Dialling Up

US stocks experienced mixed performances on Wednesday as investors assessed the Federal Reserve's rate cut trajectory and awaited Micron's earnings for AI demand insights.

The S&P 500 and the Dow fell by 0.2% and 0.7% respectively, retreating from earlier highs, with energy stocks like Chevron (-2.4%) and Exxon Mobil (-2%) leading losses.

Concerns over a slowing economy continue to linger despite the Fed’s recent rate cut.

A weak consumer confidence reading raised recession concerns, as new home sales dipped, but mortgage applications rose.

Investors are now focused on key upcoming economic data, including the GDP report and the PCE inflation index.

We talked about both the technical and fundamental case for a weaker dollar yesterday.

The outlook for lower real interest rates is clearly dollar negative. And it plays into the long-term dollar cycles, which are in the early stages of a bear cycle.

That said, the dollar ripped higher yesterday at 10am (EST), driven by the safe-haven feature of the dollar, this was the catalyst …

Zelensky took the stage at the UN and said Russia was planning attacks on Ukraine nuclear plants.

Forty-five minutes later, it was reported that the head of the Israeli army said they were preparing for a ground offensive in Lebanon.

Hours later, Putin was on the wires announcing that Russia is expanding "the category of states and military alliances subject to nuclear deterrence." If they get reliable information of an attack, aided by nuclear powers (Western world military alliance), he says they reserve the right to use nuclear weapons.

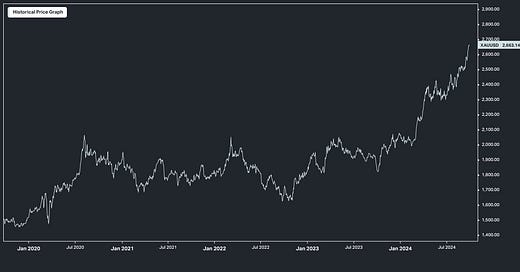

With the above in mind, we also talked about gold prices in my note yesterday.

It printed another new all-time high. Even at record highs, the reasons to own gold continue to build;

Falling real interest rates,

fiscal and monetary policy profligacy,

and now the dialling up of war rhetoric, which fuels safe haven demand for gold.