We started to talk about the closing of the bitcoin and gold performance gap yesterday.

Bitcoin has been up as much as 134% on the year. Meanwhile, gold, the historically favored inflation hedge still remains down on the year - even as inflation is running as hot as we've seen in many years. It hasn't made sense and now this dynamic is correcting.

The air is coming out of bitcoin and money is moving into gold.

Is this the bursting of a bubble, if so, are there other bubbles in danger of bursting in this world of "free" money?

Let's take a look at a few charts that would suggest things can get much uglier, at least in some specific cases…

First, for reference: In China, back in 2014-2015, a record surge in margin debt (fueled by the Chinese government) led to a bubble in the Chinese stock market. From June 2014 to June 2015 (just one year), the Shanghai Composite rose by 160%. The bottom fell out in mid-2015 and within two months, the stock market had fallen 45%, and six years later, it remains just two-thirds of the value of the bubble peak.

Let's take a look at what the chart of this Chinese stock market bubble looks like, compared to the current era high flyers...

You can see the aggressive rise in both Shanghai and bitcoin - similar ascent angle - with sharp declines already taking shape.

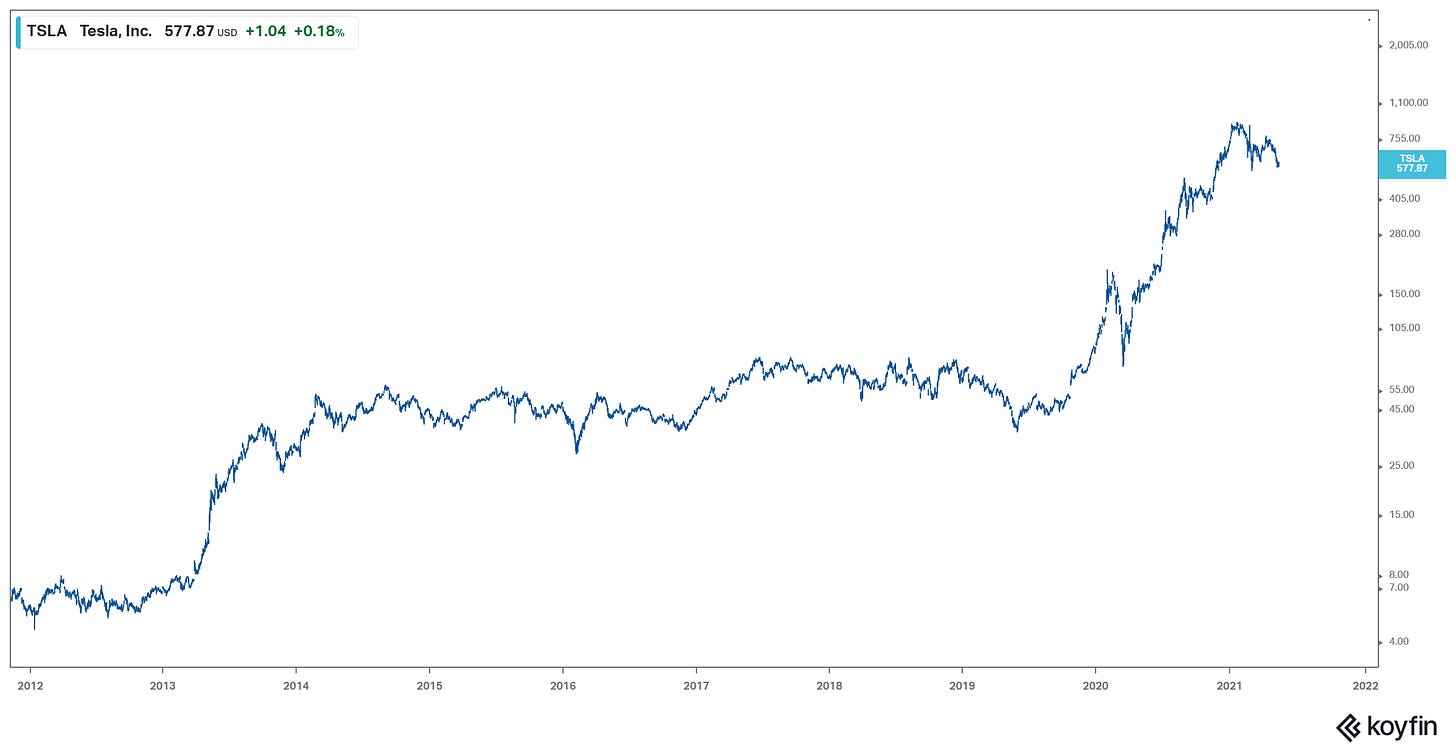

On a related note (given Tesla's investment in bitcoin), Tesla's chart looks similar...

And below, we can see the meteoric rise in the price of lumber.

As we discussed in recent Macro Perspectives notes, despite the hot housing market, lumber prices have been disconnected with reality. The supply of standing trees (called stumpage) is abundant - timber growers are getting no more today for a ton of stumpage than they were decades ago.

This lumber market, like the two above, seems to have had a healthy dose of speculation.

These three are now experiencing sharp declines. And the declines tend to get more and more slippery as speculators try to squeeze through the exit door at the same time.