Diminished

The three major averages in the US hovered near the flatline on Thursday, following a strong rally in the previous session that pushed indices to new record highs.

Traders are keeping a close eye on today's key jobs report.

The data supported Fed Chair Powell’s remark at a New York summit yesterday that the US economy remains in “remarkably good shape”.

The odds of a 25bps rate cut by the Fed this month hold steady at around 74%, largely unchanged from Wednesday.

On the corporate front, crypto-related stocks soared, namely Coinbase (4.4%) and MicroStrategy (8.6%), as Bitcoin broke above $100,000 for the first time.

We get the November jobs report Friday morning.

As a refresher, Jerome Powell maintained the stance in his November press conference that a negative surprise in the labour market was the condition to cut rates faster.

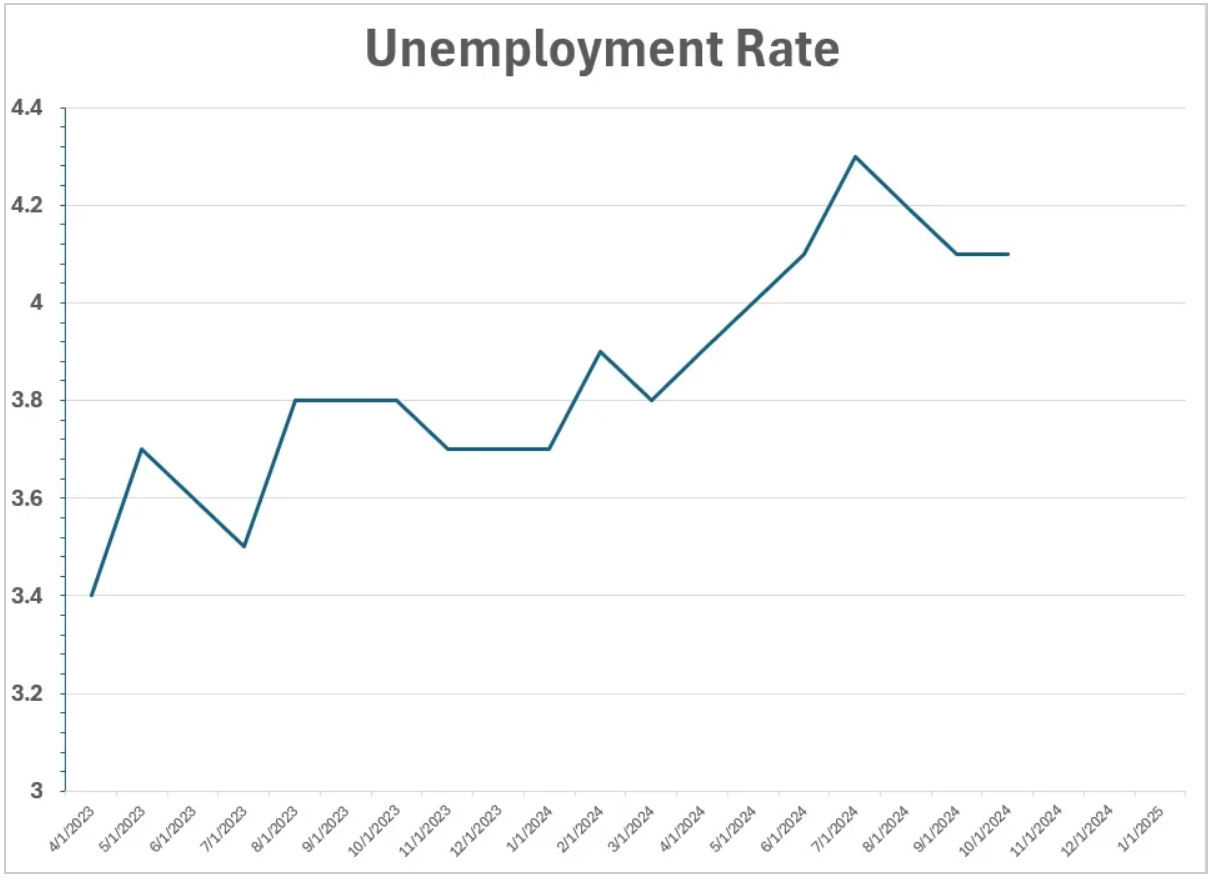

This condition has been primarily focused on the rise in the unemployment rate.

They've been most concerned with the speed of the rise, not necessarily the level.

On that note, as you can see below, the peak was July, and we've since had three lower months. The rise has stalled.

With that, in the recent commentary from Fed officials we've heard the word "stabilised" to describe the unemployment rate. And Jerome Powell recently said the economy was in "very good shape."

Add to that, based on their reaction to the 2016 election, it's fair to say that the Fed is already incorporating policies from the incoming administration into their outlook — policies which should be favourable to the labour market, and boost business confidence.

So, it seems likely that this labour market condition/reaction function for the Fed (which amounts to a "Fed put") has diminished at this point.