Devaluation Threats Upcoming?

US stocks swung between gains and losses on Thursday, as lingering concerns over tariffs and the economic outlook weighed on investors' sentiment.

The consumer discretionary sector was the top performer while tech and energy booked the biggest losses.

Meanwhile, General Motors plunged over 7% after the Trump administration announced a 25% tariff on "all cars not made in the US," set to take effect on April 2.

President Trump also warned of "far larger" tariffs on the EU and Canada if they coordinated efforts to counter US trade measures.

Traders also digested fresh economic data.

Yesterday we talked about tariffs and Trump's objective to rebalance global trade.

It's about China, and the multi-decade economic war it has waged using its currency as a weapon. That's led to a wealth transfer from the West to China. It has also led to a structurally fragile global economy.

A weak yuan has been the go-to strategy for manipulating economic advantage and the formula for China’s rise to global economic superpower status. We should expect China to counter Trump's tariffs by ... weakening the yuan.

If we look back at 2016, in the seven weeks surrounding the election, the Chinese central bank made the largest seven-week devaluation of the yuan in a decade – in anticipation of tariffs.

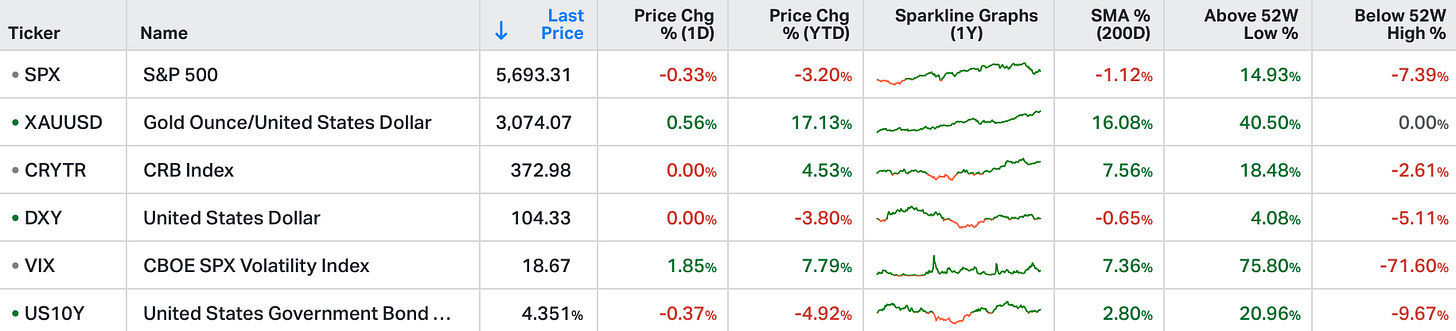

This time, for Trump 2.0, the yuan is already set around the weakest levels vs. the dollar since 2007.

If history is our guide (from trade war 1.0), we should expect China to create some leverage in trade negotiations by threatening a big one-off currency devaluation.

What leverage would that create?

A sharp yuan devaluation would (very likely) trigger global financial market instability. A small one-off devaluation in 2015 sent global stock markets into a sharp fall, on the fear that a bigger Chinese currency devaluation was coming, which could have led to a global currency war, as export competitors devalued to stay competitive.

A currency devaluation threat from China could either;

put pressure on Trump to negotiate more favourably to avoid a bigger economic fallout,

it could embolden his effort to end China's economic warfare – perhaps by rallying allies to coordinate sanctions (to put China in the penalty box).

My bet would be on the latter.

GRYNING | Valuation Model - a standardised mechanism in measuring, analysing, projecting, valuing, and discounting a firm’s underlying economic profit. In this week’s Research Roundup we cover;

Names In The News: $XZY & $BKW

European Equities: Where to put your money?

U.K. Midcaps: $QQ & $GAMA

Industry Snapshot: Global Passenger Airlines.

Valuation Model | Research Roundup

PRV The PRV framework is an internal model that translates underlying Fundamentals into metrics (Profitability, Risk, Value) that can be ranked and then compared relative to the broader market or intra-industry.