De-Risking

US stocks extended their losses at the start of the fourth quarter as markets weighed on increasing geopolitical risk, labour strikes, and a batch of fresh economic data releases.

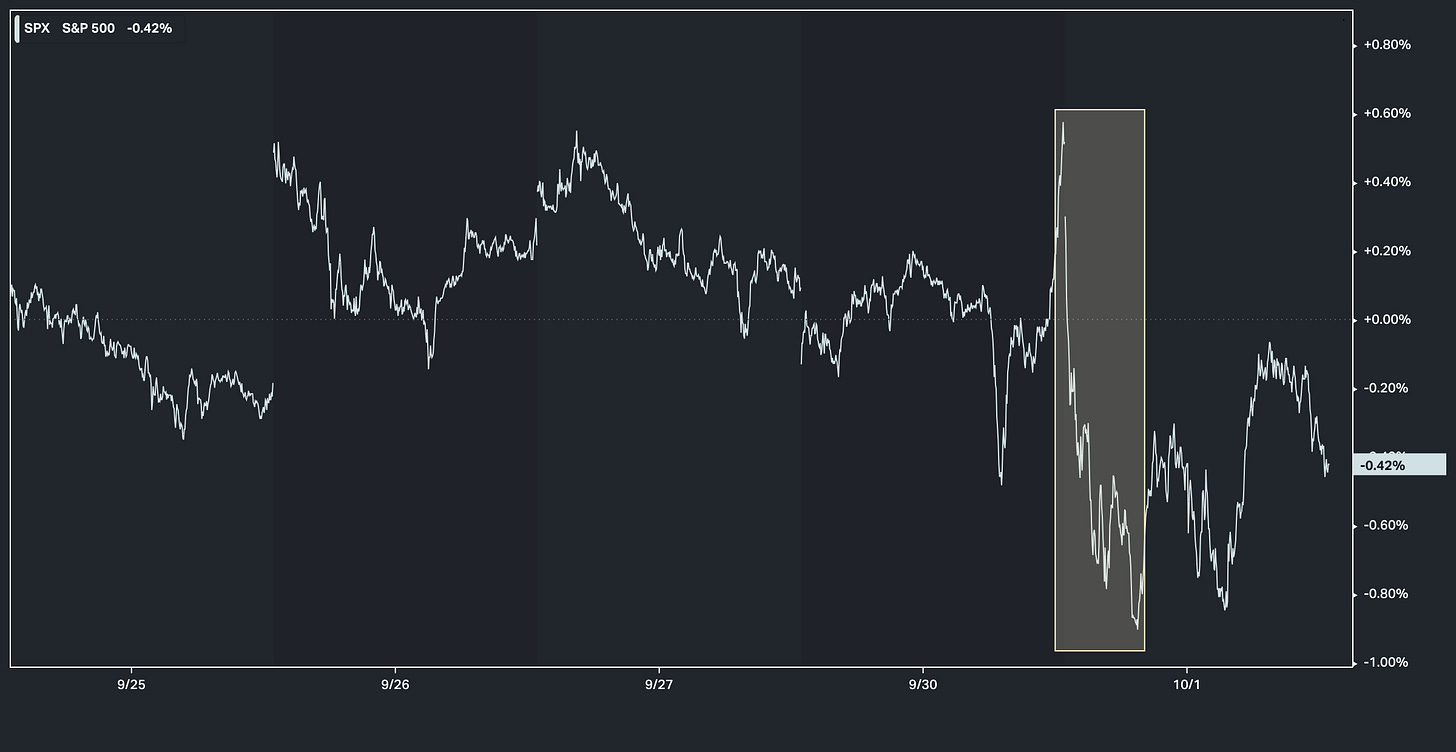

The S&P 500 and the Dow dropped close to 1%, while the Nasdaq 100 fell a sharper 1.7%.

Stocks also came under pressure from an extended strike for ILA workers in key US ports and the risk of more disruptive supply-chain issues.

ISM PMI indicated another sharp contraction for US factory activity, although softer producer prices added room for the Fed to continue cutting rates.

JOLTS pointed to a rebound in job openings.

We start the first day of the fourth quarter with an Iranian attack on Israel (and related global war threat escalation) and a supply disruption from a port worker strike which is compounded by already stressed logistics and supply issues from Hurricane Helene.

Markets went into risk aversion mode.

Where does capital flow in times of global risk aversion? U.S. Treasuries. Gold. The dollar. All were up. Stocks were down. It started with this headline just after the market opened in the morning …

Stocks did this …

So, clearly the big geopolitical risk here is that it pulls in Western allies of Israel, namely the United States, and a global war erupts.

That said, this risk was also contemplated back in April. And it happened to be right at the open of the quarter. Let's revisit that timeline.

Israel bombed the Iranian embassy in Syria on April 1st. Stocks topped.

Iran retaliated with strikes inside of Israel on April 13th.

It de-escalated on April 19th after Israel attacked targets in Iran. Iran said it wouldn't retaliate.

That was the turning point for markets, after a 7% decline in stocks, and 9% rise in gold (over 15 trading days).

In the current case, we should expect, at the very least, escalation from the recent attack. That should keep markets in de-risking mode and provide more fuel for the commodities bull market.