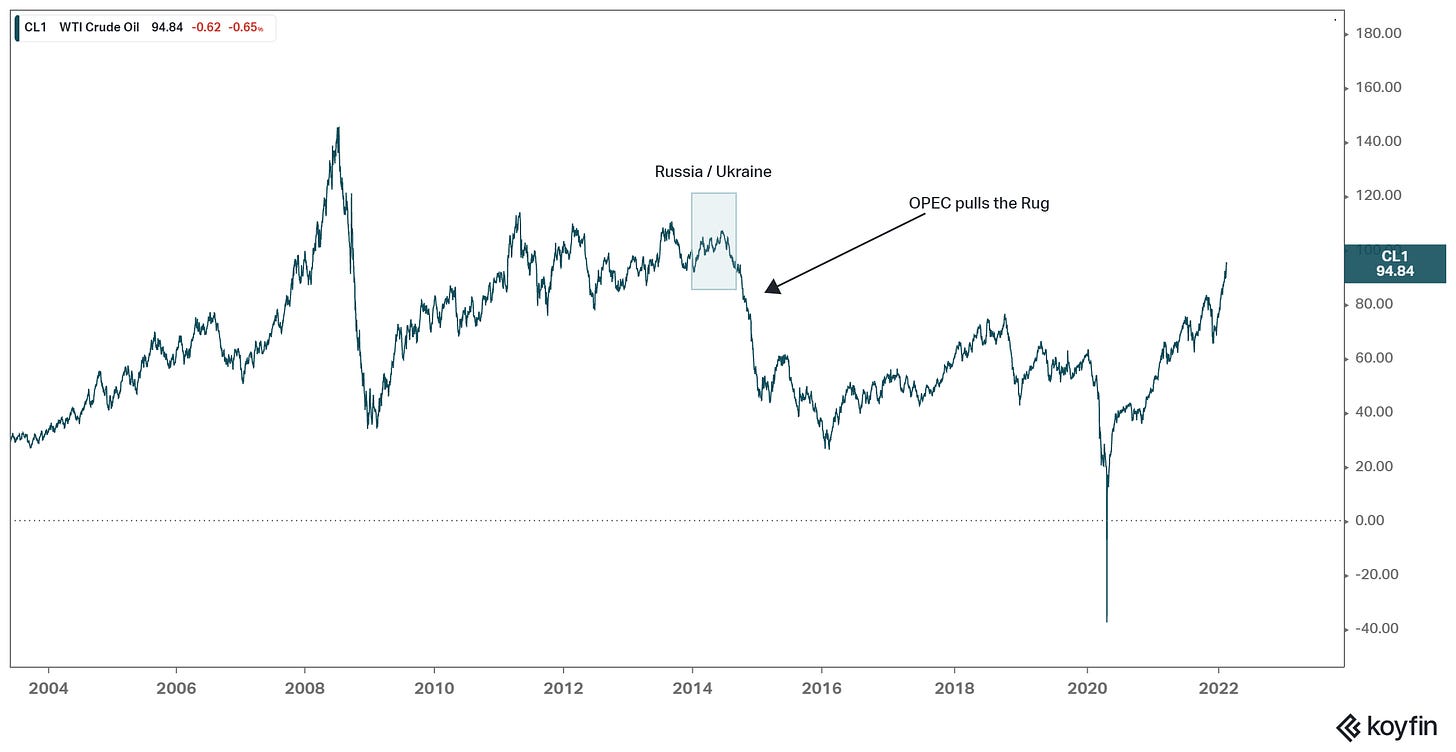

Oil traded above $95 yesterday, for the first time since 2014.

Let's take a look at the chart...

What's similar and what's different about the current environment and 2014?

First, throughout 2014, Russia was bullying it's way into Ukraine - it ended with the annexation of Crimea.

This time, Russia wants all of Ukraine.

Oil prices rose from about $90 to a high of $108 when this conflict was unraveling back in early 2014.

What happened in late 2014? Russia began withdrawing troops from Ukraine, and signed an EU brokered deal to begin supplying gas again to Ukraine (which flows to the EU).

Oil prices began to fall. Then, on the evening of Thanksgiving (2014), at a scheduled meeting, OPEC surprised the oil market with a well-timed announcement that they would not defend the price of oil with a production cut.

Oil prices fell about 14% over the next 24 hours (in a thin, holiday market) - and was nearly halved just two months later.

What was the motivation? They wanted to put the emerging, competitive U.S. shale industry out of business, by forcing prices below the point at which the shale companies could profitably produce.

They nearly succeeded. Shale companies started dropping like flies, with more than 100 bankruptcies over the next two years.

What's different now? Both domestic (Western) and global oil policy has done the job for OPEC, destroying competition (including U.S. shale). OPEC is now back in the driver's seat, in full control of the global oil market - they want higher prices (much higher).

With that, with oil at $95, the Secretary General of OPEC rebuffed any ideas that OPEC might consider increasing production to stabilise oil prices. As he should, he blamed an undersupplied market, due to the lack of global investment in new production.

He said OPEC members were having challenges just meeting the current production targets (much less an increased target). This is OPEC using the cover of the destructive global climate agenda, and the related investment withdrawal and regulatory noose placed on oil production.

So, OPEC now has every incentive to drive prices higher (not lower, like in 2014).

Add to this, unlike 2014, the Ukraine situation (as it appears) will pull the world into war, against the third largest producer of oil, in an oil undersupplied world.

Prices are going higher, much higher.