The S&P 500 and Nasdaq 100 both closed at record highs on Wednesday, rising by 0.2% and 0.1%, respectively, while the Dow Jones added 73 points.

Investors weighed the latest Federal Reserve minutes and President Trump’s renewed tariff threats.

The Fed's minutes revealed that officials remain cautious, preferring to see further progress on inflation before cutting rates, while also acknowledging the potential risks from trade policy changes.

Healthcare and consumer staples stocks led the gains, with Eli Lilly and UnitedHealth both rising over 1%, while Walmart traded higher ahead of its earnings report due tomorrow.

Among megacaps, Microsoft gained 1.3% after unveiling its first quantum computing chip, and Tesla rose 1.7%.

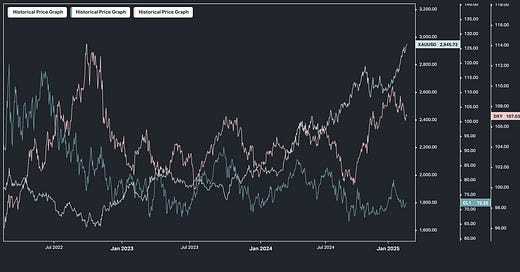

Let’s continue our discussion on the move in the price of gold. It trades around record highs, and is now closing in on $3,000 an ounce.

We looked back at the bursts higher in the price of gold over the past five years, and the catalysts — which, in all cases, were inflationary policies, from fiscal profligacy.

This most recent run-up in gold fits the bill — aligning with the January 1st reinstatement of the debt ceiling, a debt ceiling that was shockingly suspended (conveniently through the end of Biden's term) in a deal made in May of 2023, which led to an explosion of new debt issuance. You can find the full note here.

So, this brings us back to the discussion we've had over the past few months about how the Biden Treasury has left the Trump Treasury with record debt, record debt service, a record peacetime budget deficit, and a third of the debt to refinance in year one of the Trump administration — and with bond yields already at vulnerable levels, with a bond market anticipating an onslaught of supply coming.

It's all a formula for rising bond yields, which means rising debt service, which means a larger budget deficit, which means an even larger debt load.

This self-reinforcing cycle (doom loop), left to market forces, has a path: debt downgrades (which we had in 2011), which would drive the cost of debt higher, which would accelerate the cycle (higher deficits, higher debt).

The three Ds would be the natural progression: Default, (currency) devaluation, depression.

With all of this said, the sovereign debt doom loop is global. And the U.S. still has powerful relative strengths, and has plenty of (relative) appeal for global capital.

The most important strength is the world reserve currency status of the dollar. Having the reserve currency has historically dampened the penalties for fiscal profligacy. While it clearly can lead to bad behavior, maintaining the dollar's dominance is paramount. It provides flexibility in working through problems, such as the ones we have now.

As we've discussed through the years, the agreement to trade global oil in U.S. dollars (i.e. "petrodollars") has been the cornerstone of the dollar's role as the "world's reserve currency," since the end of the gold standard. And the world reserve currency status has been key in building and sustaining the United States' position as the economic superpower.

So, the explicit anti-oil policies of the Biden agenda (and global "climate" agenda) were a self-determined path to the loss of reserve currency status of the dollar, and therefore a self-determined destruction of wealth and sovereignty of the United States.

Conversely, Trump made it clear on the campaign trail that he put the highest priority on preserving the dollar's reserve currency status. He said, "if you want to go to third world status, lose your reserve currency."

Scott Bessent, his Treasury Secretary, made it clear, right up front, in his opening remarks of his Senate confirmation hearing that it's critical that the dollar remains the world's reserve currency. And when recently prodded for an official statement on the dollar he said "there is no alternative to the dollar."

All good news.

So, aside from embracing oil again and restoring global confidence in America's economy and global leadership position, what move can the Trump administration make to shore up the dollar's dominance AND, very importantly, create a new source of very deep demand for Treasuries?

Regulated dollar-based stablecoins (not a central bank digital dollar, but private stablecoins). So, dollar-denominated cryptocurrency, pegged to the dollar, backed by Treasuries or cash, and with a regulatory framework determined by Congress (with a bank deposit-like safety profile).

This would solve a lot of problems.

You get access to an entire hedge fund-grade research platform—delivering the same strategies used by professional money managers to build real, lasting wealth.

No fluff. No hype. Just high-conviction investment opportunities, world-class research, and access to a network of serious investors.

Spots are limited—we keep this exclusive to investors who actually want to take action. If that’s you, hit the link below and start making smarter, more profitable investment decisions today.

how about a coin that tracks inflation, not simply maintains the 1:1 basis, but is fully backed?