We've talked about the very positive development for stocks over the past eight trading days.

It started with the game changing declaration from Nvidia, about the beginning of a "new era in technology." We've since had the overhang of the debt ceiling drama removed, followed by the Fed telegraphing a pause on the rate cycle.

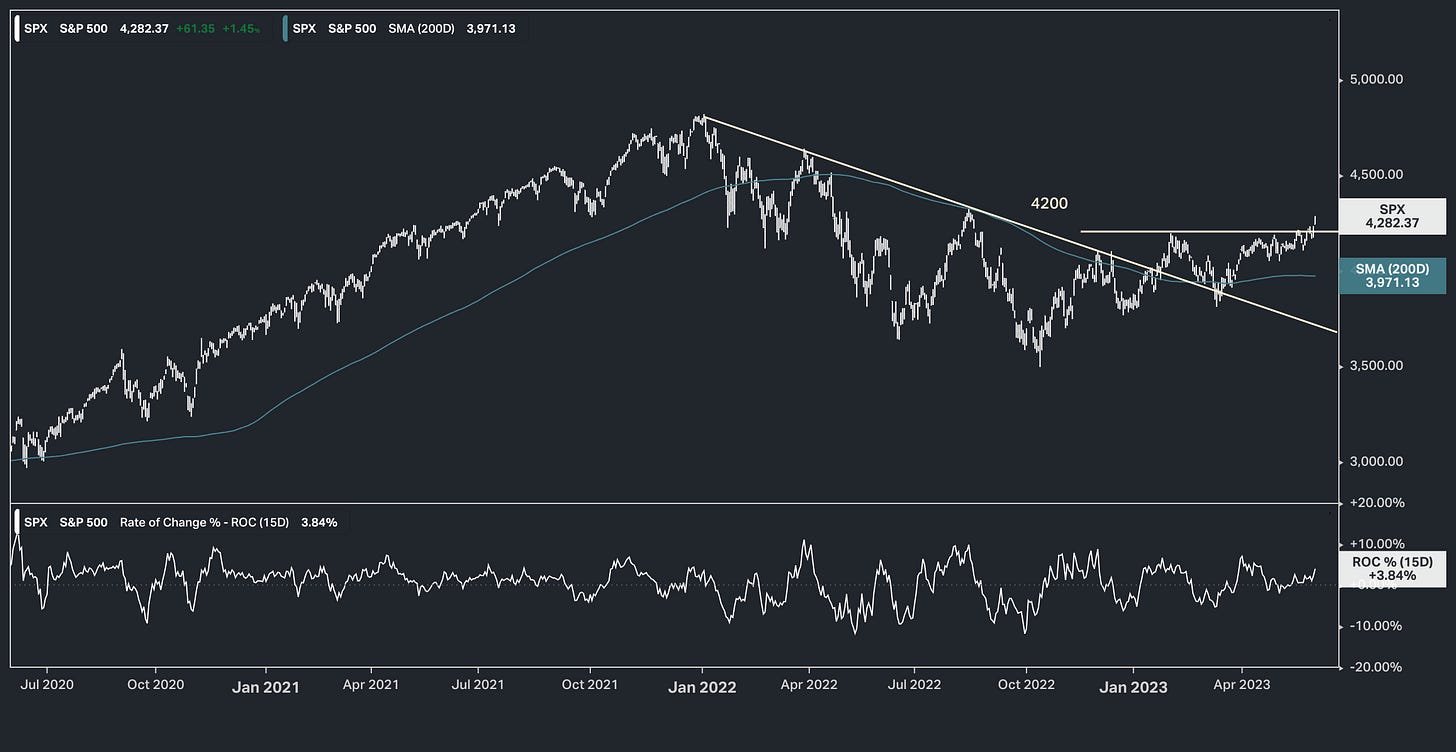

With that, we finally get a breakout of the 4200 area in the S&P - the move in stocks is now (just in the past two days) becoming more broad based.

As we head into the weekend, the S&P trades at a forward P/E of 18 - the average P/E in the post-GFC era (Global Financial Crisis) is 21.6.

In the late 90s, the Fed Funds rate averaged 5.2% (between '95 and '99). That's about where the Fed Funds rate stands now. During that time (late 90s), the P/E averaged 25x. Economic growth grew at a better than 4% annualized rate for the period and stocks averaged 28% a year.