Stocks in the US closed mixed on Wednesday.

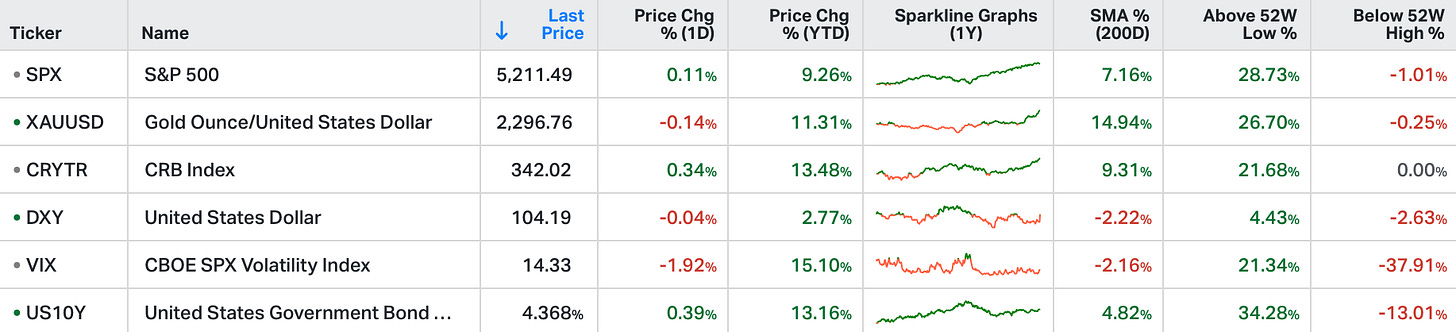

The S&P 500 added 0.1%, the Nasdaq gained 0.2%, while the Dow lost 43 points marking a three-day losing streak.

Powell mentioned that the Fed is successfully navigating a soft landing, despite the impact of higher rates on the economy.

He reiterated that interest rates would only be lowered if there is sustained evidence of decreasing inflation.

Recent data, including a drop in service provider prices and slower activity growth, support this stance.

The climb in commodity prices continues.

Let's take a look at the price of gold - it traded above $2,300 yesterday afternoon. It's up 13% over the past 24 trading days. Let's take a look at prior moves (circled in chart below) of this magnitude in the pandemic/post-pandemic environment.

As you can see above, gold had a move of similar magnitude in mid-April of 2020, in late July of 2020 and in March of 2022.

What was going on? Inflationary policy. These 2020 dates were pandemic response related. Specifically, these spikes in gold align with the fiscal response - more specifically, the government putting cash in the hands of citizens (checks, unemployment subsidies and the "Paycheck Protection Program).

The next spike? The unemployment subsidy was due to expire (end of July), and was re-upped.

The gold spike in March of 2022: Inflationary policy - Russia had invaded Ukraine. Inflation was already nearing double-digits, thanks in part to supply chain disruption, but mostly to the multi-trillion dollar fiscal response to the pandemic. Adding fuel to the inflation fire, while the clean energy agenda was already curtailing energy supply, Congress responded to Russia with threats to place sanctions on Russian energy exports.

That brings us to the current spike in gold. Gold tends to be the global safe haven asset, where global capital flows in times of heightened geopolitical risk - gold is the historically favoured inflation hedge.

That said, geopolitical risk and related uncertainty have become a constant, but these extreme moves in gold tend to be better aligned with episodes of overt fiscal profligacy (devaluation of the money in your pocket). In this current case, perhaps the catalyst is the $7.3 trillion budget that Biden revealed early last month - an egregious 6% deficit spending plan in an economy that's growing at a 3% annual rate, with an already ballooning record debt.

Keeping up with events is crucial in fast-moving markets. That’s why at Gryning I give you the very latest updates on issues that affect your portfolios, all backed by a commitment to rigorous research. I offer insights, outlooks (monthly, quarterly, and yearly) focusing on pure-play equities, bonds and credit, as well as commentary on a guided institutional grade portfolio.

For a sample report, send me an email at info@gryningcapital.com