Copper

Stocks in the US closed slightly higher on Wednesday, as investors remained cautious amid escalating tensions in the Middle East.

The S&P 500 finished relatively flat, while the Dow Jones added 39 points and the Nasdaq edged higher by 0.1%.

Meanwhile, economic data showed stronger-than-expected job growth, with 143,000 private-sector jobs added in September.

Investors await Friday’s jobs report for further insight into the economy and the Fed’s interest rate decisions.

Nike shares tumbling 6.8% after withdrawing its full-year outlook, and Tesla dropped 3.5% following weaker-than-expected deliveries. Nvidia (+1.6%) helped support tech stocks with gains.

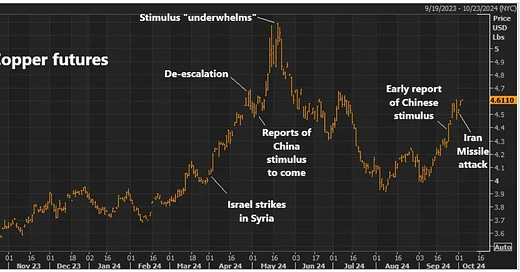

Let's take a look at the behaviour of copper prices the last time the Middle East was on a "knife edge," back in April of this year.

Copper is a proxy on economic activity and an essential commodity in warfare. With that, we have a couple of drivers behind the spike in copper prices this past April/May. And we have clear parallels with the current environment.

Copper prices spiked higher earlier this year on concerns that an escalation of conflict between Israel and Iran could lead to a global war.

Then copper had another leg higher on optimism that Chinese stimulus measures would boost the Chinese economy, and add fuel to the global economy. However, when that stimulus ultimately hit, the market judged it as underwhelming, and copper prices sold off.

Fast forward to today, and we have both of these factors at play again, but with greater intensity. And copper prices are again rising.

With the above in mind, take a look at this chart …

This is the most recent electricity generation data from the U.S. Energy Information Administration (EIA). It looks like it's breaking out.

What signal can be taken from that? Is it a signal on the economy (strength)? The most obvious conclusion is the ramp in energy requirements to power generative AI.

Copper is critical in electricity generation and distribution.