Don’t Sell Short a Boring Market

The S&P 500 and Nasdaq set new record highs on Friday, up 0.2% and 0.8% respectively, fuelled by a stronger-than-expected November jobs report that raised optimism about a Federal Reserve rate cut later this month.

Nonfarm payrolls surged by 227K, above the forecast of 214K, recovering from the weather and strike disruptions seen in October.

Major tech stocks led the rally, with Amazon (+2.9%), Tesla (+5.3%), and Meta (+2.5%) all posting gains, reflecting confidence in the labour market and the Fed’s potential policy shift.

In contrast, the Dow Jones dipped 123 points, pressured by declines in Nvidia (-1.8%) and UnitedHealth (-5.1%).

UnitedHealth's drop followed the tragic death of Brian Thompson, CEO of its insurance unit, which sparked concerns about broader implications for the sector.

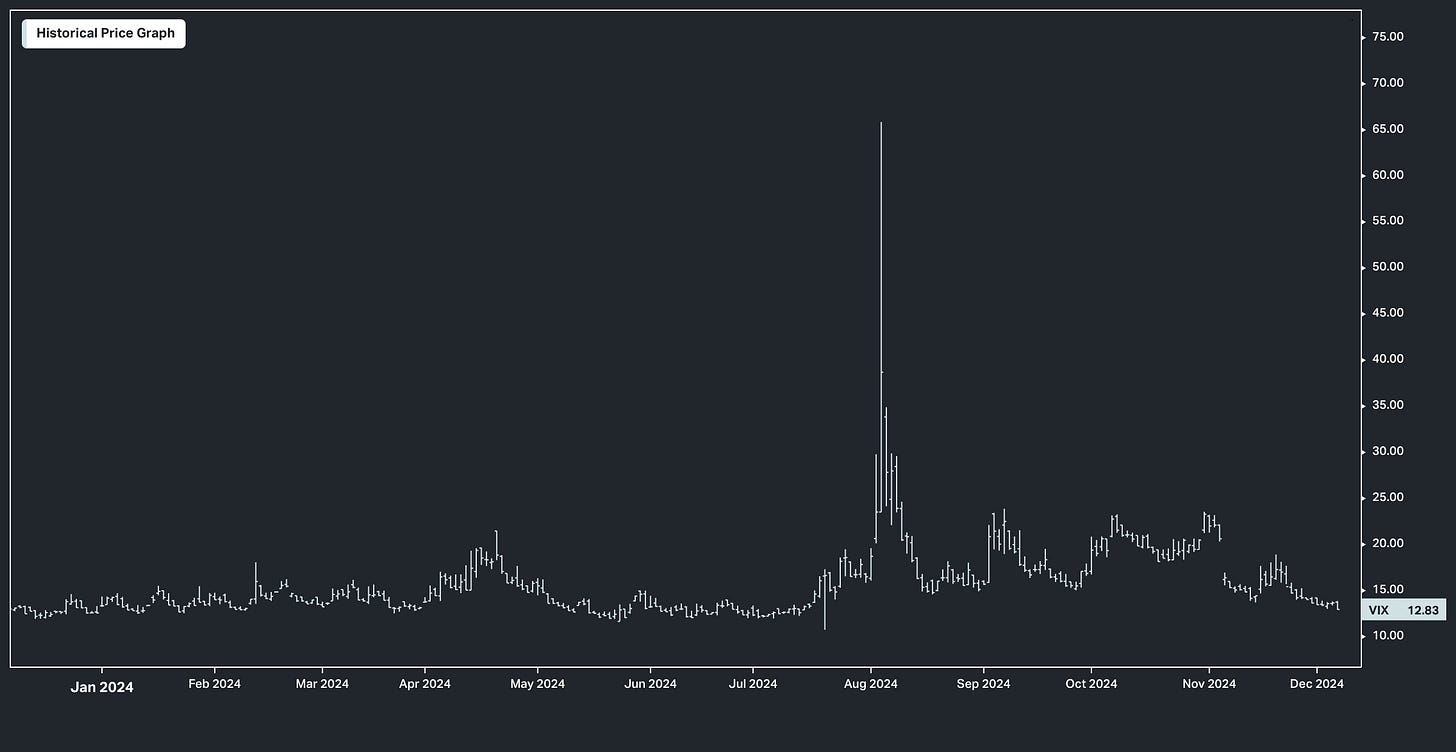

There are 16 trading days left in 2024. Through Wednesday, the S&P 500 reached 56 new all-time highs and has been higher in 11 of the past 12 trading sessions. What makes a stock market “boring” is low volatility and an upward trend.

The Chicago Board of Exchange (CBOE) volatility index on the S&P 500 (VIX) is down roughly 40% since the election. S&P 500 two-week realised volatility is the lowest it has been over the past five years.

The high-yield credit spread, a measure of concern in the bond market for the health of the economy and potential for credit risk, is the lowest it has been in a decade.

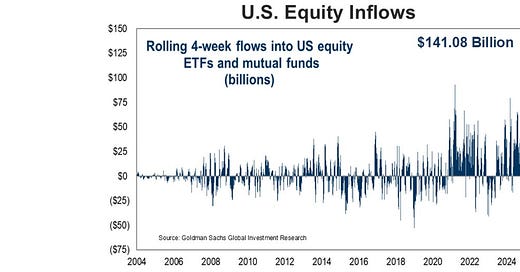

This placid backdrop during a seasonally strong period for the markets is conducive for investors to keep putting new money to work. Over the past four weeks, inflows into U.S. equities were $141.08 billion, the largest monthly inflows on record. Since 1928, the S&P 500 median monthly return for December is 2.04%. The median monthly return for December and January combined is 3.83%.

Over the past two years, analysts and investors have persistently underestimated the pace of economic growth. Twenty-four months ago, we were facing the most highly predicted recession in history. Instead, we enjoyed robust, real (greater than inflation) GDP growth of 2.5% in 2023 and a forecasted 3% in 2024.

Today, recession risk is considered no more than average (about 15% probability) and the Federal Reserve is lowering the Fed Funds interest rate. The bond futures markets are showing a 75% probability of a 0.25% rate cut following the Fed meeting on December 17-18. Fed rate cuts signal the Federal Reserve believes inflation is trending towards 2%.