A week ago (last Monday) we looked at this chart of the S&P . . .

As we discussed, the June low was marked by a central bank moment and we headed into the technical level for the week, with a central bank moment on the calendar - the July Fed minutes.

The technical level proved to be a powerful one. Stocks traded perfectly into the trendline from the all-time highs (the green line), and the 200-day moving average (the purple line), and the positive momentum failed (light blue box). But as we also discussed earlier last week, the bigger central bank moment is this week.

The Fed Chair, Jerome Powell, will give a prepared speech at Kansas City Fed's economic symposium in Jackson Hole, Wyoming. This event is well attended by the world's most powerful central bankers and finance officials, and has a history of signaling policy adjustments.

To this point, the biggest central banks in the world have been all bark and little bite;

Inflation hit double digits in the UK this week - yet the Bank of England has rates set at just 1.75%.

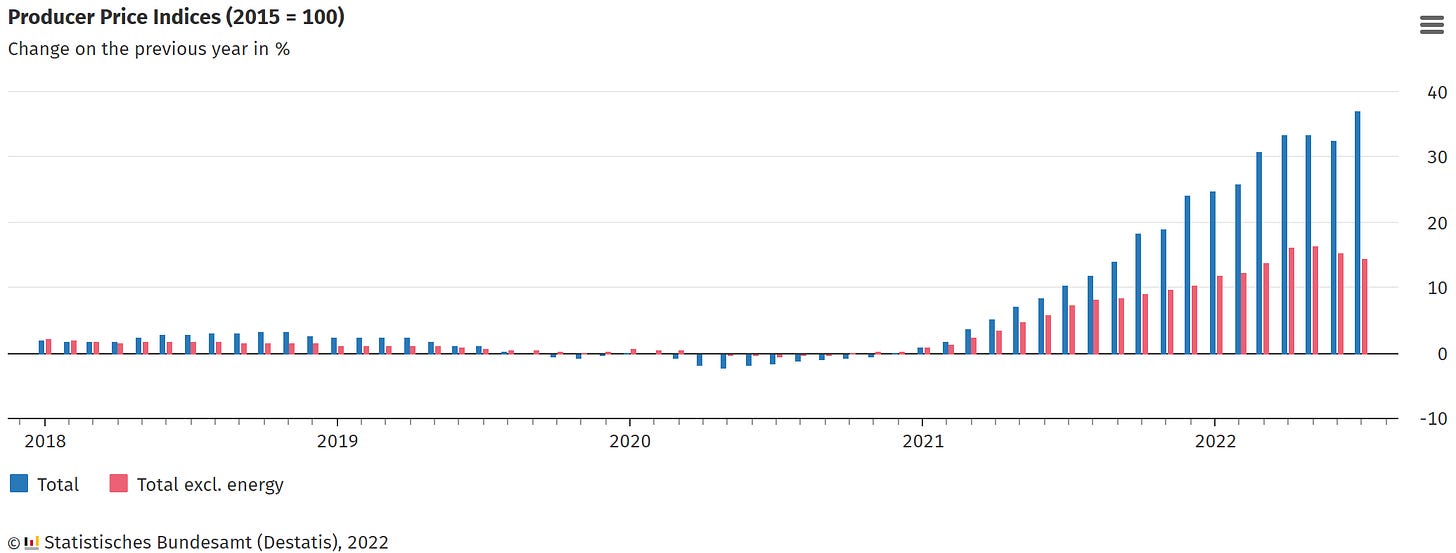

In Germany, July producer prices jumped 37% from a year ago - this is the economic engine of the euro zone.

Where are rates? Remember, they surprised markets with a 50 basis point hike (market was expecting a quarter point). That took the benchmark short-term lending rate in Europe to a whopping zero percent - they had negative interest rates before that move, despite record inflation.

Here's a look at the German PPI chart ...

Remember, all of this, and the media, corporate America and Wall Street are all constantly parsing the next words uttered from the Fed and other central bankers for clues on what's next in their alleged anti-inflation plans, all while completely ignoring the constant deficit spending binge on Capitol Hill (which is highly inflationary).

"Look over here, don't look over there."

This formula is a "debasing" of the currency/devaluing sovereign debt.

With this in mind, it's a fair bet that the conversation at Jackson Hole this week will be about Central Bank Digital Currencies (i.e. a new currency system). That might be why the cryptocurrency markets were crushed on Friday - losing roughly 10% of value, on average, across the crypto currency universe.

As we've discussed here in my daily notes, the politicians have made clear that they will regulate away private money (i.e. they will maintain their monopoly on money).

PS: If you know anyone that would find this note interesting, please share with them.