ECB intervention?

Stocks in the US plunged on Thursday, extending a three-week selloff as renewed tariff threats from President Donald Trump rattled investor confidence.

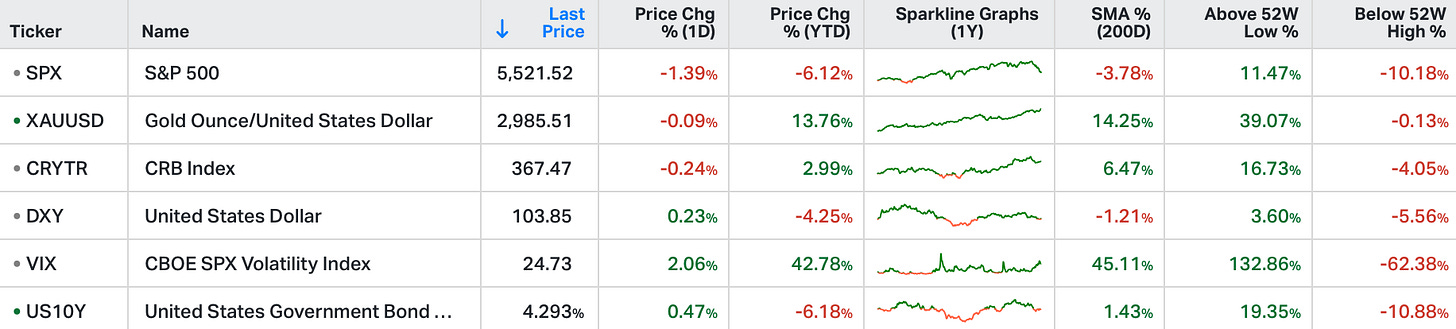

The S&P 500 slid 1.4%, entering correction territory, while the Nasdaq 100 dropped 1.9%, weighed down by declines in Apple (-3.4%) and Tesla (-3%).

Trade tensions escalated after Trump threatened a 200% tariff on European wines and spirits in retaliation for the EU’s planned duties on American whiskey, amplifying concerns over an intensifying trade war.

Meanwhile, producer price inflation data came in softer than expected, with the headline figure remaining flat and the core rate dipping 0.1%, reinforcing yesterday’s cooler CPI report.

In corporate news, Adobe shares plunged 13.8% after issuing a weak revenue outlook, while Intel surged 14.6% following the announcement of a new CEO.

We've talked about the 800 billion euro (+) debt deluge promised in Europe over the past two weeks, and it comes only a little more than a decade removed from a sovereign debt crisis.

The massive "defence funding plan," committed to by the unelected European Commission, resulted in a spike in the German 30-year bund, which was the biggest spike since 1990. It also resulted in a spike in the German 10-year yield (the absolute basis point move) that is only matched two other times in the past 13 years, one of which was in late 2011 when Greece was teetering on the edge of default.

Alongside the German’s, we’ve also talked about this next chart of French 10-year government bond yields, as the spot to watch.

A breakout in the yields of this key sovereign debt market in Europe, would almost certainly lead to the ramp of speculative French bond selling (higher and higher yields), which would quickly spread to the other fiscally weak eurozone bond markets.

Why France?

France is running a 5.5% budget deficit, with 110% debt to GDP – nearly double the debt and deficits of Germany, yet borrowing at just 70 basis points over Germany's borrowing rate.

Piling on another massive tranche of debt, should raise the borrowing rates of both, which makes servicing debt in the fiscally fragile parts of the eurozone, like France, more and more difficult. And that dynamic should only increase the spread between French and German borrowing rates (which means, ever increasing borrowing rates on French government debt).

Now, in the above, when I say "should," it implies that the bond market is determined by market-forces. But in Europe, the European Central Bank has already committed (back in July of 2022) to ensure that its constituent government bond markets stay orderly (i.e. that rates are contained).

Despite the fact that they ended QE in early July of 2022, and that they've been shrinking the ECB balance sheet, they have the "anti-fragmentation" program (QE by another name) locked, loaded and ready to fire at any time, to buy as many government bonds in Europe as needed, to maintain sustainability of bond markets (and therefore financial stability, and therefore the sustainability of the European Monetary Union).

So, this brings us to today.

German yields were in breakout territory yesterday morning. French yields continue to hang around these vulnerable breakout levels.

But yields backed off the highest levels of the day, and broadly finished lower.

Do we have any clues that perhaps the market is sniffing out some ECB intervention, either current or in the near future?

Gold.

Gold broke out to new record highs, up almost 2%, with the futures market now trading at $3,000. Is the market sniffing out a new wave of debt monetisation in Europe? Maybe.