A membership to The GRYNING Times aims to reduce the opportunity and very real information costs of maintaining situational awareness within the liquid real asset universe.

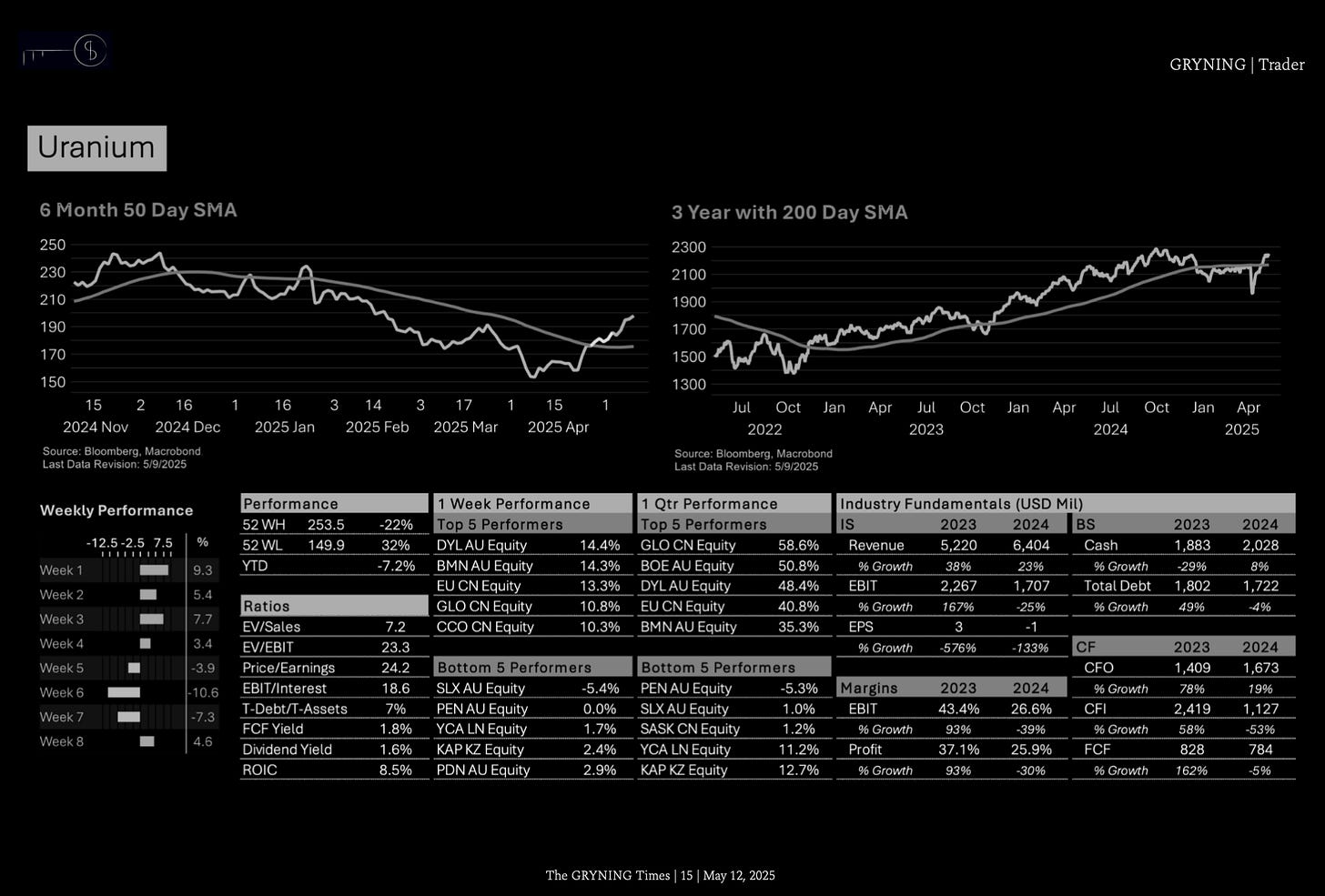

Our Uranium Equity Index looked interesting two weeks ago, the chart still looks interesting today.

We are sceptical of utilities here - I suspect a classic capital cycle issue is about to bite as utilities continue their focus on investment and building, not harvesting returns.

Someday there will be a time to dumbster dive back into US Renewables - index is mix of developers and OEMs. Not sure of we’re there just yet.

EU/UK NatGas and Oil producers. Are we going to get a bounce?

Lithium - someday you will be back in the spotlight. Currently trading near 52wk lows.

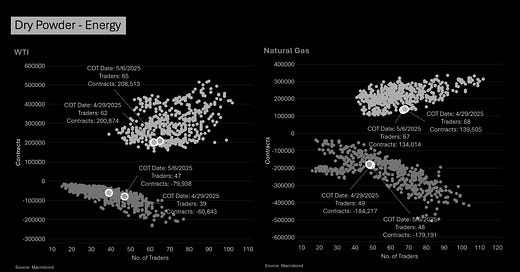

Looks like there is alot of dry powder available on the long-side in both WTI and NatGas.

At the same time, directional sentiment, based on net trader scores, still suggests a negative tilt in the short term (these charts are not yet in the Chartbook). I suspect continued weakness in the short/medium term, until economic fog clears. If it clears and it is a recession, I would be surprised if oil did not fall further, despite favourable long-term supply/demand dynamics.

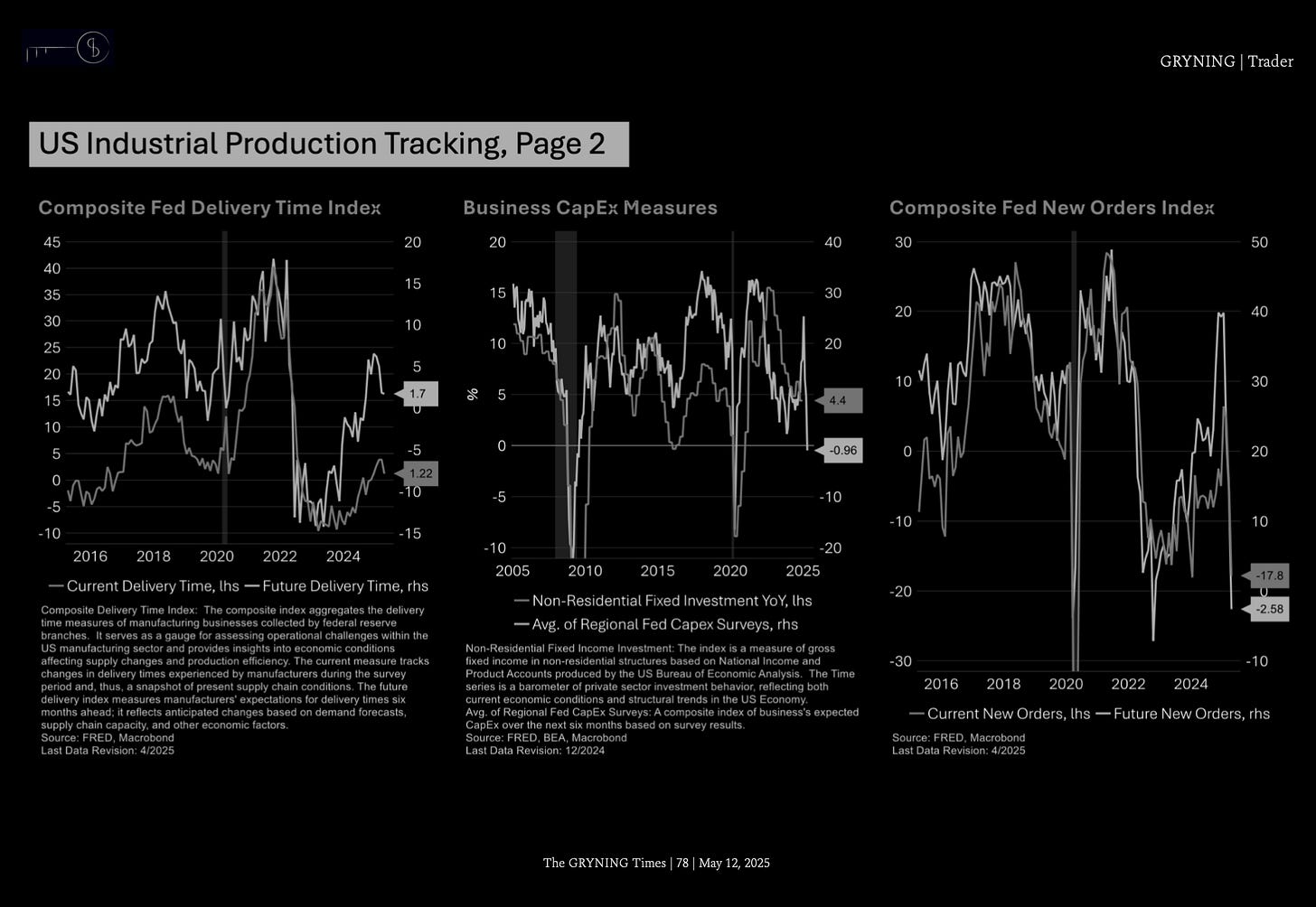

To close it out, the collapse in expected CapEx spending over the next six months is just a little concerning.

We expect the contextual understanding of the investment environment gained from the monthly, weekly & daily reviews of our document to add value to your investment practice in several ways:

Potential risks to the investment thesis can be better anticipated, allowing proactive evaluation of potential portfolio impact and a great ability to fill information gaps associated with known unknowns.

Better grasp of the current investment context creates a more nuanced understanding of knowledge boundaries.

Situational awareness facilitates the maintenance of investors’ behavioral edge through quicker and surer adaptation to the dynamic investment environment.