The Fed left policy unchanged, but Jerome Powell gave us plenty of information about what to expect in the coming months. As we've been discussing, they did indeed telegraph the tapering of asset purchases.

What do these asset purchases do? As the Fed says in a 2020 paper, buying bonds tends to lower Treasury yields, tighten credit spreads, raise equity prices and increase bank lending.

With that in mind, Powell said they could start reducing the amount of bonds they buy at their next meeting (which is November). That shouldn't surprise too many people, but what was surprising is the pace he alluded to - they could be done by mid-next year.

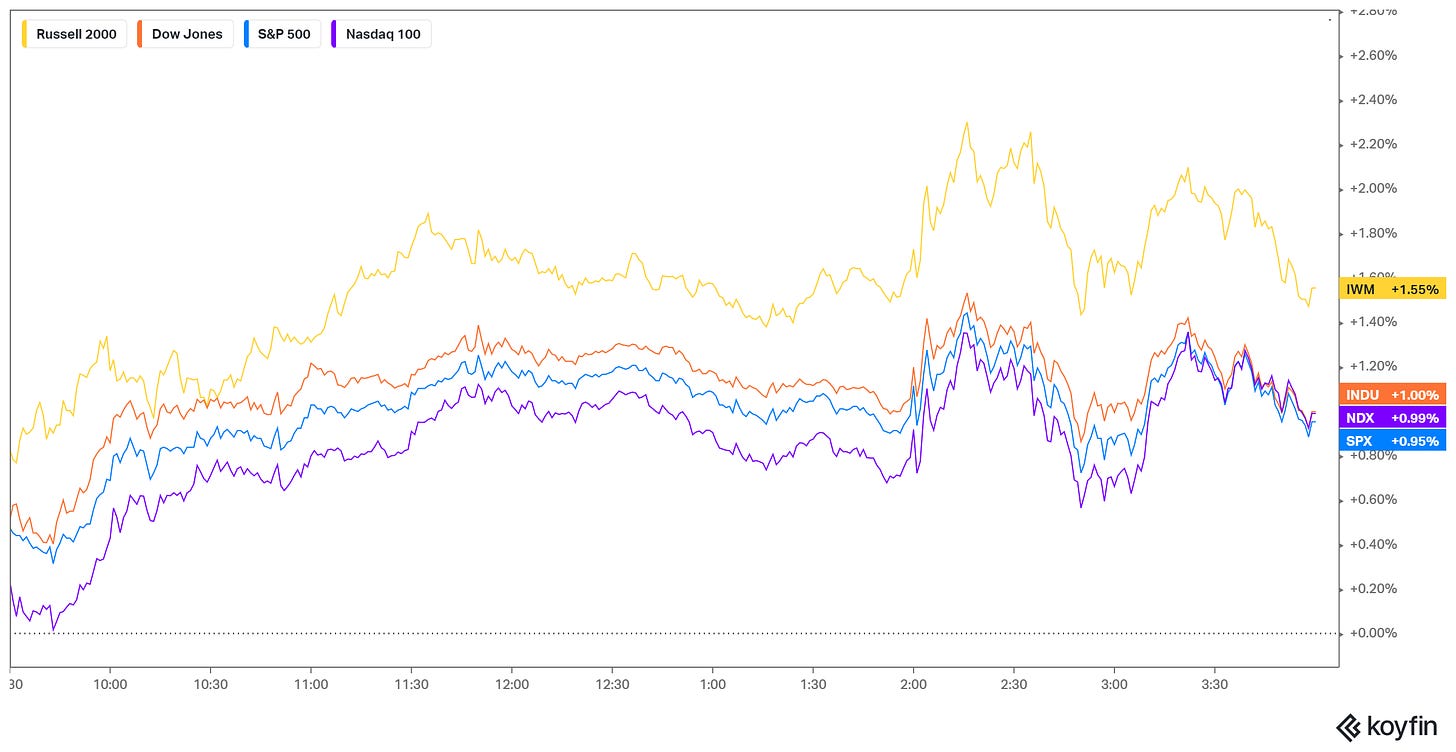

So, if we consider what effect these bond purchases have on markets, how does the announcement of an aggressive timeline to end bond purchases send stock markets higher today?

As we discussed yesterday, there is five trillion of new money in the economy (excess liquidity), and both monetary and fiscal policies are still in a defensive position, against any destabilising events. Plus, both monetary and fiscal policies are still heavily promoting spending, not saving - even after the Fed tapers and even after the Fed starts raising rates off of the zero line.

Bottom line: It will be a long while before monetary policy stops being accommodative and starts getting restrictive. Accommodation will continue to put upward pressure on asset prices.