After a series of ten consecutive Fed rate hikes, last month the Fed "skipped" an opportunity to make it eleven. It was a skip, but not a stop. Yesterday they raised the Fed Funds rate again, to the highest level since 2001.

The decision on the May hike was unanimous, despite plenty of uncertainty surrounding the bank shock (of March).

The June skip was also unanimous, though the economic projections from that meeting reflected the Fed's view of hotter growth and firmer levels of inflation.

And this July hike was also also unanimous, despite a headline inflation rate that has fallen to 3% - a full percentage point lower than the inflation data available to them the month prior, within which they chose to hold rates steady (unanimously).

In one of the more complicated environments in history, finding eleven (in the case of yesterday’s vote) economists to agree with each other, so consistently, is hard to believe.

But unanimity strengthens the Fed's ability to manipulate public perception (or as they call it, "guidance").

With a market that had fully priced in a rate hike, and with unemployment still near record lows, stock markets having resumed flight over the past quarter, and the economy likely growing better than 2%, the Fed, assumingly, thought it could only lose by showing any dissension that might imply a victory on inflation.

Why don't they want to claim victory? Because that signal (to consumers, businesses and investors) would be the equivalent of pressing the "gas pedal" on the economy- They would be doing so with an economy already positioned to ride tailwinds of big government spending programs, and a technological revolution (in generative AI).

So the question becomes, would a boom-time economy reignite the inflation they've been working to get control of?

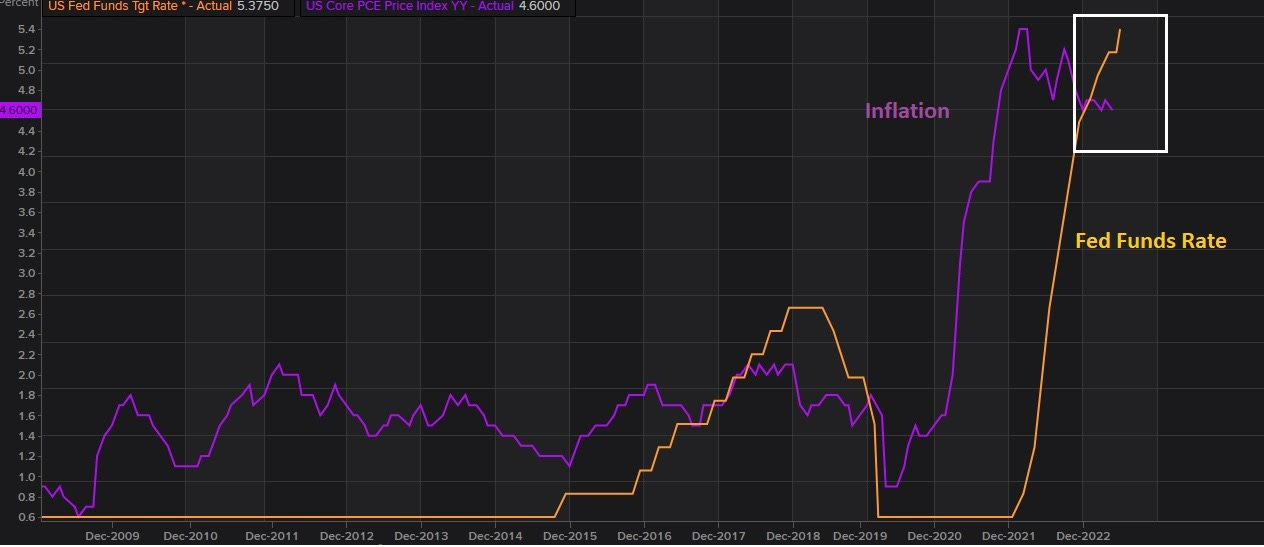

As you can see in the chart below, the Fed Funds rate is now well ABOVE the inflation rate - as measured by the Fed's favored inflation gauge, core PCE.

This is historically where the Fed has taken rates to get inflation under control (i.e. above the rate of inflation). They've been there since March and this purple line should drop to about 4.2% when we get Friday's June core PCE report.

So, this dynamic of a positive real interest rate, for the past four months, should be putting downward pressure on inflation.

And it has been.

Add to this, money supply growth has been the historic driver of inflation. It soared. Inflation soared. It has since contracted sharply as you can see in this next chart. Inflation has fallen.

The Fed's challenge has been to take the threat of hyper-inflation off the table. I would say mission accomplished.

With that, as we've discussed many times here in my daily notes, we now need a period of hot growth, rising wages (to restore the standard of living), and stable, but higher than average inflation to inflate away debt.