Business Optimism?

The S&P 500 and Nasdaq 100 closed at record highs to kick off December trading, gaining 0.2% and 1.1%, respectively, driven by large-cap tech stocks, while the Dow Jones slipped 128 points.

Leading sectors included communication services, consumer discretionary, and technology, while real estate lagged.

Investors are closely monitoring upcoming economic data, including PMIs, JOLTs, and jobs reports, as the ISM Manufacturing PMI pointed to a milder factory contraction.

November was a strong month, with the S&P 500 and Dow up 5.7% and 7.5%, respectively, fueled by a postelection rally.

However, thin trading volumes, an inverted yield curve, and Friday’s nonfarm payrolls report keep attention on potential Federal Reserve moves, including a possible 25bps rate cut.

We start the last month of the year with stocks on record highs, and asset prices broadly having one of the better years on record;

The economy is tracking above 3% growth for the quarter.

The Fed is in an easing cycle.

Businesses and consumers are anticipating a pro-growth, deregulation agenda from the incoming Trump administration.

And the VIX (downside insurance for investment managers), looks like no fear …

Despite the many shock risks in the world, the VIX appears to be signalling relative calm. It seems the bigger influence on how stocks close the year, and open the New Year, will likely come from the December 18th Fed meeting.

We come into the month with the market pricing in a little better than a coin flips chance of a 25 basis point cut this month (following the 50 bps cut in September and 25 bps cut in November).

We have a number of Fed members speaking this week, including Jerome Powell on Wednesday - we should expect some signalling.

It appears to have started with Fed Governor Chris Waller. Waller had some prepared remarks at the American Institute for Economic Research, with the not so subtle title: "Cut or Skip?"

So, without even getting into the text, clearly the Fed wants to prepare markets for the possibility of a skip, a "no rate cut" this month.

What would justify a skip. They'll see jobs data this week. They'll see CPI and PPI next week. All unlikely to justify holding rates at a level the Fed acknowledges to be well in restrictive territory. And they'll see this next week …

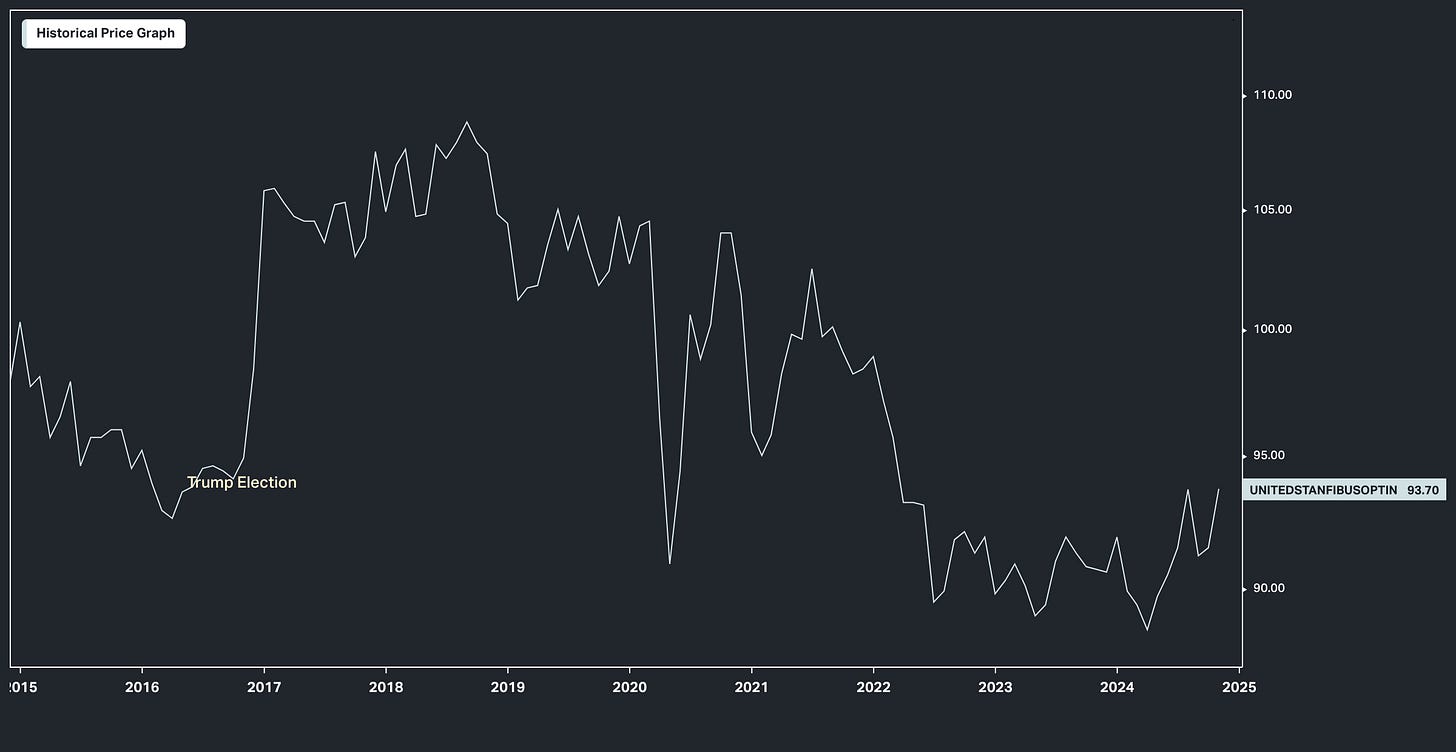

Back in 2016, small business optimism spiked in the two readings that followed the election. Also notice where the index stands now. It's lower than 2016, having last reported a 34th consecutive month UNDER the 50-year average.

We should expect to see a boom in this small business optimism index starting with the next report, which comes on December 10th.

And with that, as we discussed in my November 15th note (here), the pro-growth Trump agenda did indeed influence the Fed's policymaking back in 2016 (just a month after the election). They assumed a hotter price pressure environment was coming, enough to proactively hike rates in an economy that had averaged only slightly above 1% PCE inflation that year.

Also in that December 2016 meeting, the Fed revised UP inflation forecasts, saying "some of the participants" incorporated the "assumption of a change in fiscal policy" into their projections.

At GRYNING | Research we release a Thematic Portfolio where we provide concise, but thorough, reports on stocks that are likely to outperform over the next 3 months at a minimum.

Just under 2 weeks ago we sent a thematic portfolio report focused on Chronic Care Management, you can find the report here → Chronic Care Management

Here is how the portfolio constituents have performed so far…

Spread the cost - become a member and share the research with your group/friends by simply giving us their email.

Join for a year, get access for two years plus bespoke portfolio reports.