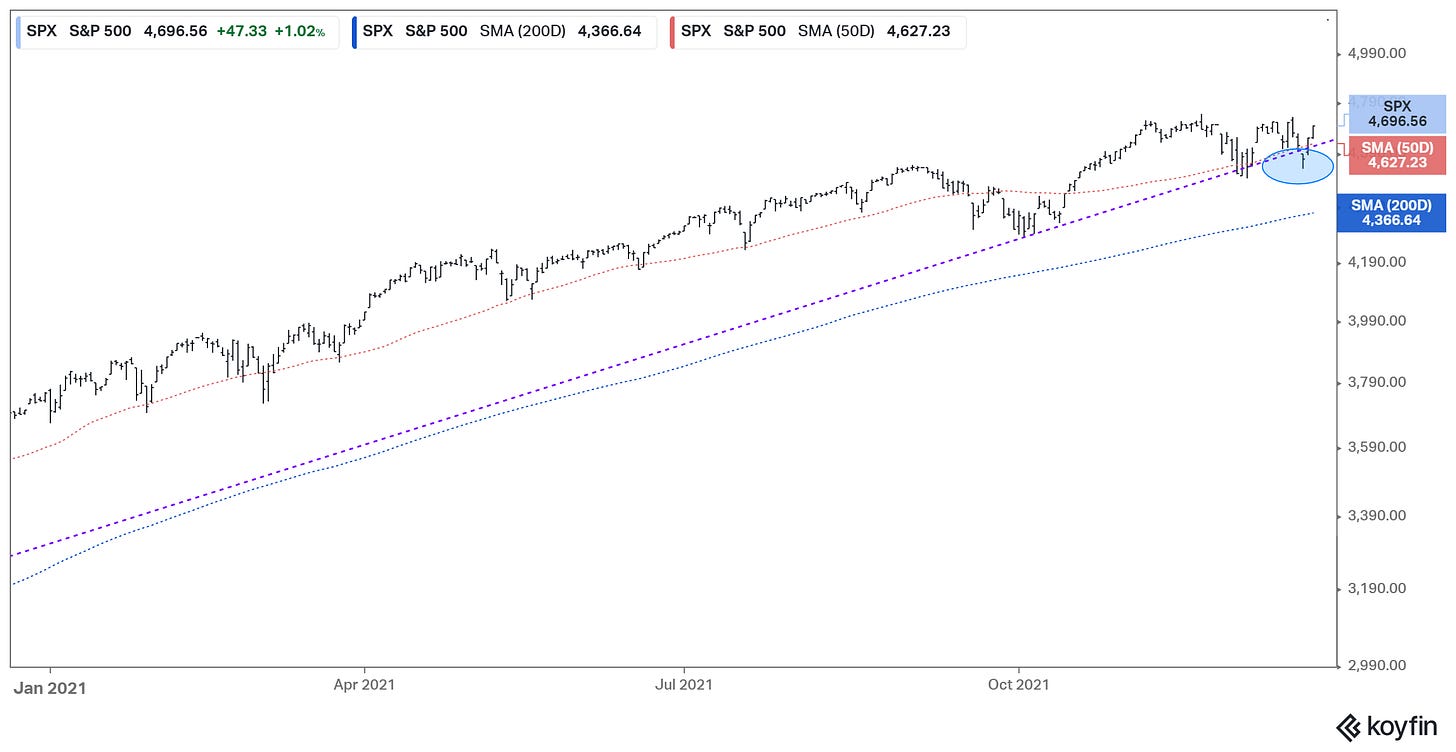

The S&P 500 was trading into the trendline (circled), and the Nasdaq was trading into a similar trendline (originating from the Fed's massive March 2020 response).

As we discussed, with this technical support in play, and adding the catalyst of an optimal outcome to the "Build Back Better" negotiations (i.e. a "no deal"), this set up for what looked like a big bounce. We've had it, just in a couple of days.

I suspect we will see new highs, and plenty of fuel for stocks into the New Year, until we hit the date of the Fed's first rate hike (which could come anywhere from March to June). Then, if history is our guide, we should expect a shift to a market that rewards good stock picking (value, over growth and momentum).

As of today afternoon, I'll be taking the remainder of the year off to spend time with my family. So this will be my last Macro Perspectives note for the year. For my OMX Portfolio & Gryning Protocol members, I will continue monitoring the markets and will be making new additions to the overall package for the new year..

If you are not a member, I'd like to invite you to join us;

Gryning Protocol - over 800 single stocks from the European and US equity markets are analysed and systematically ranked, condensing the monthly watchlist into a specialised, highly probable, list.

Gryning OMX - the full constituents of the OMX Stockholm Index are covered.

Thank you for being a loyal reader of my daily Macro Perspectives notes. I want to extend my best wishes for a Merry Christmas and a Happy and Healthy New Year!

Best,

Alexander