US stocks were mostly flat on Monday following record highs, with the Dow slipping 0.16%, the S&P 500 falling 0.38%, and the Nasdaq losing 0.13%, as traders closely monitored the market's momentum amid ongoing economic and inflation concerns.

This week, investors are focused on PCE inflation data and Federal Reserve speeches.

Additionally, the second estimate for Q4 GDP growth will be released.

In company news, Berkshire Hathaway's shares dipped 1.99% after reaching all-time highs earlier in the session, following strong Q4 operating earnings.

Nvidia saw a 0.35% increase, while other major tech stocks showed mixed performance.

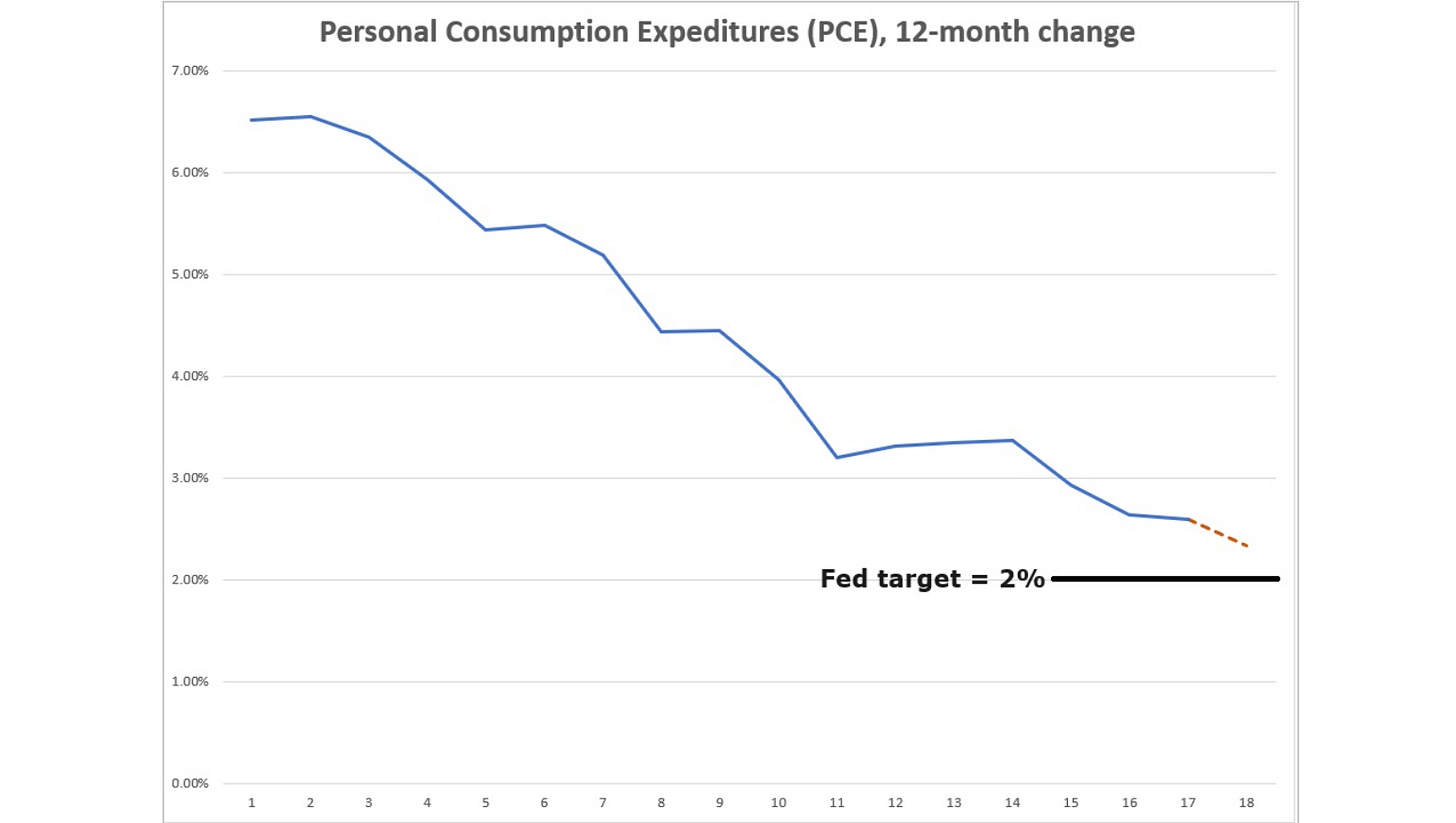

With stocks just off record highs, we get another inflation report on Thursday - January PCE (Personal Consumption Expenditures).

As we know, this is the Fed's favoured inflation gauge - it's the data point upon which the Fed's inflation target is based. The consensus view for January is for a monthly change of 0.3%. If that's the case, we should see a year-over-year change fall to 2.3% (maybe 2.4%) - last was 2.6% - which would continue the trend of falling inflation toward the Fed's 2% target.

A couple of things to keep in mind:

They've told us they will have to start cutting rates "well before two percent." As Powell has said, if they wait for two percent, "it would be too late" (they risk inducing deflation).

In the Fed's own Summary of Economic Projections, from December, they projected PCE to be at 2.4% at year end, and for the Fed Funds rate to be three quarters of a point lower than the current effective Fed Funds rate.

So, by Thursday, we should have the headline PCE BELOW the Fed's year end projection of 2.4%, and yet the Fed has yet to budge on interest rates. Instead, they have spent the better part of the past two months dramatically moderating the market's rate cut expectations, which has led to this bounce in 10-year yields.

This bounce in yields has eroded some of the improvements in consumer lending rates of the past several months, like mortgage rates, which are back above 7%.

On that note, remember as inflation continues to fall, and the Fed continues to hold rates above 5%, Fed policy only gets tighter and tighter (i.e. real interest rates rise, which means policy is more restrictive - more downward pressure on inflation and economic growth).

With all of the above in mind, the response in the bond market to the Fed's "perception manipulation" of the past two months looks overdone. This looks like a second chance to get long bonds, with the view of prices to move higher, yields lower from here.

In late October (here) we talked about the reversal signals that were flashing in bonds. It started with 2-year yields, then 10-year yields and the big bond ETFs (the biggest corporate bond ETF, LQD … and the biggest government bond ETF, TLT). And it all coincided with the Fed signalling the end of the rate tightening cycle.