We close the week, and month, with stocks near the lows of the year.

Let's take a look at what earnings are telling us.

We've seen the formerly loved streaming stock, Netflix, nearly halved after a bad earnings report. We've heard a lot about "higher costs" on earnings calls and yesterday we got a negative GDP number for Q1.

Still, Q1 corporate earnings have come in broadly better than Wall Street expectations.

Half of the S&P 500 has now reported for Q1 - Eighty-percent (80%) have beat estimates. Earnings growth is running about two-and-a-half percentage points better than was expected coming into earnings season. With rising costs, this is the most important point: profit margins are still strong, at 12.2% (the fifth highest since 2008, only topped by the prior four quarters).

So, higher costs continue to be successfully passed through to the consumer. Is it sustainable?

On that note, this is important to know: The level of prices isn't going lower (anytime soon), despite what the Fed might have in store for us.

The $6 trillion of new money floating around the economy, since the initial pandemic response, isn't going anywhere. In fact, it continues to grow.

It's the rate-of-change in the increase of prices that will slow, we hope.

Note, the only offset to the reset of prices that the government knowingly unleashed in March of 2020 (through direct payments to businesses and consumers, subsidies and debt moratoriums), is a wage reset (i.e. a broad-based shift in the wage scale, up).

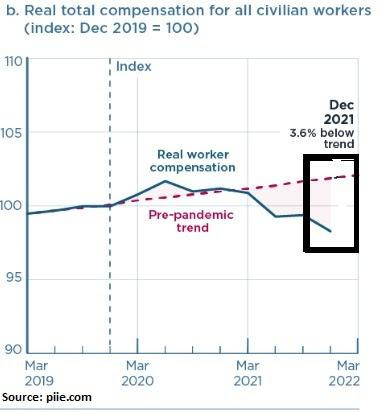

You can see the wage issue clearly in this chart ...

Despite some wage gains at the low end (driven by federal unemployment subsidies and "hazard" pay), after adjusting for inflation, wages are well below pre-pandemic trend.

That said, the wage reset is happening, but slowly. There are roughly five million more job openings than job seekers, and the number quitting jobs is the highest on record. Job switching is the driver of the highest future wage growth.