Debt Problem

US stocks declined on Friday after Donald Trump escalated trade tensions by threatening tariffs on both Apple and the European Union.

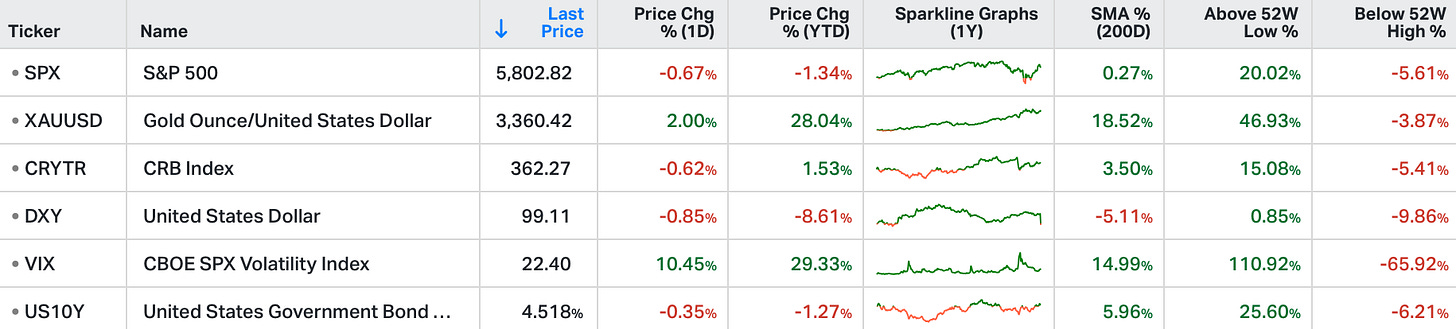

The S&P 500 fell 0.6%, the Nasdaq 100 dropped 0.9%, and the Dow lost 256 points.

He also proposed a 50% tariff on all EU imports starting June 1 due to stalled trade talks, renewing fears of protectionist policies.

Tech stocks led the downturn, with names like Micron, Qualcomm, and Nvidia posting losses of more than 1%.

This pullback came just as investors were gaining confidence amid a temporary pause in tariffs and signs of progress in negotiations with the UK and China.

Moody’s downgraded U.S. sovereign debt because they are increasingly concerned with the trajectory of deficit spending and the roughly $36 trillion of outstanding debt. Since Covid, interest expense on U.S. debt has doubled. Net interest payments are now the second-largest line item in the U.S. federal budget, trailing only Social Security.

Debt expense is crowding out other government expenditures and may reach a point whereby the only solution is to substantially reduce entitlement spending and raise taxes.

Because of the increased debt financing requirement, the government interest expense burden has become highly sensitive to interest rate changes. Rising interest rates significantly exacerbate the high level of interest expense. The U.S. 10-year treasury yield is a benchmark for government borrowing costs. It is also a key driver in many consumer loans including mortgage and car loan rates.

The 10-year U.S. treasury rate has risen from about 3.9% to 4.6% in the past two months.

A treasury bond auction last week on Wednesday experienced relatively soft demand compared to the prior 12 auctions. The reconciliation bill passed by the House of Representatives is expected to add $3.3 trillion to deficits over the next ten years. Rising borrowing requirements versus a backdrop of softening demand suggest 10-year rates may remain relatively high or move higher even if the Federal Reserve lowers the short-term Fed Funds rate.

Predicting future 10-year bond yields is notoriously difficult. Higher interest rates increase the discount rate of future earnings, lowering the present value of stocks. However, interest rates are only one input to stock valuation. In the first quarter, S&P 500 companies collectively reported 4.4% revenue growth year-over-year and 12.6% earnings growth. The Magnificent 7 companies reported 28% year-over-year earnings growth. Corporate stock buybacks surged 24% year-over-year to about $272 billion.

Plus, there is a global element to the move in interest rates. 10Y yields are above nominal GDP in France, Germany, Italy, Austria, Finland and Australia, amongst other places. Hard to pin it just on US fiscal dynamics.

Position Your Portfolio for Success

Our decades of expertise guide you through turbulent markets to build lasting wealth. With institutional-grade insights and daily oversight, we deliver more than advice - we deliver results.