The recent financial market volatility, marked by sharp swings in bond yields and equity market repricing, reflects growing uncertainty about the trajectory of the US economy amid a rapidly shifting policy environment.

Falling US growth momentum

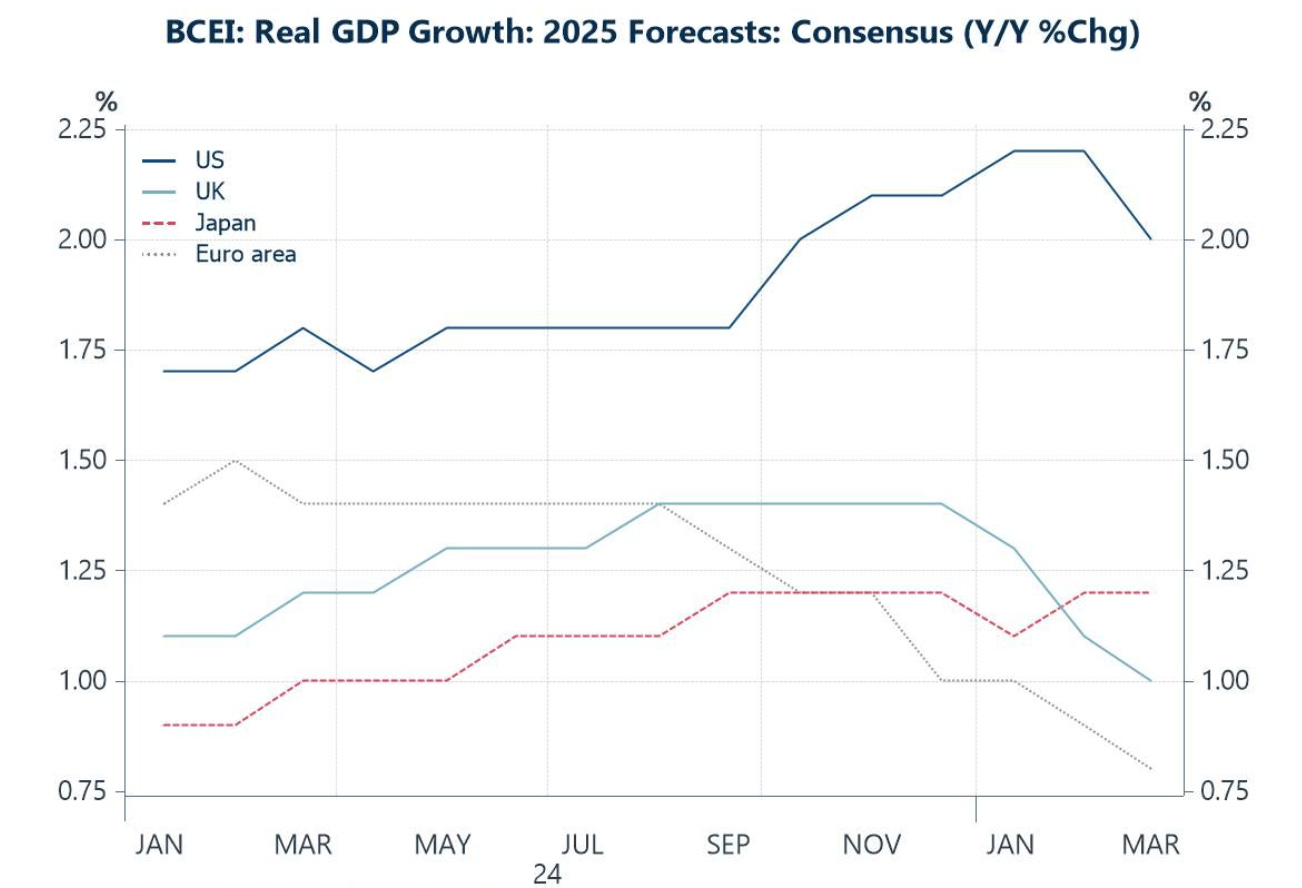

The latest Blue Chip Economic Indicators survey reflects a shifting global economic landscape, with the US experiencing a notable loss of momentum. After climbing above 2.0% on the back of a strong economic performance in late 2024, consensus forecasts for US growth in 2025 have now been revised downward for the first time in nearly a year. This reversal reflects weaker-than-expected economic data and emerging challenges tied to the policy shifts of the new administration. The downgrade in US growth projections also coincides with a further downward revision to an already subdued outlook for the UK and the euro area, reinforcing concerns about a sluggish global growth outlook.

Global inflation expectations

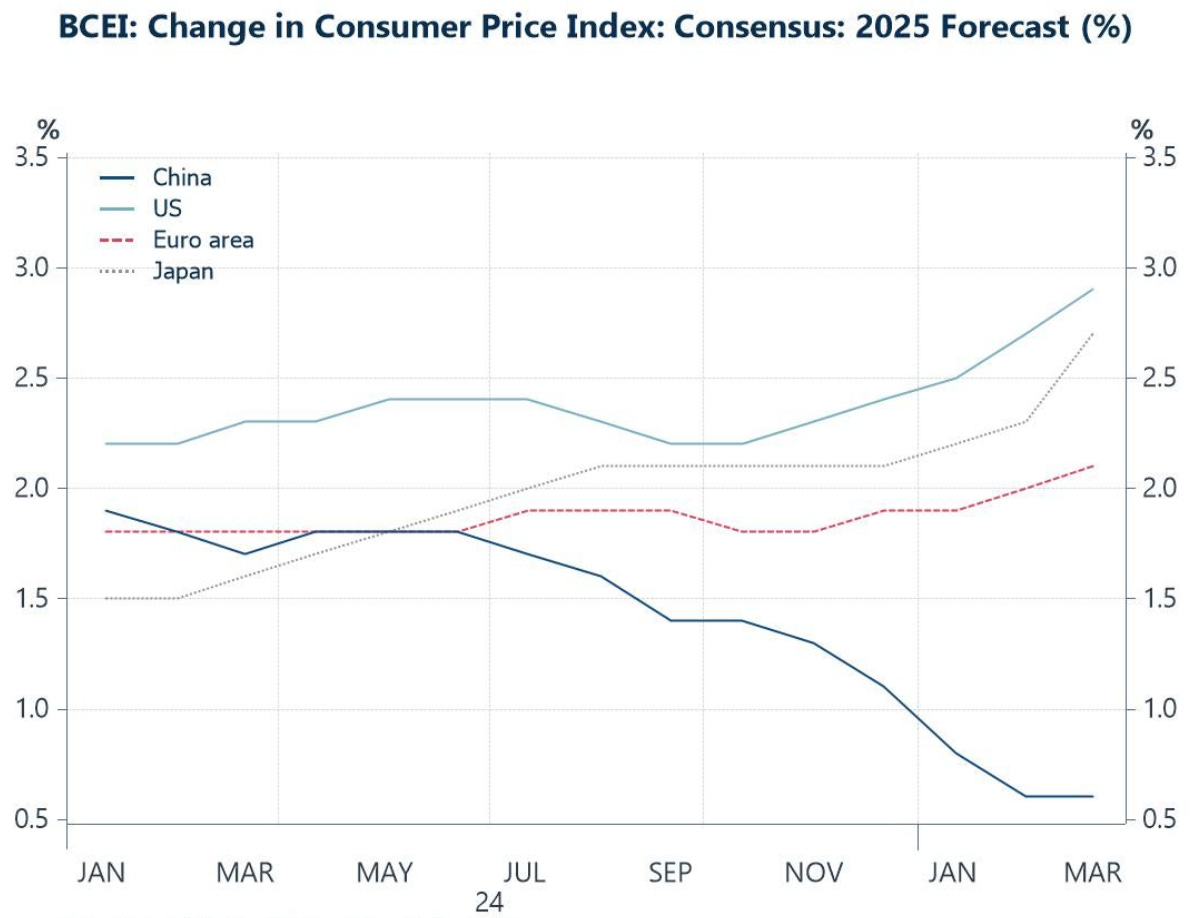

In the meantime the same survey reveals growing concerns about the inflation outlook in the US and Europe this year, and possibly reflecting the impact of US tariff policies on global price pressures. Japan’s inflation forecast for 2025 has also surged, as rising import costs and shifting trade dynamics have additionally contributed to stronger price pressures. This all stands in contrast to China with inflation expectations for this year falling below 1%, reinforcing concerns about deflation and weak demand.

Global bond markets

Recent shifts in 10-year government bond yields reflect changing market expectations. While yields have risen sharply in Germany, China, and Japan, they have fallen in the US. Germany’s increase is tied to expanded defense spending and industrial subsidies, while China’s reflects a shift toward more aggressive fiscal easing, with its deficit target rising to 4% of GDP to counter deflation and weak demand. In contrast, falling US yields signal a reassessment of growth expectations under the new administration. This divergence suggests capital may be flowing toward economies with stronger fiscal stimulus, potentially weakening the dollar, increasing borrowing costs for US businesses, and complicating efforts to revive domestic manufacturing.

Overseas holdings of US Securities

Latest data show that foreign-holdings of US long-term securities have risen steadily over the past decade, with a notable acceleration in the past two years. The most recent data additionally highlights a significant increase in foreign ownership of US corporate equities, reflecting, until recently, investor confidence in US companies.

Industrialisation versus de-industrialisation

Recent US policy shifts—particularly higher tariffs on Chinese imports—aim to address the long-term decline in domestic manufacturing jobs. However, their effectiveness is uncertain, given the growing role of automation and AI in reshaping industrial production. While tariffs may offer short-term relief, they are unlikely to reverse decades of global manufacturing shifts. China’s rise from a low-value agrarian economy to an industrial powerhouse has reshaped trade patterns, while US industrial employment has steadily declined, mirroring trends in other advanced economies. Meanwhile, Vietnam and other emerging markets have absorbed manufacturing capacity, benefiting from shifting supply chains. The real challenge for US policymakers is not just bringing back jobs but ensuring domestic industries stay competitive amid changing cost structures and technological advancements.

Global competitiveness

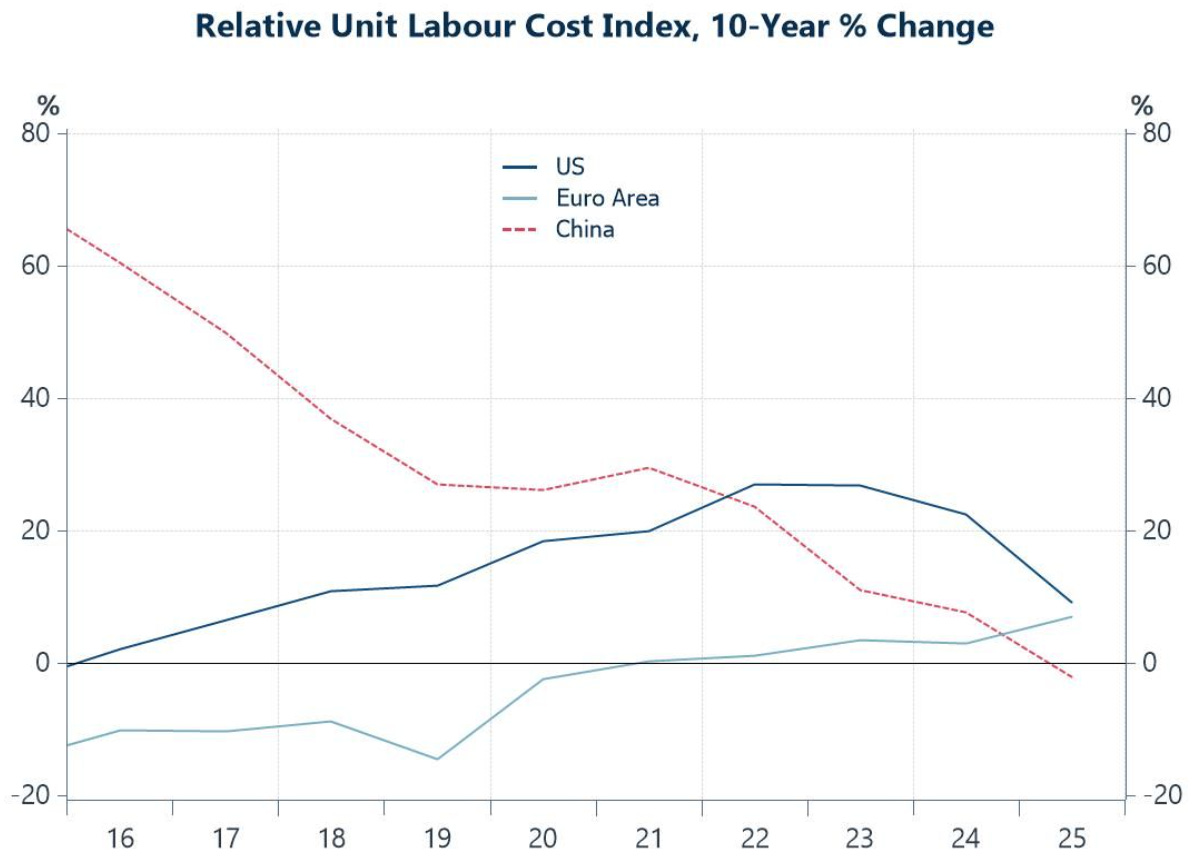

Historically, China's low unit labour costs provided it with a significant advantage, fuelling its manufacturing boom and accelerating the offshoring of US industrial jobs. However, as China's wages have risen due to economic development and increased productivity, and as US unit labour costs have remained relatively stable, the gap has narrowed considerably. Yet, still high labour costs in the US – coupled with rising trade barriers and rising input costs - still pose a challenge to the effectiveness of US policies, as firms may still find it difficult to maintain competitiveness without significant productivity gains. Indeed, as suggested above, there is a real risk that firms may instead accelerate their shift toward automation or relocate production to other low-cost regions (e.g. Vietnam), undermining the broader economic rationale for these interventions. The erosion of economic goodwill, combined with rising costs and financial market instability, additionally suggest that while the strategic objectives of US policy may be clear, the long-term implications remain highly uncertain.

Charts of the Week is part of the information package members of Investing by Design have access to every Friday. Click on the button above for more information and to become a member.