News In 5

Stocks in the US finished higher on Wednesday, as investors await the US CPI release tomorrow as well as the commencement of the earnings season later in the week.

The S&P 500 added 0.6%, the Nasdaq gained 0.7%, the Dow Jones finished 170 points higher.

Meta experienced a notable surge of 3.6%, its highest level since September 2021.

NVIDIA also demonstrated strong performance, adding 2.2%, while Microsoft rose by 1.8%, closing at its highest level since November, although it reached a record high of $382.13 during the session.

In contrast, Exxon Mobil (-1%) and Chevron (-0.8%) saw declines, reaching their lowest levels in four weeks.

Macro Perspectives

We go into the December inflation report today with the S&P 500 near record highs, the 10-year yield around 4% and a market looking for six quarter-point rate cuts this year.

Let's revisit the inflation data of the past couple of months…

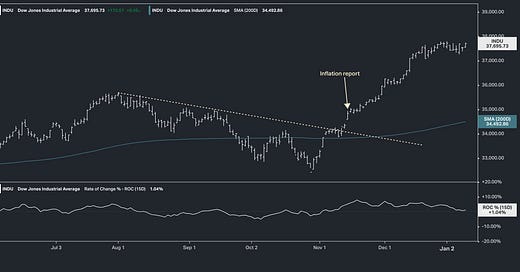

It was the November 14th inflation report (on October prices) that signaled the regime change for monetary policy. In that report, the year-over-year change in headline CPI fell from 3.7% to 3.2%. The monthly change was reported as flat (no change), but the actual change in the index was down 4 basis points from the prior month (i.e. a slight fall in prices).

We headed into that number with stocks set up for a bullish technical breakout. Indeed, stocks took off and never looked back…

The Russell 2000 jumped 5% that day.

Yields fell 20 basis points.

The dollar had its third largest decline of the pandemic/post-pandemic era.

Again, this was a signal that the rate hiking cycle was over - the interest rate market immediately reversed bets for more rate hikes, and started pricing in more, and earlier, rate cuts for 2024.

Then we had the December Fed meeting. Just months earlier the Fed had projected to be raising rates at the December meeting. Instead, they did nothing. Moreover, Jerome Powell all but claimed victory on inflation, and he telegraphed a quickening in the fall of inflation with projections on core PCE (the Fed's favored inflation gauge) ending the year at 3.2%.

That brings us to today and building on my previous notes, we should expect lower energy prices to have continued the drag on headline in inflation in December. The important number will be the monthly change in both the headline and the core (excluding food and energy prices). Could it be negative?

If it isn't, the year-over-year headline CPI will get media attention. It should bounce aggressively from the last reading (which was 3.1%). Why? It will be measured against a low base of December 2022. In that case, it was a sharp fall in gas prices that dragged the December 2022 CPI into negative territory (i.e. deflation) - pulling down the consumer price index.

If we do get a bounce in the headline CPI, we will likely get selling in stocks and bonds (bounce in yields). But keep in mind, after today the Fed will still have one more (most important) inflation data point prior to its end of month meeting. They'll get December core PCE on January 26th - which they've already told us in their Summary of Economic Projections that they see at 3.2%...which means the Fed is overly tight.

feels like inflation may not be heading to zero that soon after all. median and super-core remain quite sticky and I still do not see anything that would drive them much lower.