"Do Add Somewhat to Confidence."

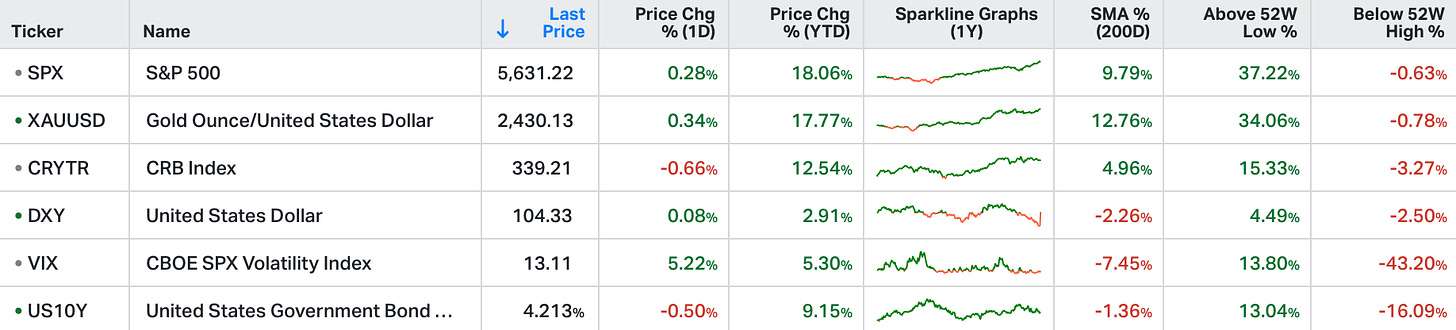

The S&P 500 and the Nasdaq added 0.3% and 0.4%, respectively, on Monday, while Dow Jones added 210 points to close at fresh record.

Traders weighed the impact of an assassination attempt on presidential candidate Donald Trump and focused on remarks from Jerome Powell.

He emphasized that the Fed can act preemptively before inflation reaches 2% but refused to signal any specific timing for potential rate cuts.

Powell also acknowledged improvements in the labor market.

In corporate news, Trump Media & Technology Group Corp gained.

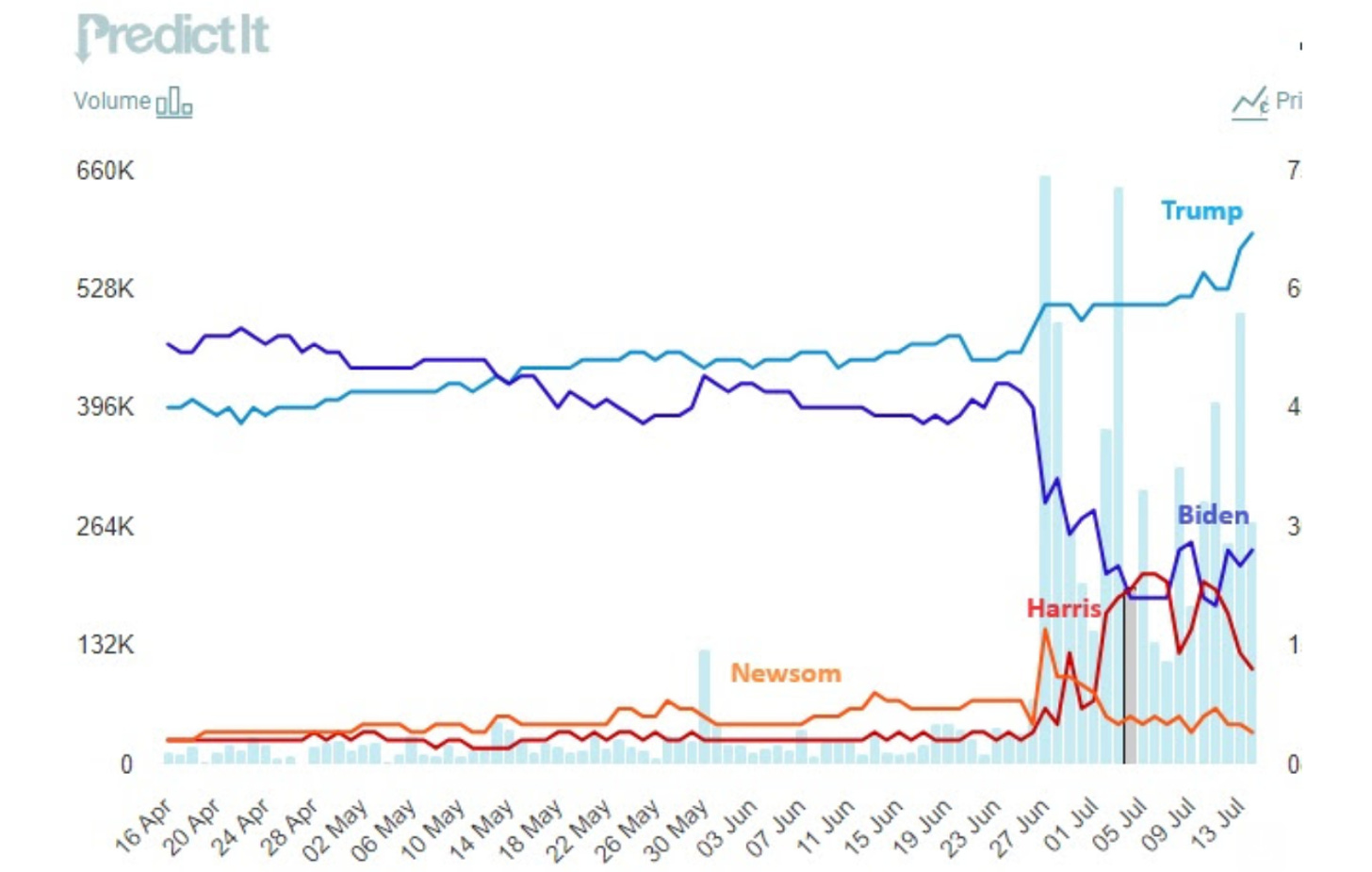

The assassination attempt on former President Trump over the weekend has bolstered the election probabilities heavily in favour of a Trump victory in November. You can see it reflected in the progression of the betting markets in the chart below ...

And a Republican sweep of Congress is now at better than a coin flips chance.

With this dynamic, let's revisit the summer of 2016, when it became apparent that Trump had a legitimate chance at a first term.

Things were looking bleak in the latter half of 2015 and first half of 2016. Oil prices had been crashing for more than a year, driven by OPEC manipulation, in an attempt to put the U.S. shale industry out of business. It nearly worked. There were mass U.S. oil and gas bankruptcies, and threats to creditors of the industry. It came with heavy deflationary pressures in the economy.

Meanwhile, China's economy was in bad shape. The stock market had a boom and bust in 2015, and the Chinese had surprised the world by devaluing the yuan (a shock to global financial markets).

Despite these signals, the Fed mechanically made its first rate hike in a decade, to end 2015 . . . And with that, to start 2016 U.S. stocks melted down, having the worst start to a New Year on record.

So, it was seven years after the failure of Lehman Brothers, and the government had blown through an $800 billion fiscal stimulus package, three rounds of QE and held rates at zero throughout, and yet the economy was on the verge of another downward spiral.

And the worse news: The monetary and fiscal ammunition needed to fight another ugly downturn (which was a high risk of a deflationary spiral) had already been fired.

This muddling economic recovery, turned deflationary spiral risk, was a global phenomenon. It brought about a revolt at the ballot box, it started in the UK, with Brexit. And right about that time, it became apparent that U.S. voters were embracing change in the U.S. - a pro-growth candidate, in Trump.

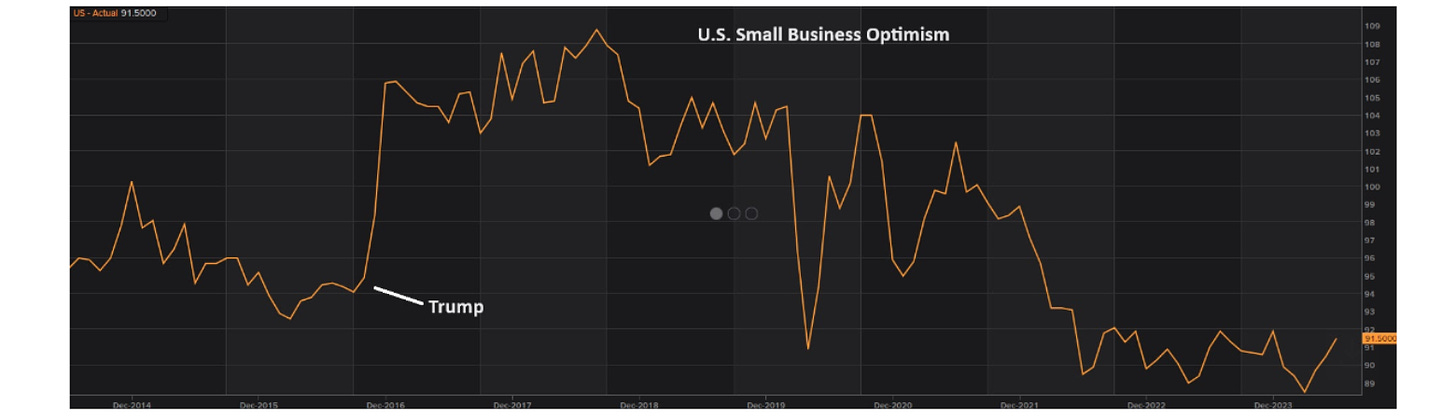

Take a look at the response of the Trump effect on the Small Business Optimism Index in 2016.

Also notice where the index stands now - it's lower than 2016, having just reported a 30th consecutive month UNDER the historical average.

With that, we shouldn't underestimate the potential for a boom in optimism (business and consumer) for the second half of the year, if the election outlook continues to hold.

What would be on the chopping block in a Trump presidency and aligned Congress? The radical multi-trillion dollar global energy transformation (which also has Biden social agenda spending).

The anti-Trump campaigners (which include the media) have claimed that Trump would be more inflationary than Biden. To the contrary, rescinding the already appropriated massive fiscal spending on the Biden agenda would be (maybe very) disinflationary.

On the inflation topic, as we discussed last week, the June inflation data showed the first monthly decline since May of 2020 (the depths of the pandemic lockdown and deep economic contraction). And conveniently, Jerome Powell was on a stage at the Economic Club of Washington for some Q&A. What did he have to say?

He said they've been looking for "more confidence" that inflation (the rate-of-change in prices) was on its way down, toward its target of 2%.

He said inflation came down by "a very large amount," in the second half of last year.

He said they "didn't gain any additional confidence" in the first quarter, but the three readings in the second quarter, including the one from last week "do add somewhat to confidence."

The headline monthly CPI change for the past three months has been 0.3% (April), 0% (May) and negative 0.1% (June).

Interestingly, these last two numbers bring down the six month average to a lower number than the average of the second half of last year, which Jay Powell described as "good data" that gave them the "confidence" to start telegraphing the beginning of the easing cycle.

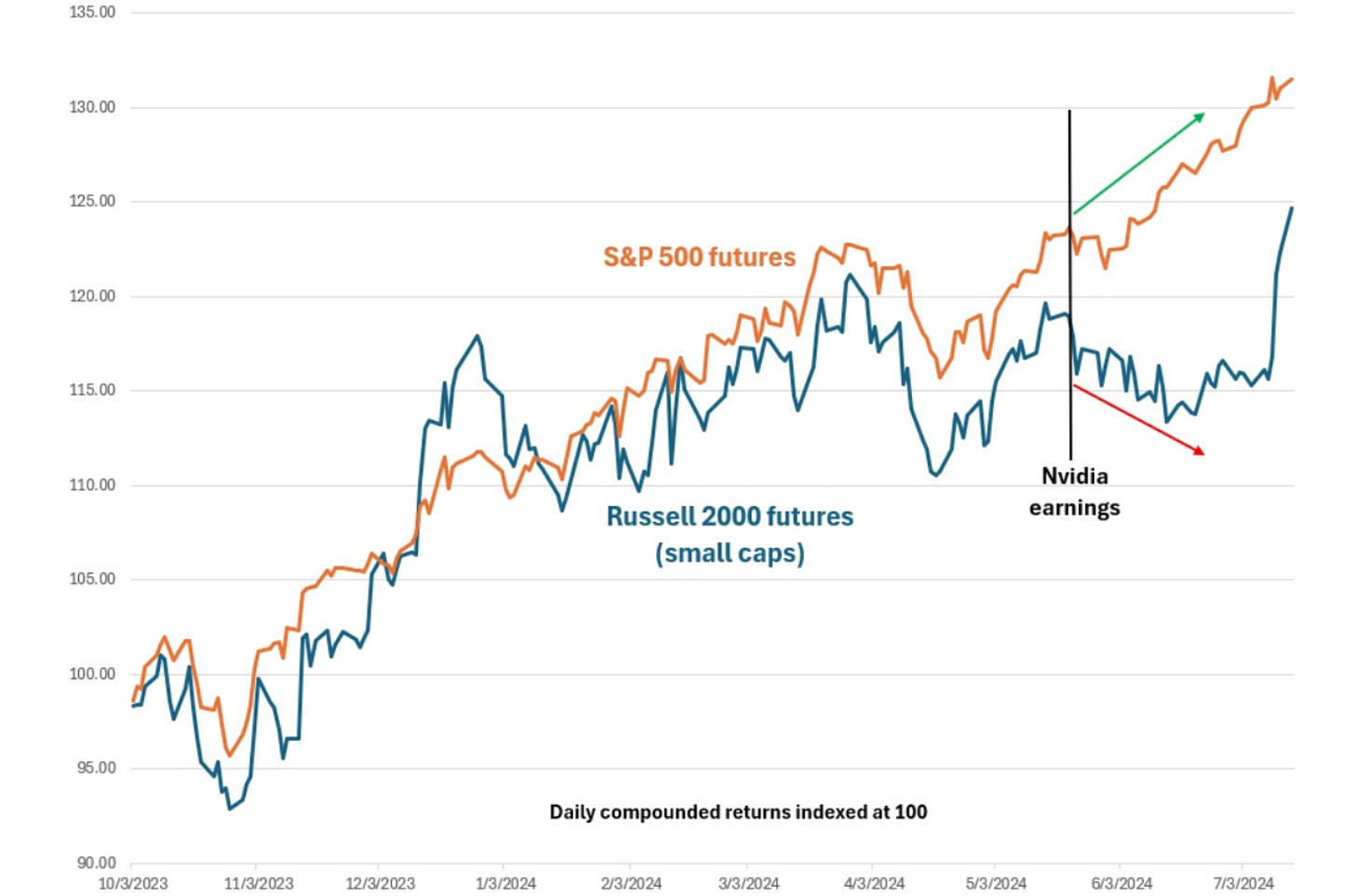

With the improving outlook on rate cuts, we looked at this chart last week, which shows the divergent paths of the Russell 2000 (small cap stocks) and the S&P 500 (led by a handful of big tech stocks). As you can see, it's now aggressively converging (i.e. Russell outperforming).