A week ago we talked about the recent inflation data and Jerome Powell's acknowledgement that financial conditions have tightened (influenced by the rise in bond yields since their last meeting), which supports the case for the continued Fed pause.

Indeed, the Fed left policy unchanged yesterday for the second consecutive meeting, citing "significant" tightening in financial conditions in recent months.

With that, for the first time in a long time, in the post-meeting press conference, Jerome Powell wasn't making threats about "doing more," rather explaining why they are making progress on their inflation goal, despite a strong economy, which remains strong despite the level of interest rates.

On the economy, he has moved the goalposts. His mantra has been, for some time, that the economy would likely need to run below trend growth to achieve their inflation target. Keep in mind, the Q3 GDP was running at a nearly 5% annual rate - that's far above trend growth.

Now he says the Fed no longer sees recession coming, and he thinks the economy might just need to run below "potential" growth, rather than trend growth - which he mumbled through a definition of "potential," as something "elevated" given unique post-pandemic circumstances.

Bottom line: This wasn't the hawkish Jerome Powell we've seen for much of the past nineteen months.

The Fed's favored inflation gauge, core PCE, is on path to go sub-3% by March of next year. The Fed knows we've yet to see a debt rollover cycle at the current level of borrowing rates (which will bite).

So, the Fed should be done. The interest rate market is pricing that scenario in. That means the next move by the Fed should be a cut - the market is betting by next summer.

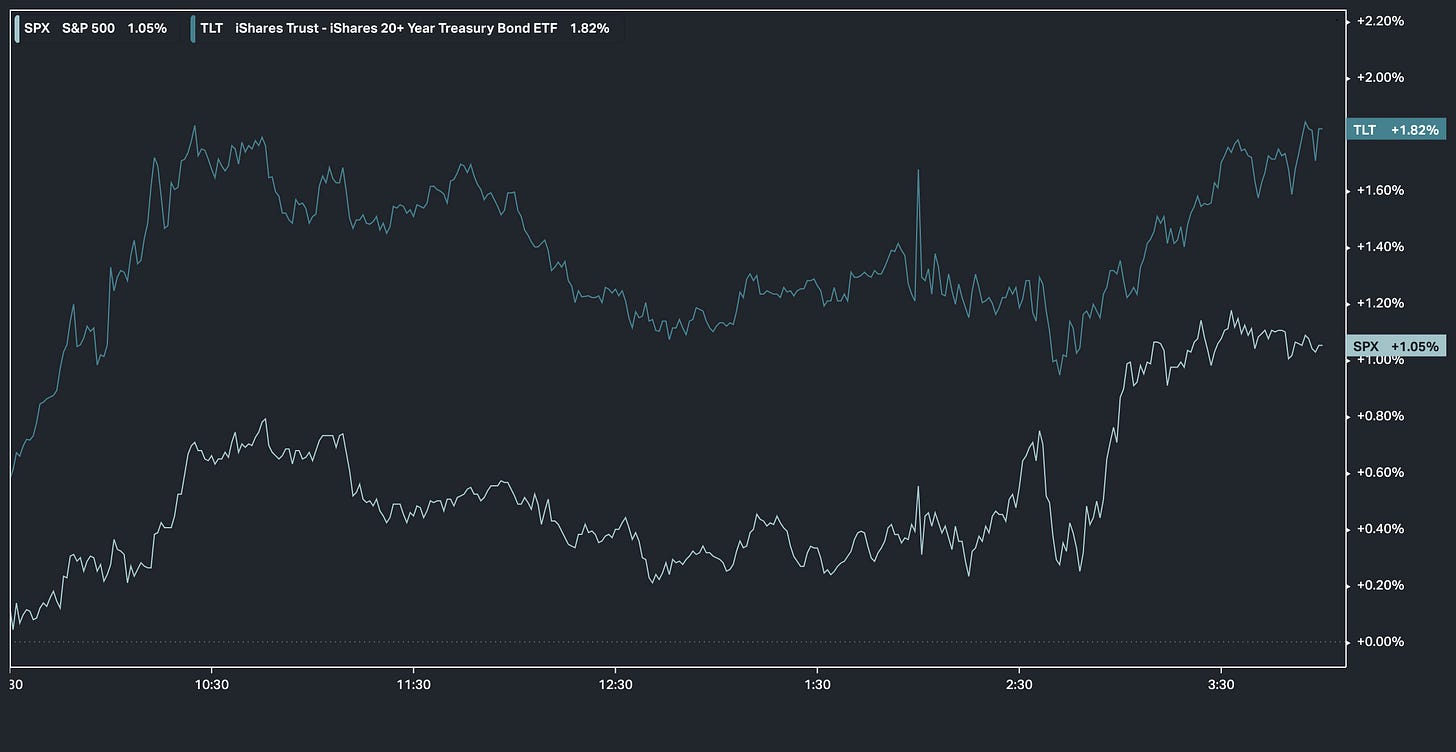

The anticipation of a change in policy direction should be fuel for stocks. As such, stocks rallied, Bond yields fell sharply (bond prices up).

With the above in mind, let's revisit my note from early October 5th (here).

Remember, we had a bad September for stocks in 2020, 2021 and 2022 - all three of these episodes were followed by a big Q4.

In September of 2020, stocks were down 4% - that was followed by a Q4 up 12%.

In September of 2021, stocks were down 5% - that was followed by a Q4 up 11%.

In September of 2022, stocks were down 9% - that was followed by a Q4 up 8%.

This past September, stocks were down almost 5% and that has been followed by a down 2% in October. This Q4 analogue of the past few years would set up for a big November and December for stocks, driven by the (likely) end of a tightening cycle and a Q3 earnings season that is already beating a low bar of expectations.

Add to this, we've just seen an 11% correction in the S&P 500. Remember, a 10% correction in stocks in a given calendar year is typical of the past eighty years.

GRYNING Capital empowers professional traders & money managers with a distinct edge to enhance their performance.

We are happy to work with traders & investors of all levels, send me an email if you have any questions or want to connect: a.karlsson@gryningcapital.com