Burden Sharing

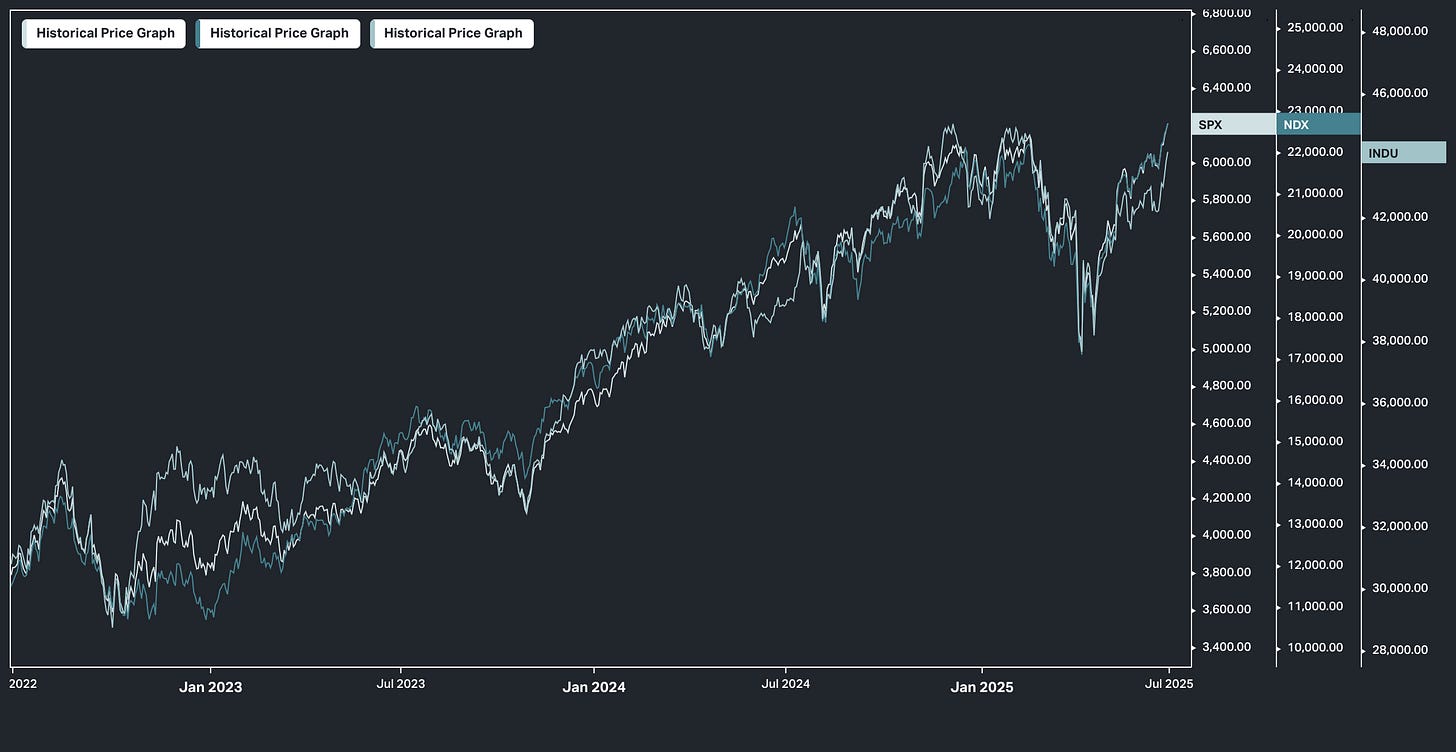

US stocks rose on Monday as investors aimed to close out a volatile first half of 2025 with fresh record highs.

The S&P 500 and Nasdaq 100 both gained 0.5%, extending their all-time highs, while the Dow added 207 points.

Investors remain focused on the July 9 deadline for the possible expiration of President Trump’s tariff reprieve, hoping that additional trade deals will help avoid tariff escalations.

Meanwhile, Treasury yields declined as expectations grew for Federal Reserve rate cuts later this year, creating a favorable environment for equities.

The S&P 500 marked its best quarter since late 2023, led by strong corporate earnings and stable inflation.

In the past two weeks, we've stepped through the tailwinds building for stocks, just as we've made new record highs in the major indices.

The resumption of the Fed easing cycle is nearing.

The extension of pro-growth tax cuts should be just weeks away.

The Fed has finally acknowledged the liquidity constraints its bank regulations have put on the U.S. Treasury market, and they've vowed to relax those constraints, and soon (regulatory relief!).

From last week's NATO meeting we now have a historic structural shift in Western world military spending and alignment.

The technology revolution continues to advance at a rapid pace.

The question is, could the self-imposed deadline on the 90-day tariff pause introduce another confidence shock?

That said, over the past several months, it has become clear that Trump can turn the dials at will - to manage economic and financial market stability. And markets now seem to be recognising that / pricing it in.

Plus, last week's NATO Summit and the defence spending commitments may end up playing a big role in the resolution of tariff negotiations.

Back in April we talked about Trump's Chairman of the Council of Economic Advisors - a guy named Stephen Miran. He wrote a report on "Restructuring the Global Trading System" in November of last year. A month later, Trump picked him to be his top economist.

This report is the blueprint for leveraging tariff threats and the United States' role in global security and financial stability to extract "burden sharing" from our allies and trading partners.

In this case, the dollar's role in the world as the reserve currency provides benefits to the world and benefits to the U.S. but also drives persistent and unsustainable U.S. trade deficits.

So Miran’s message for trading partners was simple: Share the burden. That means accept tariffs or… open your markets, spend more on defence, buy more American goods, invest in U.S. manufacturing, and buy our Treasuries.

Actionable Insights for Financial Decision-Makers: Clear, actionable overview of emerging trends and growing market instabilities. Tailored to support all parties with investment performance responsibility or managing financial risks.

*The Bespoke Portfolio gives you advanced, daily, diagnostics for 100 tickers of your choice. For annual or team/desk memberships, please reach out to me for discounts and options.

PS: We publish our Cyber Security Primer on Thursday - all you need to know to capitalise on growth in AI and B2B tech.