Inflation cooled in Q4 . . . and it has bounced back in the first month of the New Year. Following another inflation reading Friday morning, stocks traded down, and we ended the week with some big technical levels tested;

200 day sma (blue).

arbitrary downward sloping trend line (purple).

The recent steep decline of the past seven trading days started with the hot inflation report on February 14th (CPI).

Friday morning we got the last major inflation reading from the month of January (core PCE), and the stock market traded down toward the arbitrary trend line that describes the bear market of last year (the purple line). Moreover, it (the S&P futures) traded perfectly into the 200-day moving average (the blue line).

These are two significant technical levels - formerly technical resistance, is now technical support. So, into the 200-day moving average, stocks bounced.

Now, importantly, despite the hotter January inflation data, we're not getting the type of reactionary tough talk from the Fed, that we had last year. Why? Because they are in control.

As Jamie Dimon said, the Fed "lost control" of inflation for a bit. When he says inflation, he means inflation expectations. You can see it in this chart:

As we've discussed throughout this run up in prices, what the Fed fears more than inflation itself, is consumer (and business) inflation expectations - if you expect higher prices, you might behave in ways that lead to higher prices (and potentially runaway inflation).

Back in April of last year (as you can see in the chart), that threat was materializing. But now, look to the far right of the chart, inflation expectations are tame, and well under control.

So, where does the Fed go from here? Again, despite hotter prices in January, we haven't heard the reactionary tough talk (i.e. threats against markets and the economy) from the Fed this time. To the contrary, two Fed Presidents and the CEO of the country's (U.S.) largest bank all used the word "little" to describe how much higher rates will go from here.

Bottom line, the rate path expectation that has been built into markets (and the economy) haven't changed with the latest inflation data. And don't forget, the Fed needs inflation, while under control, to run hotter than average for a bit longer.

Remember, back in September of 2020, Jerome Powell made an official policy change in the way they evaluate their two percent inflation target. Because inflation had been too low, for too long he told us he would let inflation run hot, to bring inflation back to 2% on average over time.

Inflation has run hot. But as can see, if we take the average over the past fifteen years (post-Lehman) inflation remains below the Fed's two percent target.

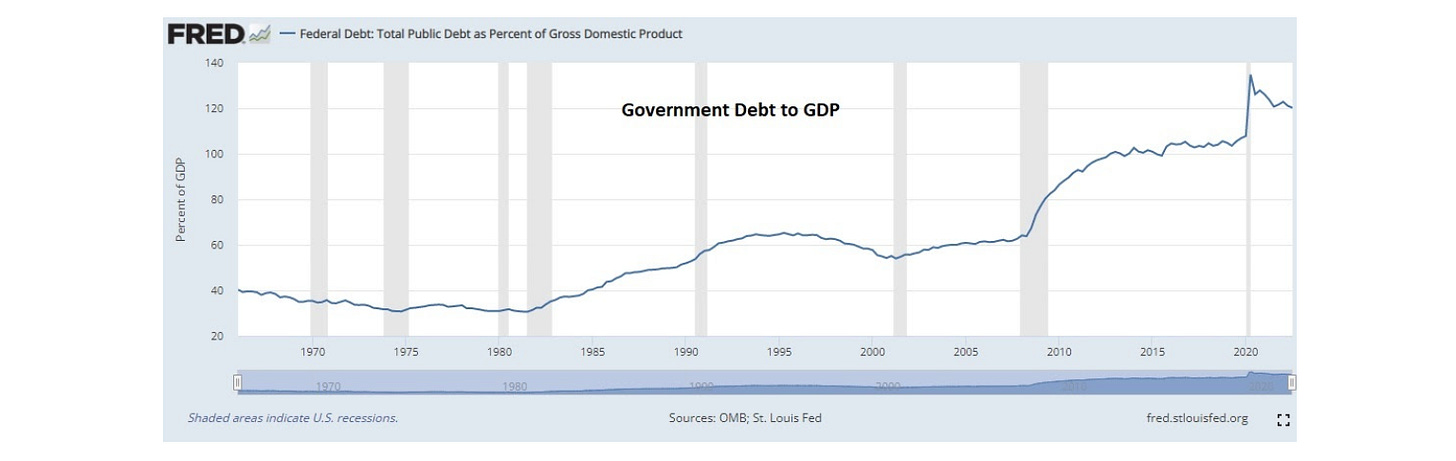

That's good. Remember, central bank’s have fired a lot of fiscal bullets over the past fifteen years and government debt has ballooned, as a result.

We need a period of controlled hotter inflation, as long as it comes with hot nominal economic growth. On that note, the economy has been growing at a nominal (including inflation) 9% pace since late summer of 2020 (average quarterly annualized GDP growth).

With the above in mind, the absolute value of government debt doesn't mean much. The debt relative to the size of the economy is what matters. As you can see in the chart below, debt has doubled, relative to the size of the economy since the Great Financial Crisis.

It now has to be inflated away. That comes through hot nominal growth, and growth is beginning to chip away at the debt, but not fast enough.

ps: If you found this post of value, please share it with those you think will benefit from it.