On MOnday we talked about the set up for a dollar decline, to reflect;

1) U.S. government spending recklessly beyond a rational crisis response

2) a Fed that denied the inflationary impact of such a fiscal response for too long.

We looked at the long term cycles for the dollar. - we are about 70% of the way (in time) through a very shallow bearish cycle, which argues that we could have a very steep drop in the dollar over the next two years.

With that in mind, we looked at a shorter term chart of the dollar yesterday. The dollar looked vulnerable to a break-down (lower).

Here's an updated look...

Indeed the dollar broke to two-month lows - and it looks like this technical break will get the ball rolling.

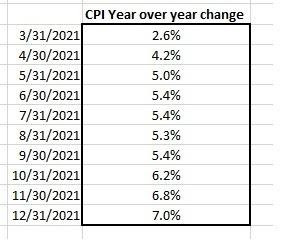

This comes on a day when the inflation report showed a 7% year-over-year increase in prices (the highest in 20 years). With that, notice in this table the clear trend in CPI, and where it started in March of last year.

I focus on March of last year, because that's when the word "transitory" started showing up in the Fed lexicon. Clearly, they were wrong.

As important, that language gave the politicians on Capitol Hill the cover of a "no inflation problem" to push through another $1.9 trillion in spending, a $1.2 trillion "infrastructure" package, and advance the dangerous (and massive) clean energy and social agenda spending plan, which finally fell flat, ONLY when Jay Powell did an about face on the inflation view.

Bottom line: The dollar may be in the early innings of paying the price for the monetary and fiscal policy errors of the past year.