Driving Oil

Stocks in the US reversed earlier gains and turned lower in afternoon trading, with the S&P 500 and the Nasdaq on track to book a 5-day losing streak, down 0.3% and 0.5%, respectively.

The Dow Jones also gave up earlier gains of 290 points, swinging near the flatline.

Semiconductors stocks dragged the most as all were trading in negative territory except Nvidia (+0.6%) while Taiwan Semiconductor Manufacturing booked its first profit rise in a year amid strong AI demand.

Tesla dropped about 2.4% after a Deutsche Bank downgrade to hold from buy.

Las Vegas Sands was down 7% after Q1 revenue narrowly beat forecasts.

Stocks put in another lower low - it appears that the weight of geopolitical uncertainty will remain through the weekend, which should continue to weigh on stocks.

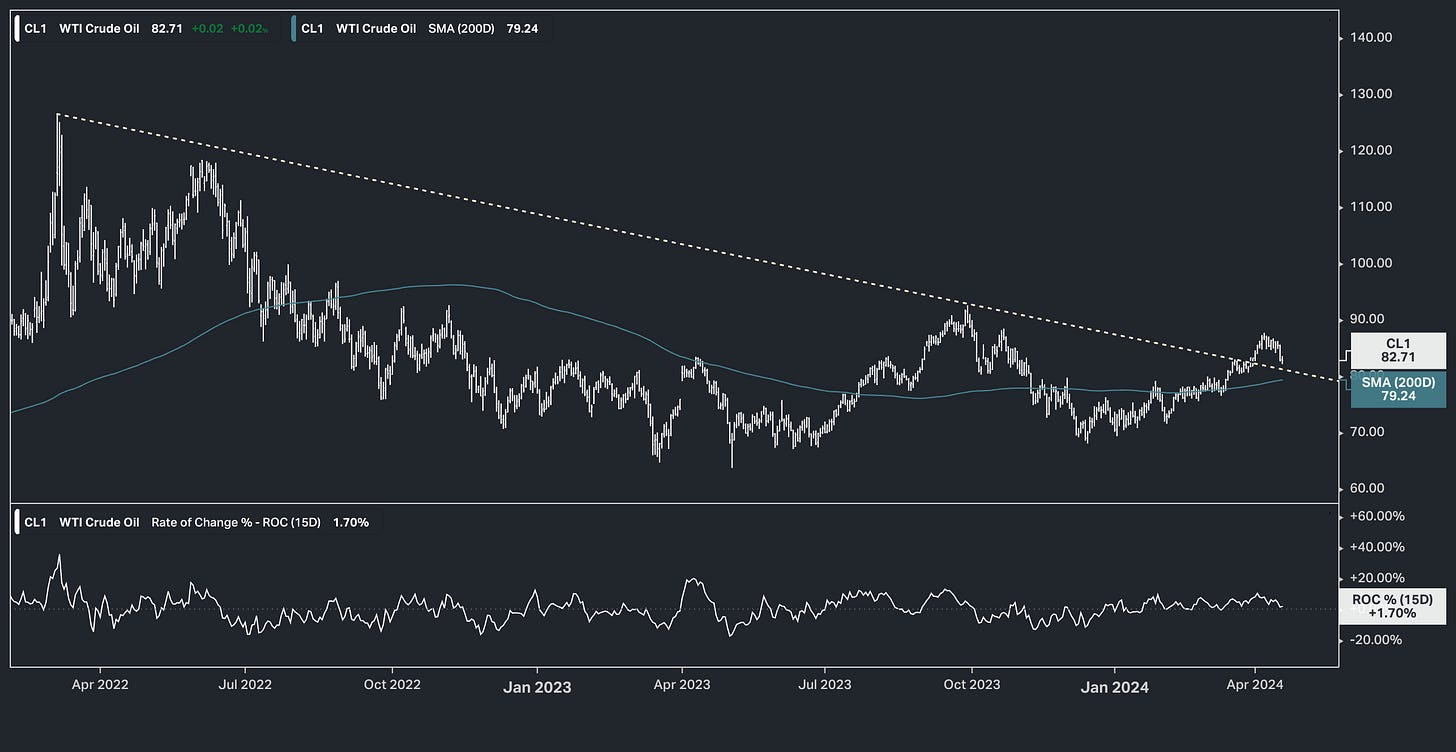

Let's take a look at oil …

When Israel struck the Iranian consulate in Syria on April 1, oil broke this trendline from the $130 highs of two years ago.

It topped out last Friday, prior to the retaliatory attack from Iran over the weekend. And even with the threat of escalation, the price has (strangely) fallen as much as 7% this week.

With the Middle East on a "knife-edge" (in the words of the UN Chief), the price of oil isn't reflecting the supply disruption risk - certainly not supply shock risk.

Add to this, one of the best research-driven commodities analyst teams of the past three decades (Leigh Goehring and Adam Rozencwajg) have recently drawn attention to what they believe are overstated U.S. oil production data.

They think the new EIA Administrator's restatement of data, in the middle of last year, to account for a new "adjustment factor" resulted in overstating crude growth by 40%. Moreover, they see risk of U.S. production growth turning negative in the coming reporting months.

That would put OPEC+ back in the driver's seat to determine oil prices and higher prices serve their interest.

In 2020 institutions spent $1.1B on alternative data. GRYNING | AI aim’s to level the playing field by providing hedge fund-level intelligence with proven market performance.

We turn complex trading patterns and analysis into stock insights that earn you more wins.

You can keep your current strategy and we’ll get you more wins.

Offer:

Become a member today and we’ll upgrade your monthly membership to three (3) months.

Yearly membership will be upgraded to lifetime* membership.

ps: for group/team memberships, or if costs are inhibiting, I can be found on: a.karlsson@gryningcapital.com