Jerome Powell is back on Capitol Hill.

It was just a week ago that the Fed ended a series of ten consecutive rate hikes - though for good measure, to keep any exuberance in check, the Fed projected a couple more (hikes) by year end.

He reiterated as much yesterday - the markets don't seem to care.

Why? As we discussed, as long as the 10-year yield (the anchor market interest rate) is out of the danger zone (in the 3s), then financial and economic stability seem to be preserved. This phenomenon of "inverted yield curves" can clearly be attributed to bond market manipulation by central banks.

It's a similar situation in Europe and the UK. That said, the Bank of England will likely* hike rates again today.

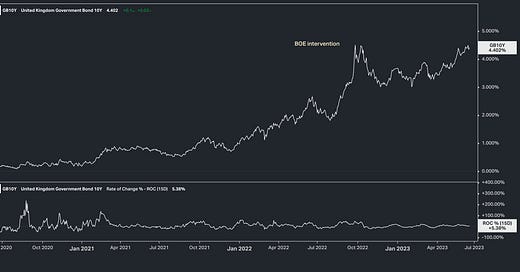

They are dealing with the highest inflation of G7 countries whilst having to accommodate with the highest 10-year government bond yield - which is creeping dangerously toward the levels of last September.

Importantly, in September, the BOE had to step-in to rescue failing pension funds, which was directly unraveling the UK government bond market, which would have quickly become a financial crisis.

The moral of the story: the central banks will continue to plug the holes, where needed, with the full support of their global central banking counterparts.

Become a member of The GRYNING | AI Portfolio;

High Growth Potential | Compelling Economics | Unconstrained Approach

Plus this is how you get access to sophisticated discretionary strategies created by experienced traders, without the costly Hedge Fund structure which tends to eat away a large chunk of the profits. This strategy aims to provide positive returns in both bull and bear markets with limited drawdown.