Warren Buffett just invested $6 billion into five of Japan's biggest "trading companies."

Assuming he took a little greater than a 5% position in each, he became the largest shareholder of each of these companies - the combined market cap of which would make it the biggest publicly traded company in Japan. So, Warren Buffett is now the second most influential shareholder in Japan, behind the Japanese government (which would include the Government Pension Investment Fund).

Now, the timing of it is interesting.

The Prime Minister, Shinzo Abe, just announced his resignation on Friday (for health reasons, he says). On Monday morning, just before the Tokyo stock market opened, Buffett announced he had made this investment.

These are diversified conglomerates, but with common themes; infrastructure, energy, metals, raw materials, chemicals, food, textiles.

Is this a bet on new leadership and a new plan to end three decades of economic stagnation in Japan? Is a bet on a revival of Japan's role in the world as an exporter, assuming China is headed toward the "trade penalty box," to be enforced by a global alliance - led by the U.S.?

Maybe both. Japan's decline came, not coincidentally, with China's ascent.

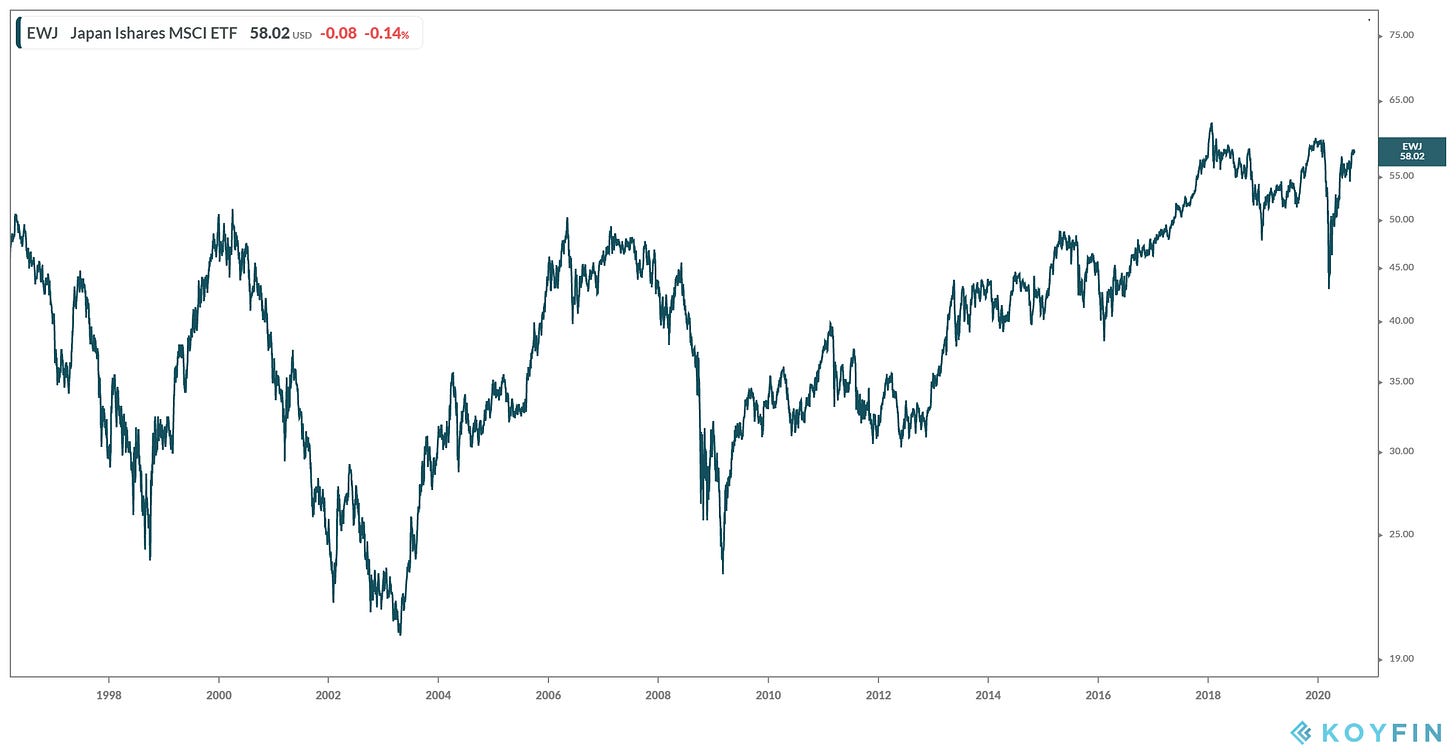

Japan's Nikkei remains 41% off of the all-time highs, marked three decades ago.