"done"

US stocks ended lower on Wednesday as investors took a breather from the recent rally, despite encouraging inflation data and a tentative US-China trade agreement.

The S&P 500 slipped 0.3% to snap a 3-day win streak, the Nasdaq lost 0.5%, and the Dow finished flat.

On the trade front, US and Chinese negotiators reached a preliminary deal that includes China supplying rare earths and the US easing restrictions on Chinese student visas.

Still, the agreement lacked clarity on tariffs and export controls, dampening investor optimism.

President Trump said the deal was “done,” pending final approval from him and President Xi, while Commerce Secretary Howard Lutnick indicated a decision could come within days.

U.S./China trade talks went into a third day.

Bessent, the lead U.S. negotiator, was back in the U.S. testifying on Capitol Hill about the budget. On China, he called the negotiations "successful." He said he was "confident" that the negotiations will bring balance to the economic relationship.

That's quite a statement given the 2019 "Phase One" trade deal was never adhered to by the Chinese, whilst the deal agreed to last May was ignored.

Bessent later called the takeaway from the London meetings "an excellent start."

On that note, we are four months into the tariff timeline, which started on February 4th, with a broad 10% tariff on all Chinese goods. That was then raised to "up to" 145%. And lowered to 55% last month, in the 90-day truce.

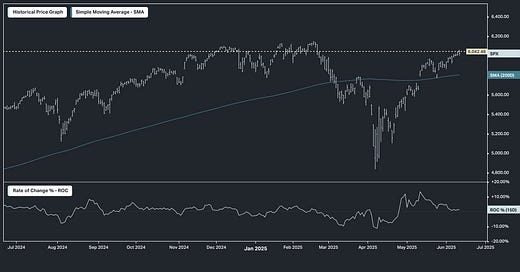

What has happened to stocks along the way? We've had a full V-shaped move, and have now traded back to the opening level of February 4th, almost to the number.

Successful Call: Bio-Techne Corp | Global Trend Report 25 May 25

The stock (TECH) has rebounded over 10% after our call pointing to an exhaustion of the down move (pink box).

For the option enthusiasts amongst you, the 20June25 50 Call has traded from $1.70 to $3.80, giving you +123% gain in a little over 12 days.

The Global Trend Report provides indicators and diagnostics to help assess the current state of financial markets across various asset classes and regions. Become a member and join us - the above insight alone covers the membership!