Following this week’s (Wednesday) Fed meeting, the 10-year yield is trading well above 4% again.

Rising U.S. yields, on the expectations of higher Fed rates, strengthens the dollar, and drags global interest rates higher - both of which create strains in global sovereign debt markets.

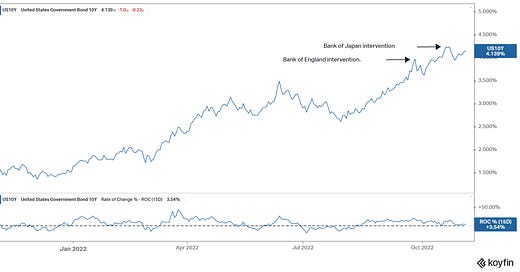

As you can see in the chart, this area for U.S. yields has, in recent history, resulted in damage, and (related) central bank intervention.

Now, with this, and with a very high stakes election coming next week, let's talk about what has taken the world's most influential interest rate market to this damaging 4%+ level.

It was only three months ago that the Fed raised the short term rate to 2.5%, and in the post-meeting press conference, Jerome Powell called that level "neutral" (i.e. not accommodative nor restrictive of economic activity). And he said they would no longer "guide" on policy, but take things meeting by meeting, dependent on the data.

That was the stopping point for rates.

What happened? Before the day ended, the Democrat-controlled government demonstrated that getting their agenda done was a higher priority than securing economic stability (much less prosperity).

They countered the Fed's inflation fight, by pouring more fuel on the inflation fire. They went on a $1.5+ trillion spending binge over the following month. That forced the Fed back on the offensive.

Again, among many other reasons, the opportunity to de-seat Democrat power in Congress makes this election very high stakes. With a flip in the House and the Senate (both of which are projected), the Republican-led Congress can go to work dismantling some of this spending. That would cool the inflation outlook, and take pressure off of the Fed.

PS: If you, or anybody you know, would like access to an institutional grade portfolio based on my daily notes, please join The Gryning Portfolio.