We get the Fed's favoured inflation gauge - personal consumption expenditures (PCE).

For the month of April, the market consensus is for 0.3% m/m and 2.7% y/y, which would be a continuation of this leveling off under 3% (but above the Fed's target).

That said, it may have become a less important event for markets after the guilty verdict of the President's political opponent was announced yesterday afternoon.

We won't know if Trump will be jailed until July 11th, conveniently four days before the Republican National Convention, where delegates of the party will officially select the party's nominee for president.

As we discussed in my note yesterday, the potential jailing of a U.S. presidential candidate driven by partisan lawfare should raise concerns for every investor about America’s role in the world as the reliable anchor of law, fairness, and stability.

As we've also discussed, this has the potential to be a tipping point for trust in the historical global safe haven role of the U.S. Treasury market and the dollar. Will we see selling/ capital flight?

With that, this chart will be an important one to watch. Yields have been climbing back towards this trendline – a break of which (higher) would bring about risk of another visit to the 5% area, a level the Fed wasn't comfortable with back in October.

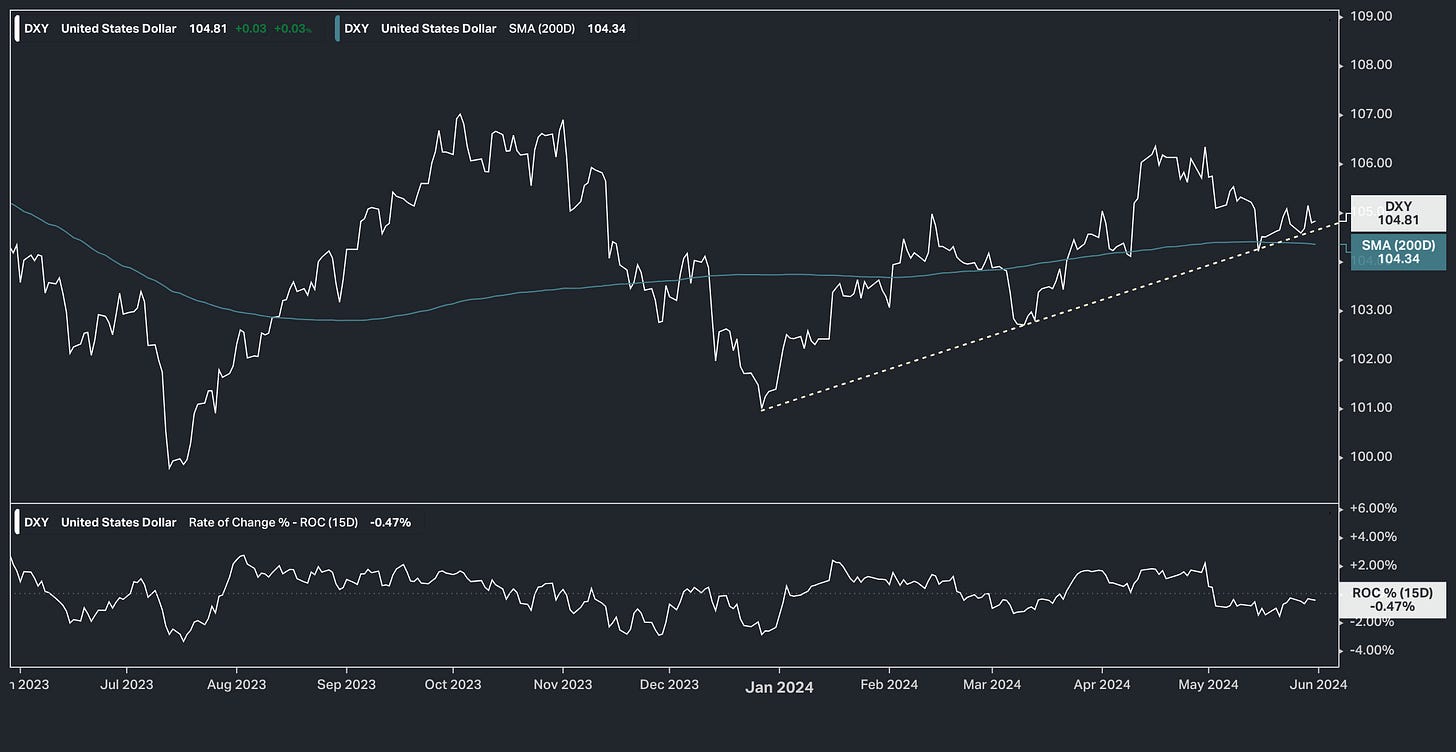

As for the dollar, we sit on this trendline …

For more perspective, let's revisit the long-term dollar cycles, which we've kept an eye on throughout the history of my daily note.

Since the failure of the Bretton-Woods system through the onset of the Global Financial Crisis, the dollar traded in five distinct cycles – spanning 7.4 years on average. The average change in the value of the dollar (in those five cycles), from extreme to extreme was greater than 50%.

As you can see, the era of quantitative easing (QE) has seemingly distorted this last bull cycle.

The top was in late 2022, just after the Fed started QT (quantitative tightening/reversing QE).

And now we're early into a dollar bear cycle, as the dollar's world reserve currency status is being opportunistically challenged by, primarily, China. And as the vulnerabilities created by U.S. fiscal profligacy are being exacerbated by the potential erosion of trust in the U.S government.

Interestingly, both Chinese and Hong Kong stocks (indices) gapped higher on the open, following the news of the trial verdict in the U.S.

So the rule of law does not apply to you, America is different from a banana republic because no one is above the law , stop your nonsense