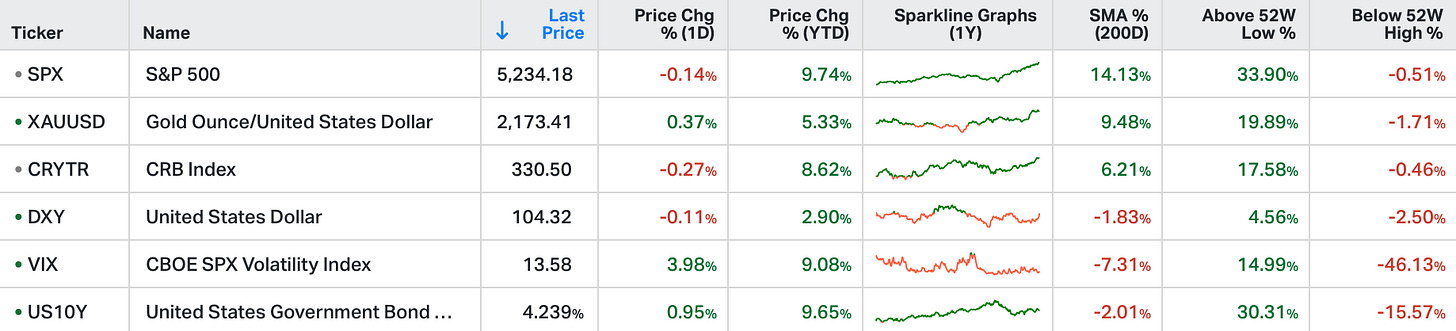

Stocks in the US finished mixed on Friday as the record-breaking rally fueled by optimism that the Federal Reserve will cut rates three times this year came to a pause.

The Dow Jones retreated 305 points after nearing the 40,000 level, while the S&P 500 dipped 0.1%.

Nike shares fell 6.8% after the company warned of an expected sales decline in the first half of the fiscal year.

Tesla lost 1.1% amid reports of reduced EV production at its China plant.

Lululemon's shares declined 15.7% following a disappointing outlook and a slowdown in growth in North America, marking its worst day since March 2020.

We have a shortened week with Easter, today’s note will be a quick seasonal/sentiment review of sorts.

A strong week for equities saw SPX close up 2.3% for the week driven initially by Powell’s dovish messaging on recent inflation at Wednesday’s FOMC press conference.

NVDA was the highlight again, finishing up 7.3% for the week and its 11th straight weekly gain. This is its longest consecutive run of weekly gains in its history having previously only closed up nine straight weeks once and seven straight weeks seven times.

Looking ahead to Q2 we're leaving Q1 with sentiment elevated. The number of bears in the AAII sentiment survey continues to remain at low levels.

Net positioning among institutional investors in the NAAIM survey also remain high, having just come off its highest level since 2021 (note: the most recent survey was taken before SPX’s large post-FOMC gain so it will likely be much higher as of Friday).

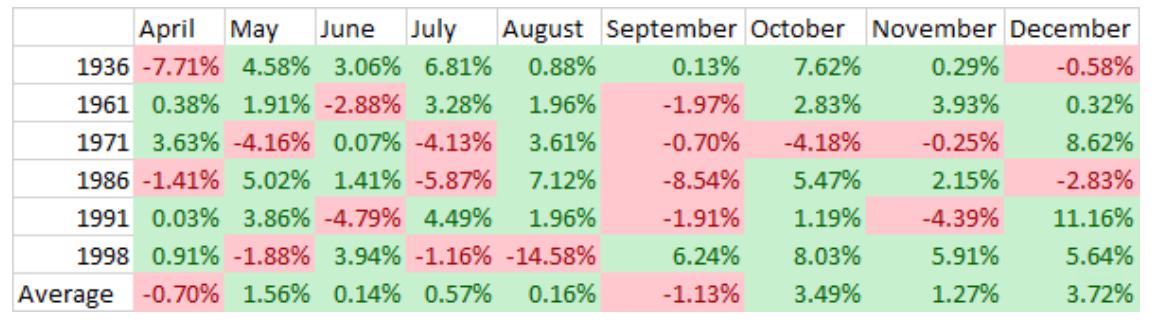

SPX is also on course to close out Q1 with its second straight quarterly gain of 8% or more. There have only been 7 previous instances of an 8%+ gain in Q4 followed by an 8%+ gain in Q1. All years saw either closed lower for Q2 or lower for Q3 - can we expect a loss of upward momentum in the next few months?

Looking at monthly data tells a similar story. There have only been six previous instances of SPX closing higher for five straight months for the November to March period and had a cumulative gain of 15% or more. SPX is currently on course to make it a seventh time and its second largest cumulative gain over that period.

The average returns from April to September for those years is almost flat with all years having at least one month with a decline greater than 4%. This suggests a large monthly drop in one of the coming months cannot be discounted and need to be vigilant before a strong finish to the year in Q4.

As we come to the end of the month and quarter, and financial year in the UK & Europe, it is unlikely that any of the macro news will have much impact. Look out for a little end-of-quarter profit taking (maybe only on Thursday) and rebalancing in this four-day week, after this very strong quarter.