U.S. policy decisions have sparked a sharp rise in financial market volatility in recent weeks, reflecting mounting investor unease about the global economic outlook. Before we get into the note’s theme, here are some macro updates (with diffusion scores) we published on Long Form this week:

The Blue Chip Growth consensus

Our first chart this week highlights the widespread downward revisions GDP growth forecasts for 2025 across major economies seen in the latest Blue Chip Economic Indicators survey that have been made in recent months. The most significant downward adjustment has been seen in the United States. But export-reliant economies such as South Korea, Canada, and Germany have also seen sharp downgrades, possibly reflecting their exposure to US demand and cross-border industrial linkages. These adjustments underscore growing concerns that escalating protectionism may weigh heavily on global growth prospects.

The Blue Chip Inflation Consensus

Our second chart highlights a concomitant marked upward revision to CPI inflation forecasts for 2025 for several major economies—most notably for the US and Japan. Together with the first chart above, this illustrates how US tariff policies could not only be dampening global growth but could also be amplifying inflationary pressures—raising the spectre of stagflation and complicating the task for central banks navigating an increasingly fractured economic landscape.

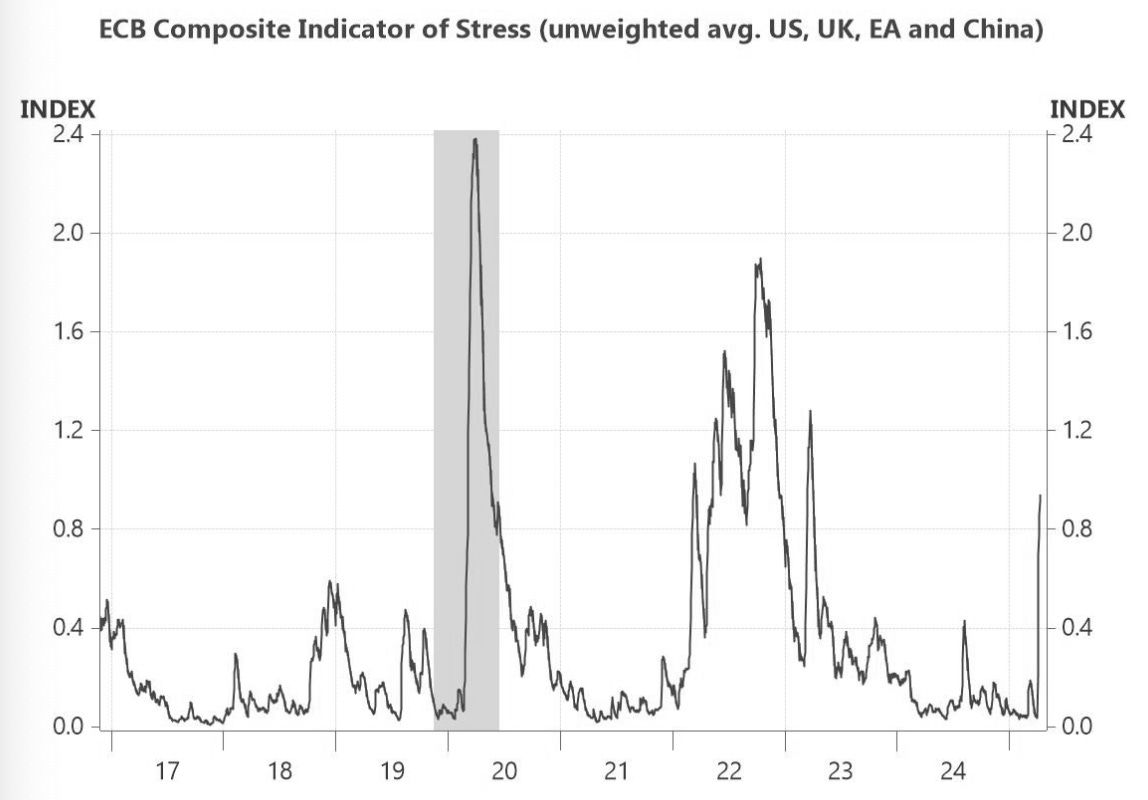

Global financial conditions

Our next chart shows the ECB Composite Indicators of Stress and specifically an unweighted average for the US, UK, Euro Area, and China. These show a sharp spike in recent weeks reflecting rising investor anxiety about escalating trade tensions. Their rapid uptick is a warning sign of potential spillovers from rising policy and economic uncertainty into credit markets, investor sentiment, and broader financial stability.

US business sentiment

This week’s US Empire State Manufacturing Survey additionally paints a more concerning picture of the near-term economic outlook. The diffusion index for general business conditions over the next six months ahead has plunged into negative territory—its lowest reading since the early pandemic period. In the meantime, expectations for prices paid have surged, suggesting that firms anticipate significant cost pressures in the months ahead. This divergence points squarely to stagflation risks: a scenario of slowing or contracting economic activity coupled with rising input prices. The recent spike in price expectations likely reflects the anticipated impact of newly enacted US tariffs, which are raising costs for imported components and materials.

Supply chain bottlenecks

Our next chart, showing the Harper Petersen Charter Rate Index, suggests that global shipping costs have started to climb again. This follows a prolonged post-pandemic decline and suggests fresh disruptions or capacity constraints in global freight markets—likely linked to the latest wave of US tariffs and retaliatory trade actions that are altering shipping patterns and congesting key trade routes. Notably, the past strong correlation between HARPEX and goods CPI inflation in advanced economies highlights the potential inflationary pass-through from higher transport costs to consumer prices. Although goods inflation has moderated from its pandemic-era highs, the recent rebound in shipping rates could reignite upward pressure, especially if firms are forced to pass on elevated logistics and import costs.

China’s economy

Our final chart this week turns to China’s real estate sector, where recent hopes that the market may have finally found a bottom appear to be fading. While the price index for existing residential buildings has shown tentative signs of stabilization, the continued and pronounced contraction in real estate investment—still running at double-digit negative year-on-year rates—points to persistent fragility. Confidence among developers and financial institutions remains deeply impaired, and despite a modest rebound from the lows of early 2024, the latest data suggest that structural challenges—excess supply, tight credit conditions, and cautious homebuyers—are still weighing heavily on the sector. With investment activity still in decline, the prospect of a durable recovery in housing and construction—long a cornerstone of China’s domestic demand—looks increasingly remote.