It looks like the Fed started the end of globally coordinated easy money.

Yesterday the Bank of England raised rates - with a surprise 25 basis points. That's the first major central bank to raise rates. The European Central Bank telegraphed an end to its pandemic/emergency asset buying program by March. The Bank of Japan decided on policy overnight - BoJ to wind down pandemic funding but keep loose monetary policy in face of Omicron.

That said, emerging market central banks have already been moving on rates for much of the year. These are central banks that don't have the luxury of representing 90% of the world's foreign currency reserves (like the U.S., UK, Japan and Europe). They couldn't afford to sit around, waiting and watching inflation. They had to act.

Mexico, South Korea, South Africa, Chile, Brazil, Czech Republic, Hungary, New Zealand, Norway, Poland, Russia, Turkey - all have been raising rates to fight inflation and to defend against capital flight.

So with major central banks joining over the past 24 hours, the change in direction of global monetary policy is probably official now.

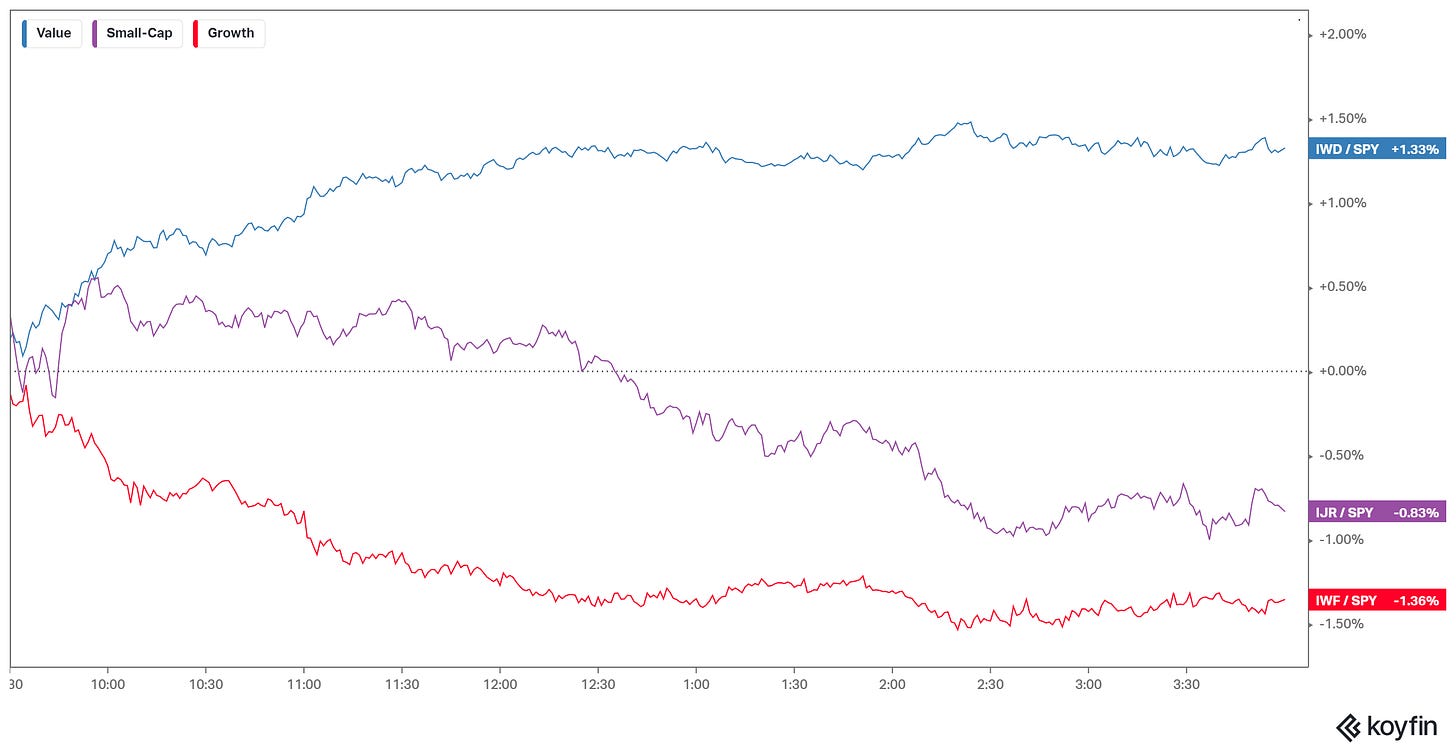

With that, as we've discussed, a higher rate outlook makes the high multiple stocks most vulnerable, which includes the no-earnings/ innovation story stocks. For perspective on today's losses in the big indexes, let's take a look at the sector performance on the day.

As you can see, money moved out of technology (high multiple stocks) and consumer discretionary (a beneficiary of stimulus). And into financials and commodity related stocks (materials). This is the "growth to value" rotation we've been talking about.

It's early days.