Goldman Sachs has called copper "the new oil." Let's talk about why…

In a world where global powers have come together and committed to transform global energy, by supplanting fossil fuels with "clean" energy, there are clearly winners and losers.

We've talked a lot about what it means for fossil fuels: long-term a loser, short-term we will see much higher prices.

What about the price outlook on the key inputs for "renewables?" Same outlook: Higher prices!

Among the most important commodities in the clean energy movement is copper. With that, as the pandemic and economic crash of last year telegraphed a Biden presidency (which assured a climate action agenda), here's what has happened to the price of copper (it's gone straight up)...

Expect this trajectory to continue for copper. Why? This metal plays a key role in everything from solar energy, to wind energy, to electric vehicles.

Consider this: Conventional cars use 18-49 pounds of copper. Battery electric vehicles use 183 pounds of copper - 4 to 5 times the amount of copper will be needed in battery cars.

For the above reasons, the head of the biggest copper producer in the world says we will see "meaningfully higher copper prices," in a world where "the outlook for copper has never been better."

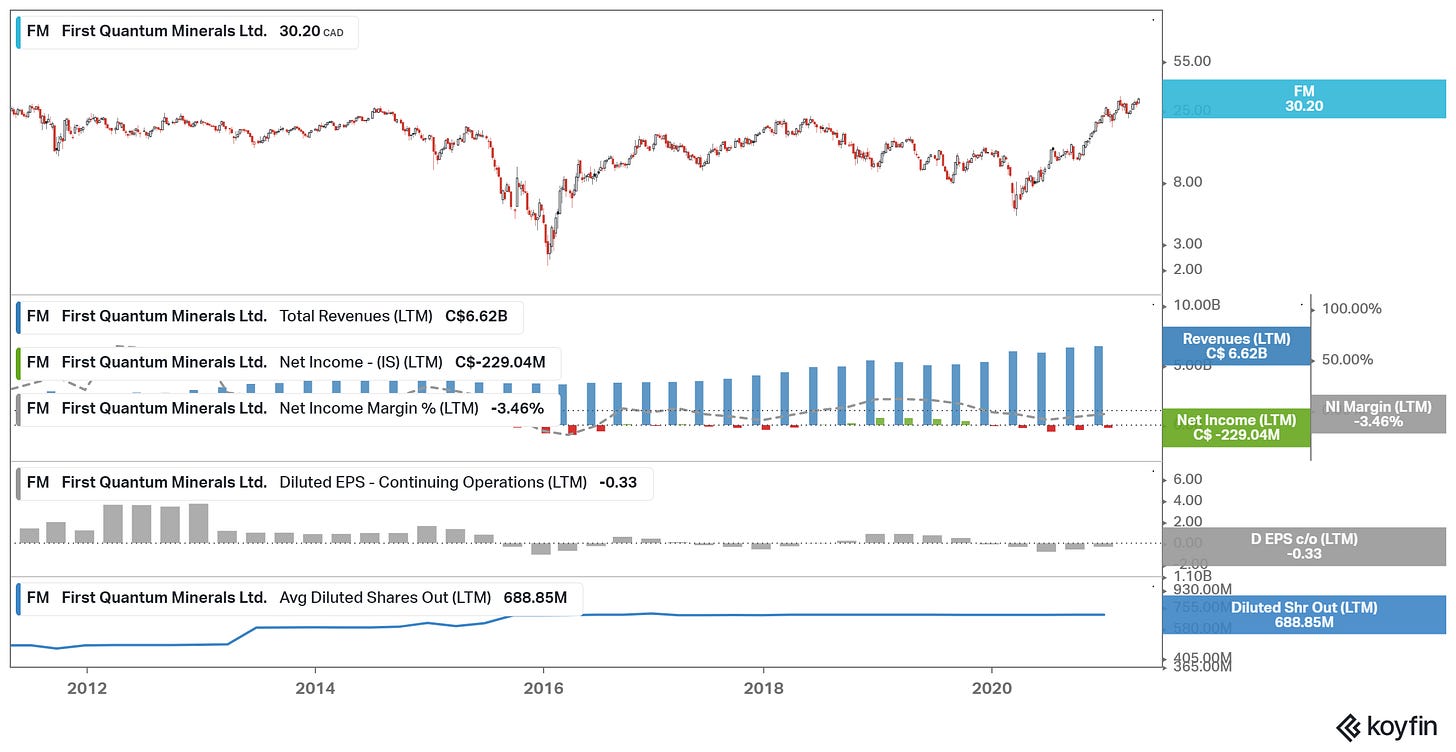

Some stocks that I think are worth adding to our watchlist;