If you questioned whether or not pouring another $1.9 trillion onto an economy, that was already on track to do better than 5% growth this year, would be inflationary, the White House is now discussing plans for another $2.5 trillion in deficit spending.

This, they say, will address "infrastructure" - code for the clean energy transformation. If that (clean energy plan) spending requirement will come in this next package, then where exactly is the trillion dollars going, of the $1.9 trillion, that is not associated with covid relief?

Logic would tell us that rapidly increasing the money supply, as our policymakers have done, will create inflation. For perspective on money supply growth, here's the latest look at M1 (the most highly liquid assets, cash and coins in circulation + demand deposits...). This is before this next wave of money hits...

The average year-over-year growth in M1, dating back to 1995 is a little better than 5%. The growth in M1 over the past year has been about 350%. With that, the deluge of money, in the hands of people, should finally get this chart moving higher.

This is the velocity of money - the rate at which money circulates through the economy - and you can see to the far right of the chart, it hasn’t been fast over the past decade (therefore, no inflation).

We get inflation, only if the recipients of the money, spend it (if it circulates). That didn't happen coming out of the global financial crisis. Banks used cheap/free money from the Fed to recapitalize, not to lend.

In the current case, by design, money is being dropped directly into the hands of consumers. This money will inevitably translate into hot demand for stuff (it already has in many cases) and based on the surveys from manufacturers, it will be met with "a scarcity of supply chain goods." Logic tells us prices will go up.

The Fed has told us, inflation is not a concern (it will go up, but will be short-lived). Powell says, arrogantly, that the long period of low inflation won't "change on a dime." On a related note, I've just looked through an academic paper that concluded that inflation and money supply growth were positively correlated prior to 1990, but no longer- "inflation is no longer a monetary phenomenon; it is a wealth allocation phenomenon." Why? Because in wealthy countries "commodity supply is abundant" (they say).

Commodities markets clearly haven't been given this message. This complacent view toward inflation sounds a lot like "this time is different." Historically, in markets, when people say "this time is different," it doesn't end well.

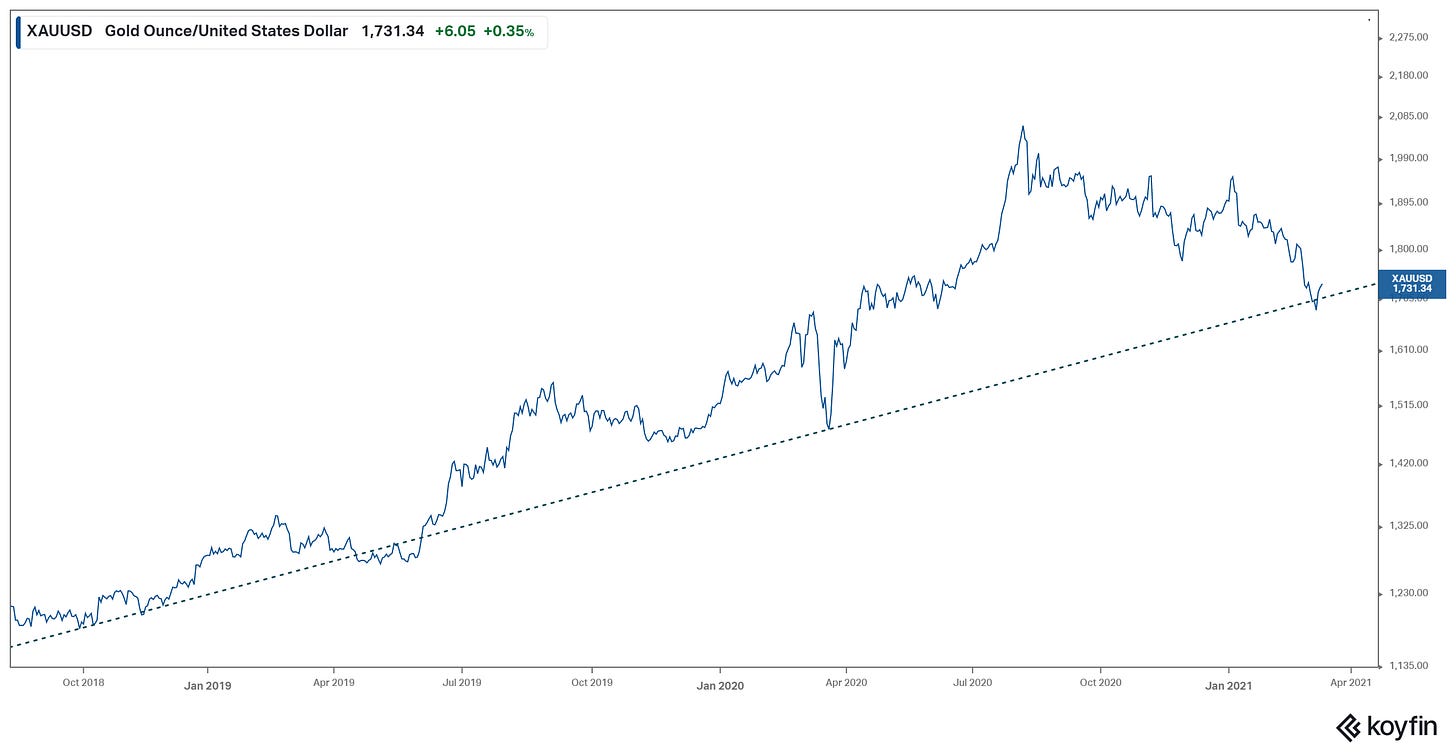

With this backdrop, gold (the historic inflation hedge) has been moving lower recently since August of last year, but it bounced into this long term trendline - a good spot to buy or add to gold, on the inflation theme.