As we head into the long holiday weekend, we can see where the pain is for the market.

We see plenty of the daily ebb and flow for markets, driven by news, distractions and sometimes outright sentiment manipulation (by the Fed, by the government, by corporate leaders, by Wall Street). With the noise of the day, markets will go up/ markets will go down.

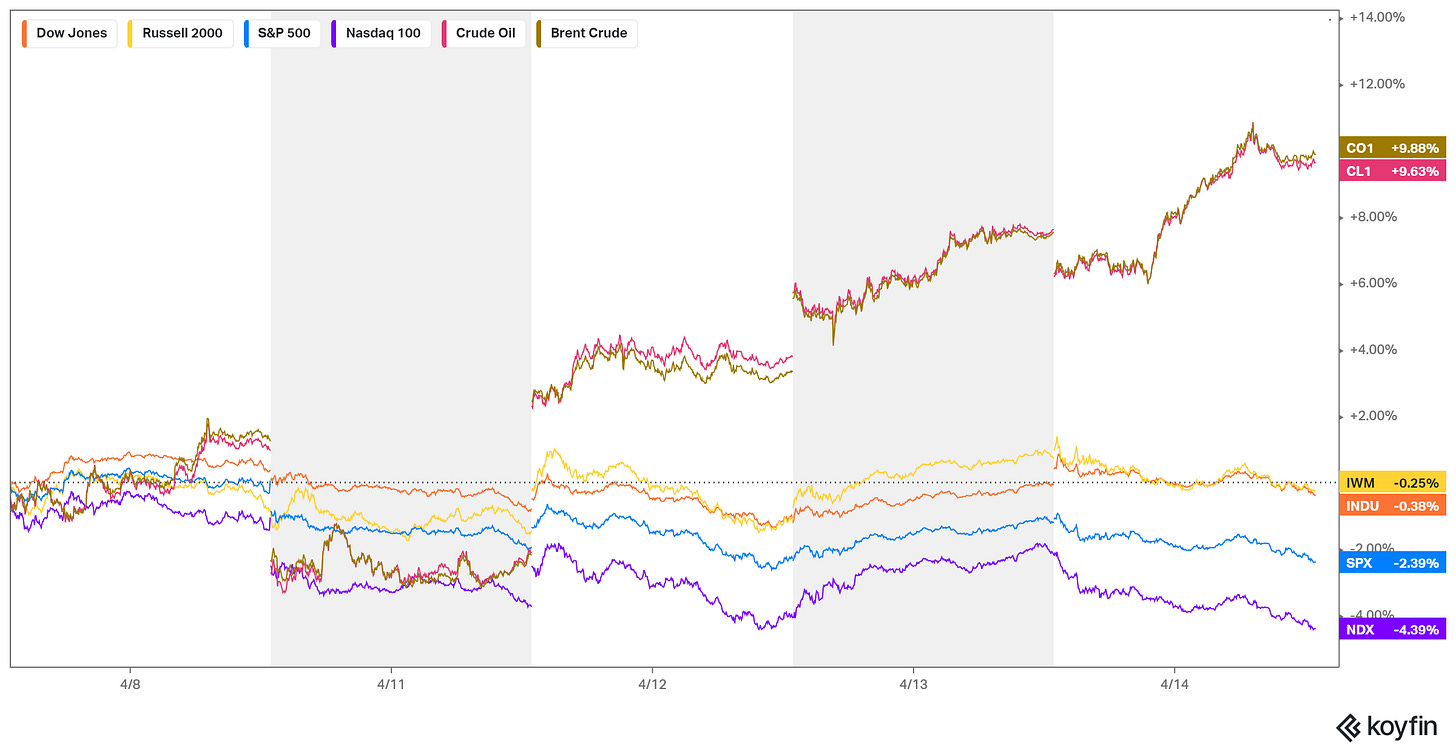

The overwhelming fundamental themes rise to the top when investors have to contemplate going home into a long weekend with positions they don't have confidence in. If they are positioned against the broad fundamental theme, they course correct. With that, we close the week with lower stocks (led lower by high-valuation tech stocks) ... higher crude oil ... and higher yields.

This is course correcting for what seems like a market that has been offside: wishing for the bounce back in big tech, believing that oil prices are only up for event reasons (Ukraine/Russia), and convinced that the Fed will be able to beat inflation with just a shallow path of interest rate hikes (stopping at under 3%).

That's a dangerous market view. As such, we saw course correcting activity yesterday, that demonstrates the respect for the big themes: 1) the globally coordinated disinvestment in fossil fuels, and 2) rising interest rate environment forced by inflation.

These fundamental realities for oil and interest rates are entrenched, and won't change without the passage of time and "repricings." So, we should expect much higher yields, much higher crude oil (still) and the continued rotation out of growth stocks and into value stocks (still).

My view: It's early days for all three.

PS: If you know someone that might like to receive my daily notes, they can sign up by clicking below ...