Consistently Better

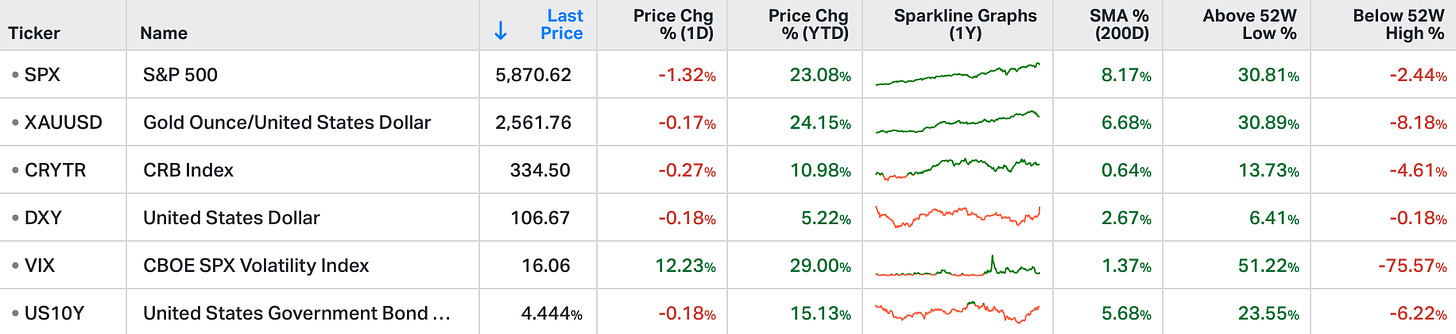

Wall Street saw a sharp downturn on Friday, as investors assessed Fed Powell's remarks.

The S&P 500 dropped 1.4%, while the Dow fell by 350 points and the Nasdaq dropped 2.4%.

Retail sales exceeded forecasts in October, rising 0.4%.

The technology sector saw significant losses, with major companies like Nvidia, Amazon, Meta, and Alphabet falling over 2%.

The pharmaceutical sector also faced pressure due to news that Trump may appoint vaccine skeptic Robert F Kennedy.

Fancy getting access to Institutional Grade Stock Market Analysis?

Designed for Independent & Professional traders - skip endless hours of research to find companies not on your radar and see stocks & etf's in a whole new light.

The economy is maintaining above average growth and the Federal Reserve is lowering interest rates.

Better growth with lower interest rates is constructive for equity values.

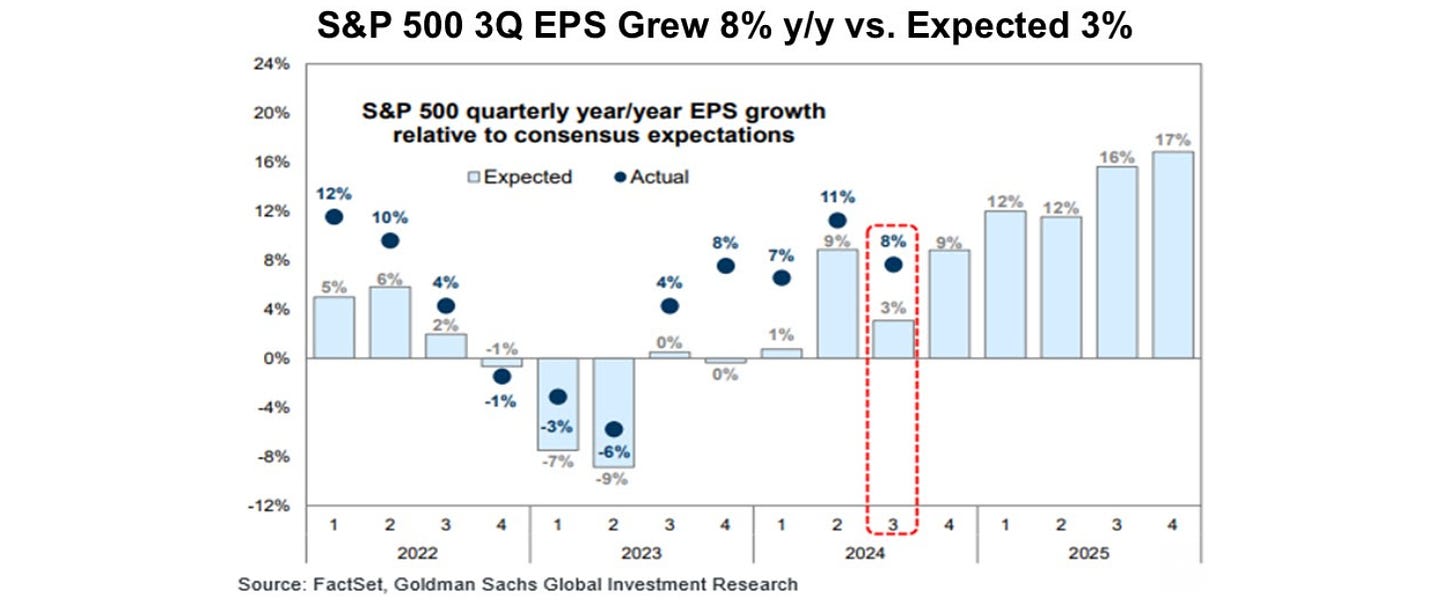

S&P 500 earnings in the third quarter were up 8% year-on-year. Consensus expectations were for 3% growth, whilst actual earnings have been consistently better than expected over the past year.

With 89% of S&P 500 companies having reported, 71% beat 3Q earnings estimates. Roughly 49% of companies beat both earnings and revenue projections.

2024 full-year earnings growth is now expected to be up 13% versus 2023.

2025 earnings are expected to advance by 10% over 2024.

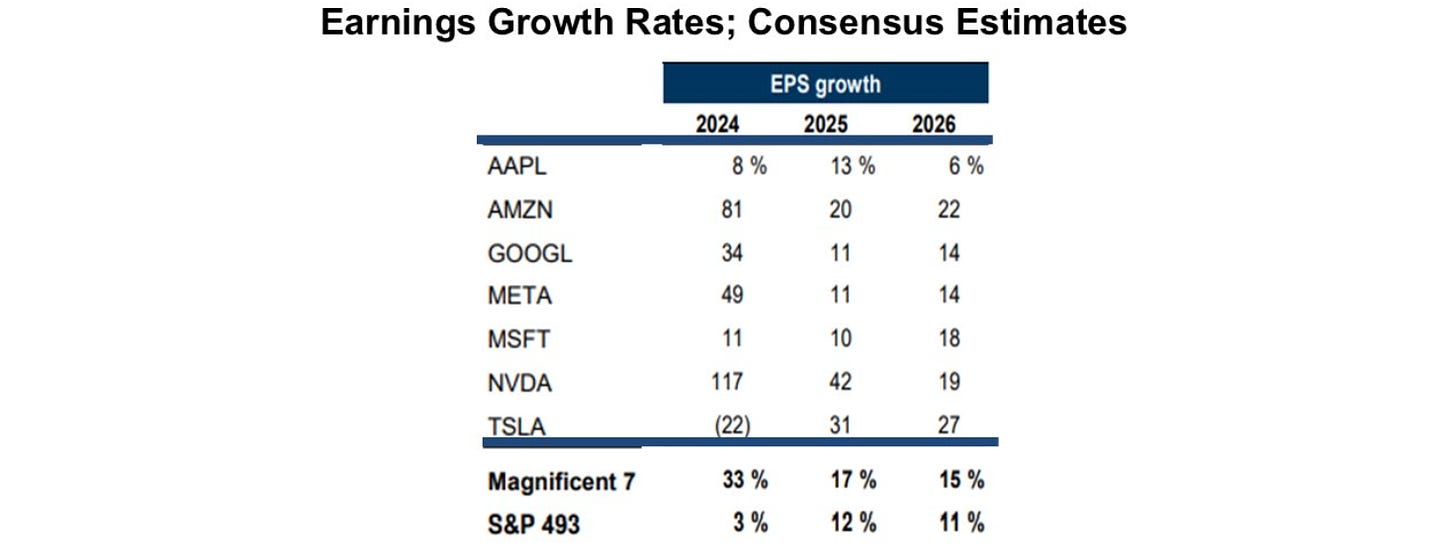

The Magnificent 7 (Apple, Amazon, Google, Meta, Microsoft, Nvidia, Tesla) carried the load when it comes to earnings growth. For 2024, the Magnificent 7 are expected to grow earnings 33% year-over-year.

The remaining 493 companies have combined earnings growth of 3%. In 2025 and 2026, the earnings growth rate of the 493 are expected to be up 12% and 11%, respectively. A broadening out of earnings growth may help provide the next leg higher in this bullish run.

Gryning is Ready to Help. Access Institutional Grade Stock Market Analysis.

All research is free this week - annual & foundational membership will be upgraded to 2 years.