Consensus -> Fall

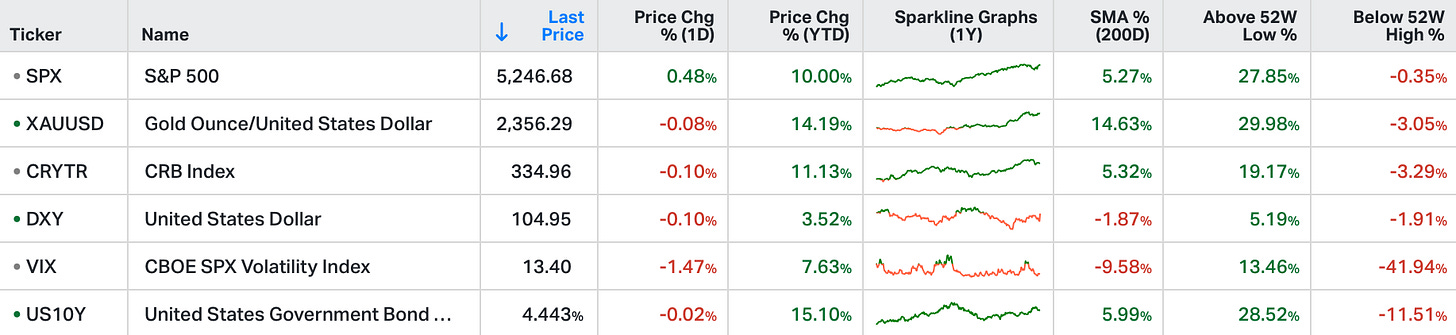

On Tuesday, the S&P 500 edged closer to its all-time high, adding nearly 0.5%.

The Dow Jones gained 126 points, and the Nasdaq 100 rose almost 0.7%, closing at record high.

Producer prices surpassed forecasts in April, but the March reading was revised sharply lower.

Chair Powell's comments at the Meeting of the Foreign Bankers’ Association did not offer any new clues.

“We did not expect this to be a smooth road.

We get the April inflation report today - there continues to be a lot of noise about "hot" inflation data. For perspective, let's revisit the chart of CPI.

This chart should do nothing to promote fear of another surge in inflation. It's a "stall" in the disinflation trend - if the April monthly change in prices is in line with the consensus view, the year-over-year CPI will fall.

Building on previous discussions, the stall in CPI is largely due to a couple of hot spots in the data (shelter and insurance). On the latter, the auto insurance component was up 22% year-over-year in the March inflation report. Just pulling that out, the headline CPI drops below 3%.

But let’s not pull it out, and instead take a look at what the Progressive CEO said about auto rates in the Q1 earnings call: "Inflationary trends are showing indications of stabilising … It's comforting to be able to report that we're pivoting to a more normalised operation, where in most states we can take small bites of the apple when it comes to rate (i.e. prices) … so, we'll continue to focus on having more stable rates."