We've talked about the Bank of Japan's newly amplified role as the shock absorber to the global economy, as they execute on their license to print unlimited yen and buy unlimited assets. The global finance ministers (and politicians) have resolved that, in a world of global interconnectedness, the only way to avert the spiral of global economic crises into an apocalyptic outcome is to coordinate policies.

Japan is in the unique position, after battling decades of deflation while buried under the world's worst-debt burden, to be the implicit provider of global liquidity - to keep printing, to devalue the yen and inflate away debt.

Let's take a closer look at the yen and Japanese stocks.

Following on from Wednesday’s note, since the Fed started rate liftoff in March, the yen has crashed as much as 17% (in just three months). By April, the Japanese currency had already posted a record losing streak against the dollar - it hit a 24-year low this week.

Strong dollar/weaker yen is the consequence of the policy divergence between the U.S. and Japan (the Fed tightening, the BOJ easing).

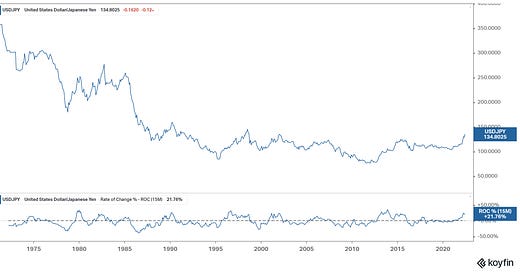

The above is a chart of the dollar versus the yen (the line moving higher represents a stronger dollar/weaker yen and vice versa). It shows through the 80s inflation era in the U.S., the dollar was dramatically stronger versus the yen.

What about Japanese stocks?

Both German and U.S. stocks hit new record highs in the pandemic environment, thanks to the global liquidity deluge. Japanese stocks never did - it would take another 50% to revisit the 1989 all-time high in the Nikkei.

Now, the interest rate divergence between the U.S. and Japan would typically drive money out of Japan and into the U.S. (seeking higher yield). That would be bad for Japanese stocks, but this is not a typical case. It's important to know that the BOJ is still outright buying Japanese stocks as part of its QE program.

SNB have been at it for a while.

They'll soon come into focus too, especially with the tech stocks down big - SNB were a huge holder of AAPL.

I can look into their holding's over the weekend.

Which other central banks buy stocks?

Love this