Stocks continued the big bounce from technical support.

Let's take an updated look at the S&P 500 chart…

So, we had a 5% decline in this benchmark index to start the year, and now we have a sharp bounce of nearly 3% from this big technical trendline, which comes in from the election day lows of November 2020 (an important marker).

We heard from Jay Powell yesterday, in his renomination hearings before the Senate. He did nothing to change the expectations on the Fed's guidance on the rate path - whether it be three or four hikes this year, we've just finished a year with around 10% nominal growth and over 5% inflation.

The coming year may be more of the same, and yet we have a market and Fed posturing and speculating over how close to 1% the Fed Funds rate might be by year end - a dynamic that only adds fuel to the inflation and growth fire.

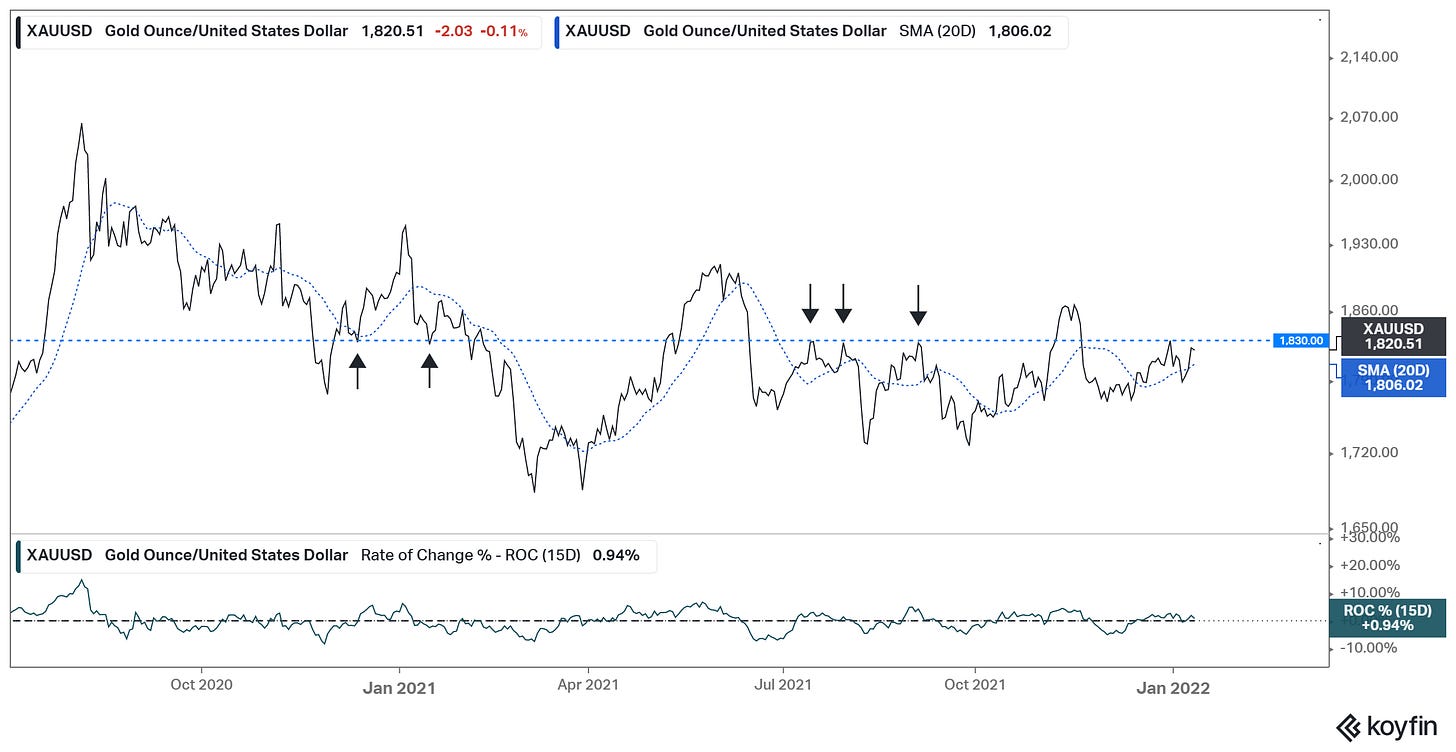

On that note, we've been watching three key spots that should be on the move with this policy outlook: bonds (down), gold (up) and the dollar (down).

Gold was up 1.25%, making another run at this 1830 level. If that level gives way, the move in gold should accelerate. As you can see in the chart, we would get a breakout from this horizontal resistance line that held 3 times last year whilst havnt played a role earlier in the year.

On a related note (dollar down, commodities up), the dollar looks vulnerable to a breakdown technically...