The November jobs report comes out today - this is even more important than usual, because the Fed told us in early November that the condition for liftoff in interest rates would be "maximum employment."

Remember, just days after Powell made these comments (on November 3rd), we had a booming October jobs report, with an unemployment rate that dropped to 4.6%, on 5% wage growth. Then another effective oral Covid treatment option was introduced, followed by which Biden's vaccine mandate for businesses was blocked by a federal court. Culminating with the House passing the $1.2 trillion infrastructure bill alongside the lifting of the foreign travel ban.

This is a cocktail for creating and filling jobs - it's a good bet that the employment situation in November was hot.

If that's the case, not only are we looking at a faster taper (as Powell telegraphed this week), but validation for a much sooner interest rate liftoff.

So where do the markets stand, the interest rate market has already been pricing in a more and more aggressive timeline on rate hikes - pricing about a 30% chance of a March hike. If we get a hot number, the expectations for a March hike will jump.

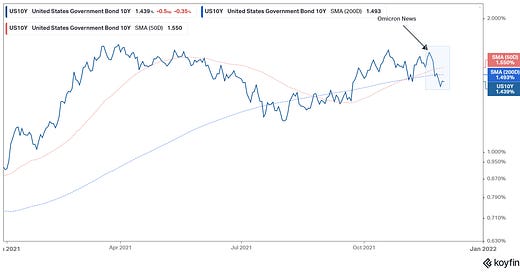

What should also jump is the 10-year yield - this has been diverging from the trajectory of Fed policy and inflation, in recent days.

This scenario, where the 10-year yield begins to reflect an impending inflation-fighting Fed, would embolden the sellers in the very high multiple stocks (high growth tech).

The Nasdaq may have quite a bit more pain to come.